Region:Middle East

Author(s):Rebecca

Product Code:KRAB7044

Pages:100

Published On:October 2025

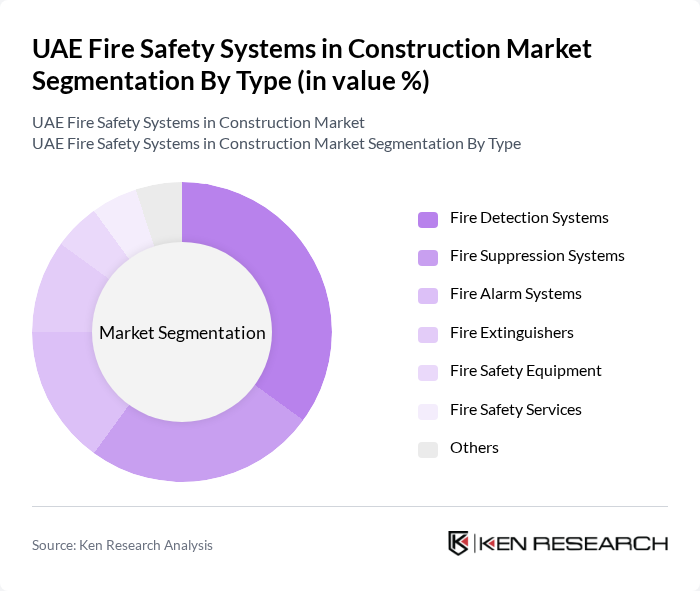

By Type:The market is segmented into various types of fire safety systems, including fire detection systems, fire suppression systems, fire alarm systems, fire extinguishers, fire safety equipment, fire safety services, and others. Among these, fire detection systems are leading the market due to their critical role in early fire detection and prevention, which is essential for safeguarding lives and property. The increasing adoption of smart technologies in fire detection is also contributing to its dominance.

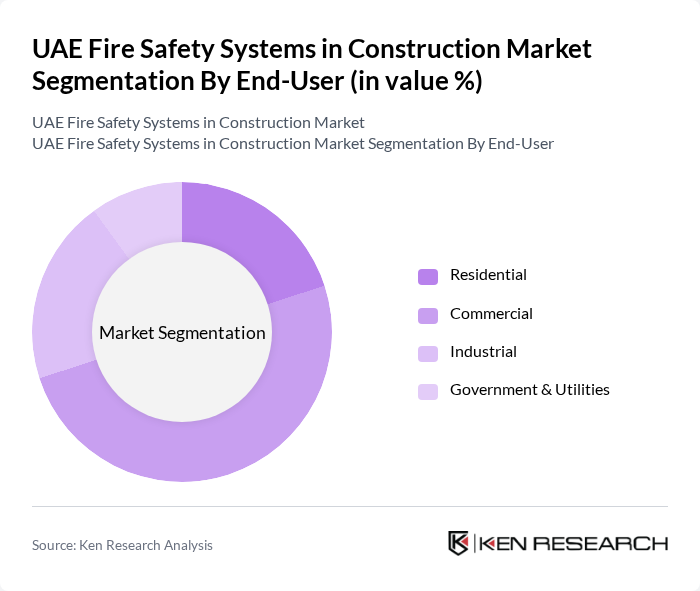

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The commercial sector is currently the largest end-user of fire safety systems, driven by the increasing number of commercial buildings and the need for compliance with safety regulations. The growing focus on employee safety and asset protection in commercial establishments further fuels the demand for advanced fire safety solutions.

The UAE Fire Safety Systems in Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tyco SimplexGrinnell, Honeywell International Inc., Siemens AG, Johnson Controls International plc, UTC Fire & Security, Bosch Security Systems, Schneider Electric SE, Minimax Viking GmbH, Firetrace International, Ansul, Kidde, Apollo Fire Detectors, Fike Corporation, Securitas AB, Halma plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE fire safety systems market in construction appears promising, driven by technological advancements and increasing regulatory compliance. As smart building technologies gain traction, the integration of IoT in fire safety systems is expected to enhance efficiency and effectiveness. Furthermore, the government's commitment to infrastructure development will likely sustain demand for fire safety solutions, ensuring that safety remains a priority in construction projects across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire Detection Systems Fire Suppression Systems Fire Alarm Systems Fire Extinguishers Fire Safety Equipment Fire Safety Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Projects Maintenance Services Emergency Services |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Fire Safety Systems | 100 | Project Managers, Safety Compliance Officers |

| Commercial Building Fire Safety Solutions | 80 | Facility Managers, Fire Safety Engineers |

| Industrial Fire Safety Equipment | 70 | Operations Managers, Safety Inspectors |

| Fire Safety Training Programs | 60 | Training Coordinators, HR Managers |

| Fire Safety Regulatory Compliance | 90 | Regulatory Affairs Specialists, Compliance Officers |

The UAE Fire Safety Systems in Construction Market is valued at approximately USD 1.2 billion, driven by stringent regulations, urbanization, and increased construction activities. This market is expected to grow further as safety compliance becomes a priority in new projects.