Region:Middle East

Author(s):Shubham

Product Code:KRAD6736

Pages:90

Published On:December 2025

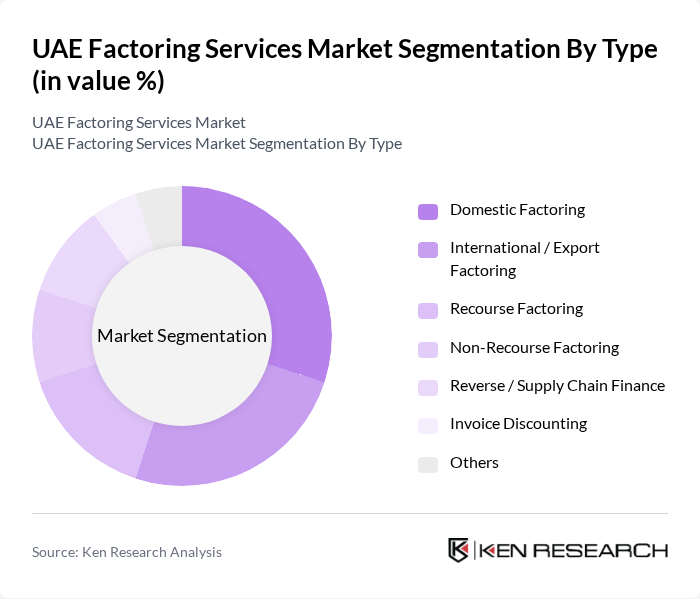

By Type:The segmentation of the market by type includes various forms of factoring services that cater to different business needs. The subsegments are Domestic Factoring, International / Export Factoring, Recourse Factoring, Non-Recourse Factoring, Reverse / Supply Chain Finance, Invoice Discounting, and Others. Each of these subsegments plays a crucial role in addressing the diverse financial requirements of businesses operating in the UAE.

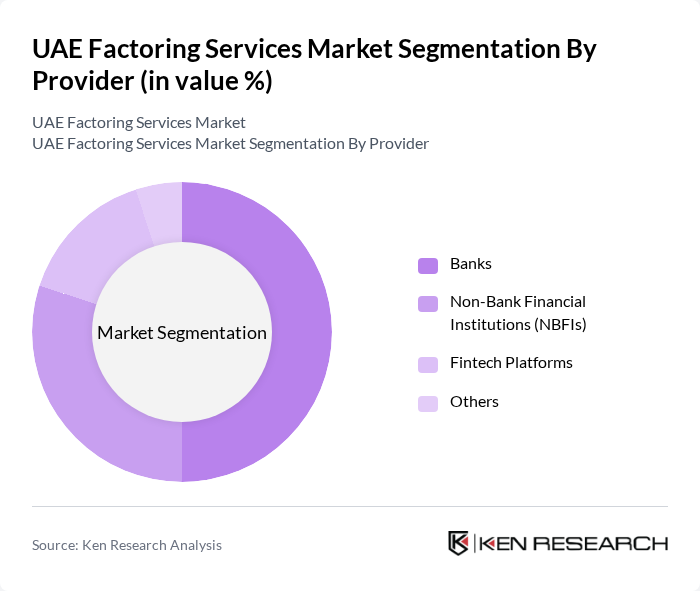

By Provider:The market is segmented by provider, which includes Banks, Non-Bank Financial Institutions (NBFIs), Fintech Platforms, and Others. Each provider type offers unique advantages and services, catering to the varying needs of businesses seeking factoring solutions. The competition among these providers drives innovation and enhances service delivery in the market.

The UAE Factoring Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD Bank PJSC, First Abu Dhabi Bank PJSC, Abu Dhabi Commercial Bank PJSC, Mashreqbank PSC, Dubai Islamic Bank PJSC, National Bank of Fujairah PJSC, Commercial Bank of Dubai PSC, RAKBANK (National Bank of Ras Al?Khaimah PJSC), Sharjah Islamic Bank PJSC, Arab Bank PLC – UAE Operations, QNB Group – UAE Operations, HSBC Bank Middle East Limited – UAE, Standard Chartered Bank – UAE, Abu Dhabi Islamic Bank PJSC, Etihad Credit Insurance (ECI) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE factoring services market appears promising, driven by technological advancements and increasing demand for flexible financing solutions. As businesses continue to seek innovative ways to manage cash flow, the adoption of digital platforms for factoring services is expected to rise in future. Additionally, the growing trend of cross-border transactions will further enhance the market's potential, providing opportunities for financial institutions to expand their service offerings and reach new clients.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Factoring International / Export Factoring Recourse Factoring Non-Recourse Factoring Reverse / Supply Chain Finance Invoice Discounting Others |

| By Provider | Banks Non-Bank Financial Institutions (NBFIs) Fintech Platforms Others |

| By Enterprise Size | Micro and Small Enterprises Medium Enterprises Large Corporations |

| By Application | Trade Finance Working Capital Management Project and Contract Financing Others |

| By End-Use Industry | Manufacturing Retail and E?commerce Construction and Real Estate Transportation and Logistics Oil & Gas and Energy Services and Others |

| By Tenor | Up to 90 Days –180 Days Above 180 Days Others |

| By Geography (Within UAE) | Abu Dhabi Dubai Sharjah and Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Factoring Utilization | 120 | Business Owners, Financial Managers |

| Corporate Factoring Services | 100 | CFOs, Treasury Managers |

| Industry-Specific Factoring Insights | 80 | Sector Analysts, Trade Finance Experts |

| Regulatory Impact on Factoring | 50 | Compliance Officers, Legal Advisors |

| Market Trends and Future Outlook | 110 | Market Researchers, Economic Analysts |

The UAE Factoring Services Market is valued at approximately AED 18 billion, driven by the increasing demand for working capital solutions among SMEs and the expansion of digital platforms that enhance accessibility and efficiency in factoring services.