Region:Asia

Author(s):Rebecca

Product Code:KRAD4335

Pages:91

Published On:December 2025

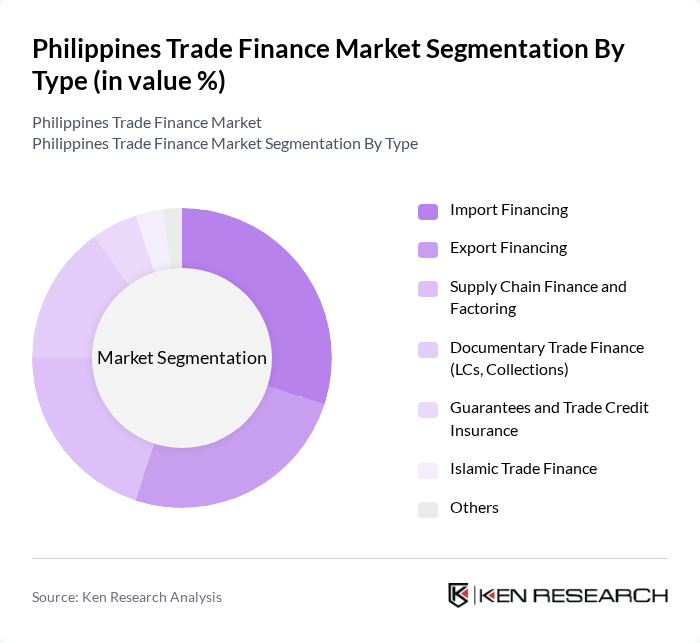

By Type:The trade finance market can be segmented into various types, including Import Financing, Export Financing, Supply Chain Finance and Factoring, Documentary Trade Finance (LCs, Collections), Guarantees and Trade Credit Insurance, Islamic Trade Finance, and Others. Each of these segments plays a crucial role in facilitating international trade and ensuring liquidity for businesses engaged in cross-border transactions.

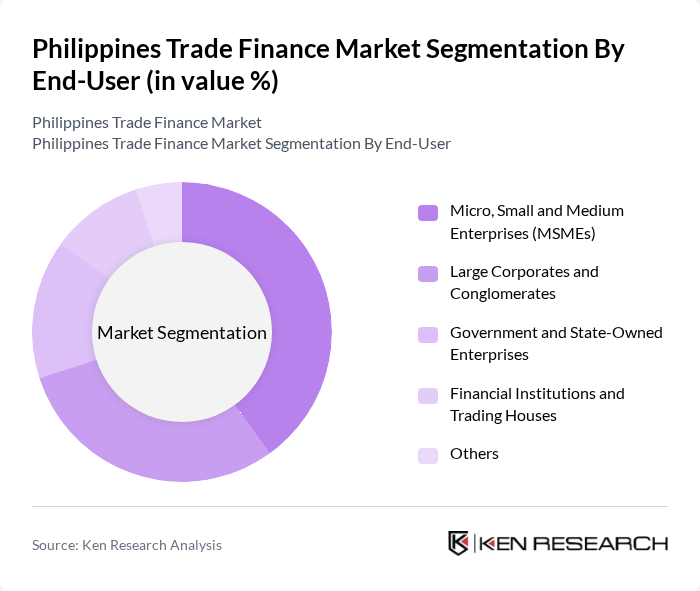

By End-User:The end-user segmentation includes Micro, Small and Medium Enterprises (MSMEs), Large Corporates and Conglomerates, Government and State-Owned Enterprises, Financial Institutions and Trading Houses, and Others. Each end-user category has distinct financing needs and contributes differently to the overall trade finance landscape.

The Philippines Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Unibank, Inc., Bank of the Philippine Islands (BPI), Metropolitan Bank & Trust Company (Metrobank), Union Bank of the Philippines, Land Bank of the Philippines (LANDBANK), Philippine National Bank (PNB), Rizal Commercial Banking Corporation (RCBC), Security Bank Corporation, EastWest Banking Corporation, China Banking Corporation (China Bank), Development Bank of the Philippines (DBP), Philippine Bank of Communications (PBCOM), Asia United Bank Corporation (AUB), Sterling Bank of Asia, Inc., Philippine Export-Import Credit Agency (PhilEXIM / Trade and Investment Development Corporation of the Philippines) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Philippines trade finance market appears promising, driven by increasing digitalization and government support for trade initiatives. As e-commerce continues to expand, the demand for innovative trade finance solutions is expected to rise. Additionally, collaboration between traditional banks and fintech companies will likely enhance service delivery, making trade finance more accessible. The focus on sustainable practices will also shape the market, encouraging the development of green financing options that align with global environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Import Financing Export Financing Supply Chain Finance and Factoring Documentary Trade Finance (LCs, Collections) Guarantees and Trade Credit Insurance Islamic Trade Finance Others |

| By End-User | Micro, Small and Medium Enterprises (MSMEs) Large Corporates and Conglomerates Government and State-Owned Enterprises Financial Institutions and Trading Houses Others |

| By Industry | Manufacturing and Electronics Agriculture, Food and Commodities Retail and Consumer Goods Construction and Infrastructure Shipping, Logistics and Ports Energy and Natural Resources Others |

| By Financing Method | Letters of Credit Documentary Collections Bank Guarantees and Standby LCs Supply Chain Finance / Reverse Factoring Invoice Discounting and Factoring Export Credit Agency and Multilateral-backed Finance Others |

| By Transaction Size | Up to USD 1 Million USD 1–10 Million Above USD 10 Million Others |

| By Geographic Focus | Intra-ASEAN Trade Trade with East Asia (China, Japan, Korea) Trade with North America and Europe Domestic Trade Others |

| By Risk Profile | Low Risk (Investment Grade Counterparties) Medium Risk (Emerging Market Counterparties) High Risk (Sub-investment Grade / SME Counterparties) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Trade Finance | 100 | Trade Finance Managers, Risk Assessment Officers |

| Exporters' Financing Needs | 80 | Export Managers, Financial Controllers |

| Importers' Financing Strategies | 70 | Import Managers, CFOs |

| Logistics Providers' Role in Trade Finance | 60 | Operations Managers, Supply Chain Analysts |

| Regulatory Impact on Trade Finance | 50 | Compliance Officers, Policy Analysts |

The Philippines Trade Finance Market is valued at approximately USD 15 billion, reflecting significant growth driven by increasing import and export activities, e-commerce expansion, and the country's strategic location in Southeast Asia.