Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7991

Pages:92

Published On:December 2025

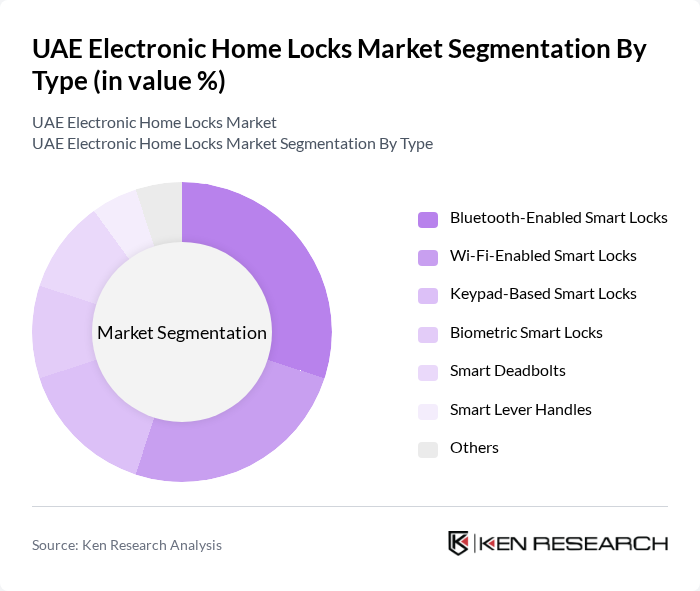

By Type:The market is segmented into various types of electronic home locks, including Bluetooth-Enabled Smart Locks, Wi-Fi-Enabled Smart Locks, Keypad-Based Smart Locks, Biometric Smart Locks, Smart Deadbolts, Smart Lever Handles, and Others. Each type caters to different consumer preferences and security needs, with Bluetooth and Wi-Fi-enabled locks gaining significant traction due to their convenience and integration with smart home systems.

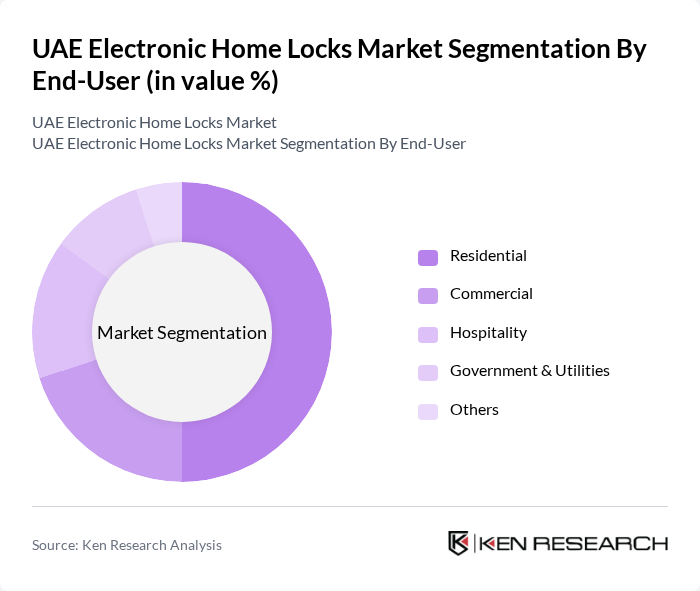

By End-User:The electronic home locks market is segmented by end-user into Residential, Commercial, Hospitality, Government & Utilities, and Others. The residential segment dominates the market, driven by increasing consumer awareness regarding home security and the growing trend of smart home automation.

The UAE Electronic Home Locks Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASSA ABLOY, Allegion plc, Samsung SDS, Yale (ASSA ABLOY subsidiary), Schlage (Allegion subsidiary), Kwikset (Allegion subsidiary), Xiaomi (Smart Door Lock Division), Nuki Smart Lock, Igloohome, Danalock, Level Lock, Lockly, Ultraloq, August Home (Assa Abloy subsidiary), Eufy Security (Anker Innovations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE electronic home locks market appears promising, driven by technological advancements and increasing consumer interest in smart home solutions. As urbanization continues, the integration of electronic locks with IoT devices will enhance security and convenience. Additionally, the growing emphasis on energy efficiency and sustainability will likely influence product development, leading to innovative locking solutions that cater to environmentally conscious consumers. The market is poised for significant growth as awareness and acceptance of these technologies expand.

| Segment | Sub-Segments |

|---|---|

| By Type | Bluetooth-Enabled Smart Locks Wi-Fi-Enabled Smart Locks Keypad-Based Smart Locks Biometric Smart Locks Smart Deadbolts Smart Lever Handles Others |

| By End-User | Residential Commercial Hospitality Government & Utilities Others |

| By Installation Type | New Installations Retrofit Installations Others |

| By Connectivity | Bluetooth Enabled Wi-Fi Enabled Z-Wave Zigbee Others |

| By Security Features | Biometric Recognition (Fingerprint & Facial) Keypad Entry Mobile App Control Remote Access & Cloud-Based Management Multi-Factor Authentication |

| By Price Range | Budget (Entry-Level) Mid-Range Premium (Enterprise-Grade) |

| By Brand Preference | Local & Regional Brands International Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electronic Lock Users | 120 | Homeowners, Renters |

| Commercial Property Managers | 100 | Facility Managers, Security Directors |

| Security Consultants | 80 | Security Experts, Technology Advisors |

| Retailers of Electronic Locks | 70 | Store Managers, Sales Representatives |

| Smart Home Technology Users | 90 | Tech Enthusiasts, Early Adopters |

The UAE Electronic Home Locks Market is valued at approximately USD 8 million, driven by urbanization, rising disposable incomes, and a growing emphasis on home security solutions. This market is expected to grow as consumers increasingly seek advanced locking systems for convenience and security.