Region:Middle East

Author(s):Dev

Product Code:KRAD3287

Pages:95

Published On:November 2025

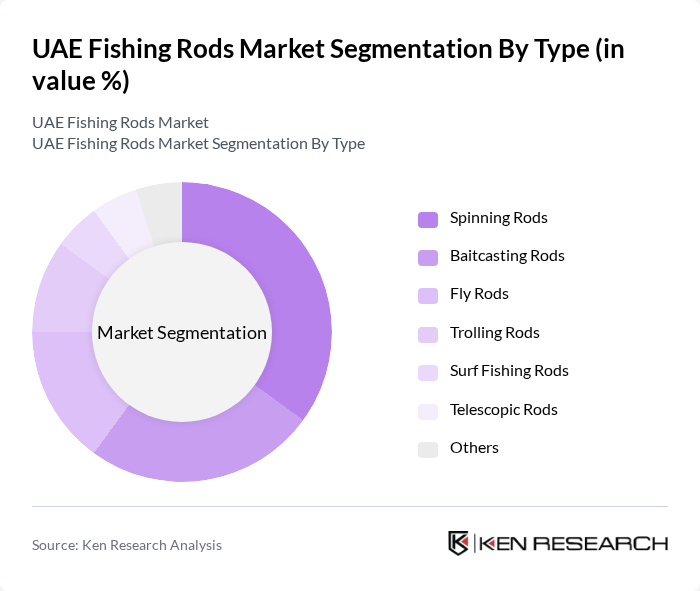

By Type:The fishing rods market can be segmented into various types, including spinning rods, baitcasting rods, fly rods, trolling rods, surf fishing rods, telescopic rods, and others. Each type serves different fishing techniques and preferences, catering to both amateur and professional anglers. The demand for spinning rods has been particularly strong due to their versatility and ease of use, making them a popular choice among recreational fishers.

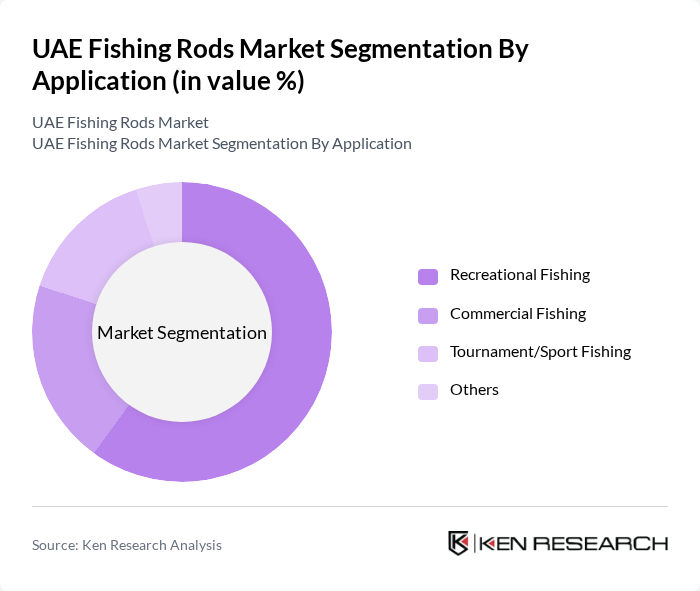

By Application:The market can also be segmented based on application, which includes recreational fishing, commercial fishing, tournament/sport fishing, and others. Recreational fishing dominates the market, driven by the growing interest in outdoor activities and family-oriented fishing experiences. The rise of fishing as a leisure activity has led to increased sales of fishing rods tailored for casual anglers.

The UAE Fishing Rods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shimano Gulf FZE, Daiwa Middle East, Pure Fishing (Abu Dhabi), Rapala VMC Corporation (UAE), Okuma Fishing Tackle Co. (UAE Distributor), Abu Dhabi Angling, Fishing UAE (Dubai), Al Fajr Fishing Equipment Trading, Desert Angler Trading LLC, Ocean Blue Fishing Tackle, Emirates Fishing Supplies, Fishing World UAE, Al Marjan Fishing Supplies, Fishing Pro UAE, Fishing Hub UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fishing rods market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As smart technology integration becomes more prevalent, manufacturers are likely to develop innovative fishing gear that enhances user experience. Additionally, the growing emphasis on sustainability will encourage the production of eco-friendly fishing products, aligning with global trends. These developments, coupled with the increasing popularity of fishing tournaments, are expected to create a dynamic market landscape that attracts both new and seasoned anglers.

| Segment | Sub-Segments |

|---|---|

| By Type | Spinning Rods Baitcasting Rods Fly Rods Trolling Rods Surf Fishing Rods Telescopic Rods Others |

| By Application | Recreational Fishing Commercial Fishing Tournament/Sport Fishing Others |

| By Distribution Channel | Offline (Specialty Stores, Sporting Goods Retailers) Online (E-commerce Platforms, Company Websites) Others |

| By Material | Carbon Fiber/Graphite Fiberglass Composite Bamboo Others |

| By Price Range | Budget (Under AED 200) Mid-Range (AED 200 - AED 800) Premium (Over AED 800) Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Brand | Local Brands International Brands Emerging Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fishing Rod Sales | 60 | Store Managers, Sales Representatives |

| Professional Anglers Insights | 40 | Competitive Anglers, Fishing Guides |

| Recreational Fishing Enthusiasts | 50 | Hobbyist Anglers, Fishing Club Members |

| Fishing Equipment Manufacturers | 40 | Product Development Managers, Marketing Directors |

| Fishing Event Organizers | 40 | Event Coordinators, Sponsorship Managers |

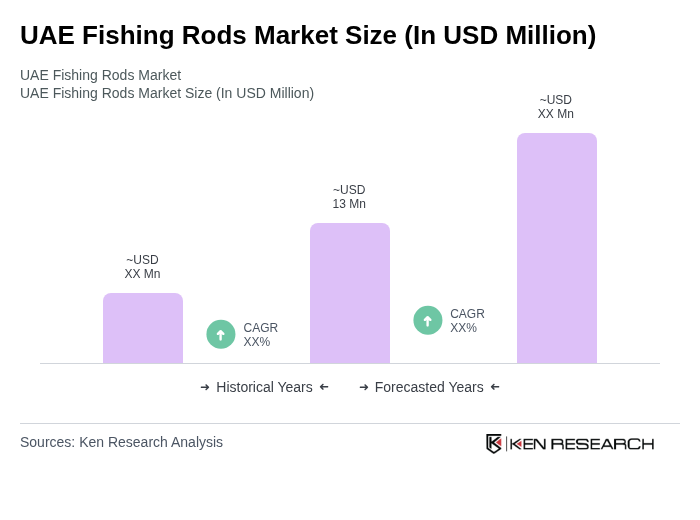

The UAE Fishing Rods Market is valued at approximately USD 13 million, reflecting a growing interest in recreational fishing, tourism, and outdoor activities. This market has seen a shift towards premium fishing gear as consumers become more discerning about their equipment.