Region:Middle East

Author(s):Shubham

Product Code:KRAB7472

Pages:91

Published On:October 2025

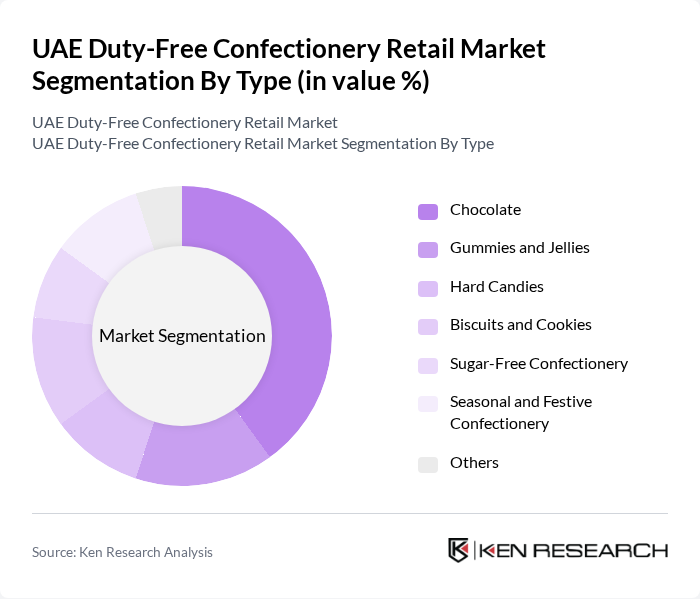

By Type:The confectionery market is segmented into various types, including chocolate, gummies and jellies, hard candies, biscuits and cookies, sugar-free confectionery, seasonal and festive confectionery, and others. Among these, chocolate has emerged as the leading sub-segment due to its universal appeal and the growing trend of gifting premium chocolate products. The increasing demand for innovative flavors and artisanal chocolates has further propelled this segment's growth.

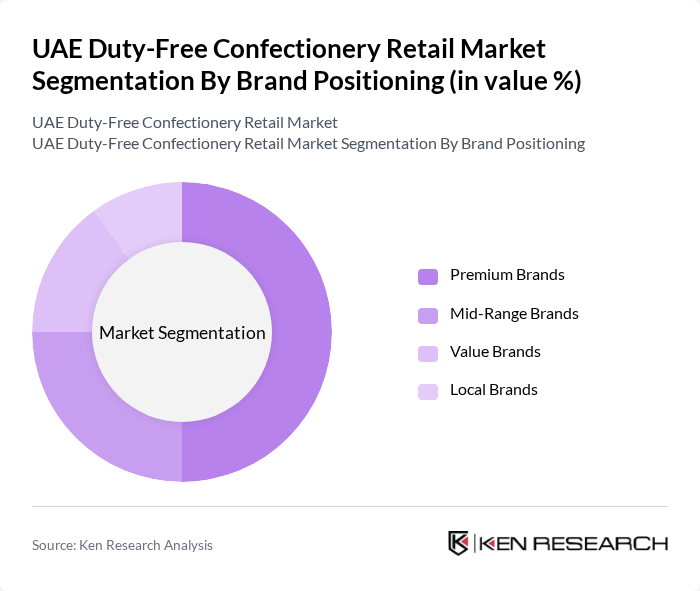

By Brand Positioning:The market is also segmented by brand positioning, which includes premium brands, mid-range brands, value brands, and local brands. Premium brands dominate the market due to the increasing consumer preference for high-quality and luxury confectionery products. This trend is driven by rising disposable incomes and a growing inclination towards gifting premium items, especially during festive seasons.

The UAE Duty-Free Confectionery Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Duty Free, Abu Dhabi Duty Free, Qatar Duty Free, Emirates Leisure Retail, Al Haramain Perfumes, Mondelez International, Ferrero Group, Nestlé S.A., Mars, Incorporated, Haribo GmbH & Co. KG, Lindt & Sprüngli AG, Perfetti Van Melle, Godiva Chocolatier, Ghirardelli Chocolate Company, Toms Confectionery contribute to innovation, geographic expansion, and service delivery in this space.

The UAE duty-free confectionery market is poised for significant growth, driven by increasing tourism, rising disposable incomes, and expanding retail spaces in airports. As consumer preferences shift towards premium and health-conscious products, retailers will need to adapt their offerings accordingly. Additionally, the integration of e-commerce platforms will enhance accessibility, allowing consumers to purchase confectionery items online. The market is expected to evolve with innovative product launches and strategic partnerships, positioning it for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chocolate Gummies and Jellies Hard Candies Biscuits and Cookies Sugar-Free Confectionery Seasonal and Festive Confectionery Others |

| By Brand Positioning | Premium Brands Mid-Range Brands Value Brands Local Brands |

| By Packaging Type | Gift Packs Bulk Packaging Single-Serve Packaging Eco-Friendly Packaging |

| By Distribution Channel | Airport Retail Online Retail Specialty Stores Supermarkets and Hypermarkets |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) |

| By Occasion | Festivals and Holidays Corporate Gifting Personal Celebrations |

| By Price Range | Low Price Mid Price High Price Luxury Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Duty-Free Confectionery Purchases | 150 | Frequent Travelers, Airport Retail Managers |

| Consumer Preferences in Confectionery | 100 | Travelers aged 18-45, Confectionery Buyers |

| Impact of Promotions on Sales | 80 | Marketing Managers, Retail Analysts |

| Trends in Duty-Free Shopping | 120 | Travel Industry Experts, Retail Consultants |

| Seasonal Buying Patterns | 90 | Tourism Officials, Retail Strategists |

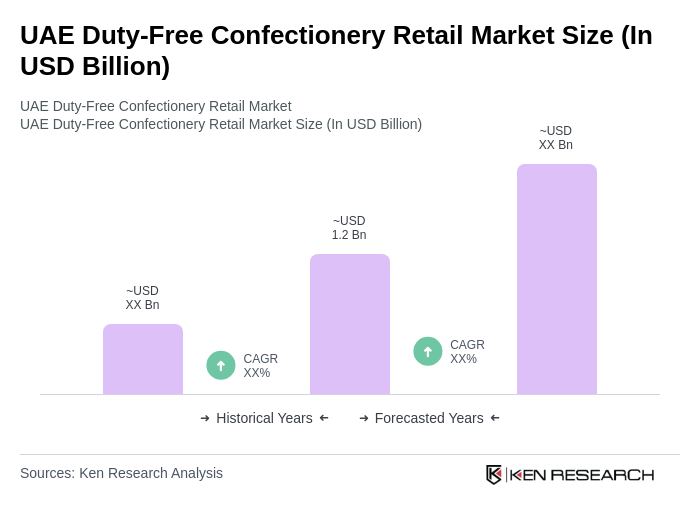

The UAE Duty-Free Confectionery Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased international travel, rising disposable incomes, and a preference for premium confectionery products among consumers.