Region:Asia

Author(s):Geetanshi

Product Code:KRAD7160

Pages:83

Published On:December 2025

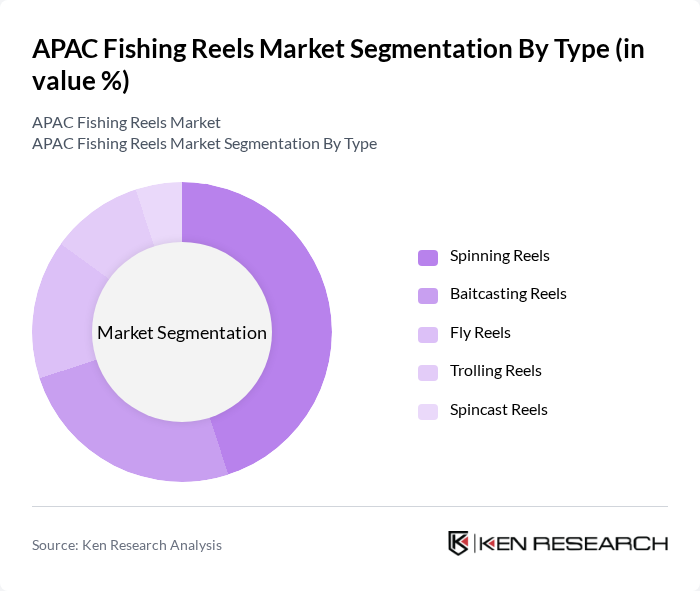

By Type:The fishing reels market can be segmented into various types, including spinning reels, baitcasting reels, fly reels, trolling reels, and spincast reels. Each type serves different fishing styles and preferences, catering to both amateur and professional anglers. Spinning reels are particularly popular due to their versatility and ease of use, making them a preferred choice for recreational fishers.

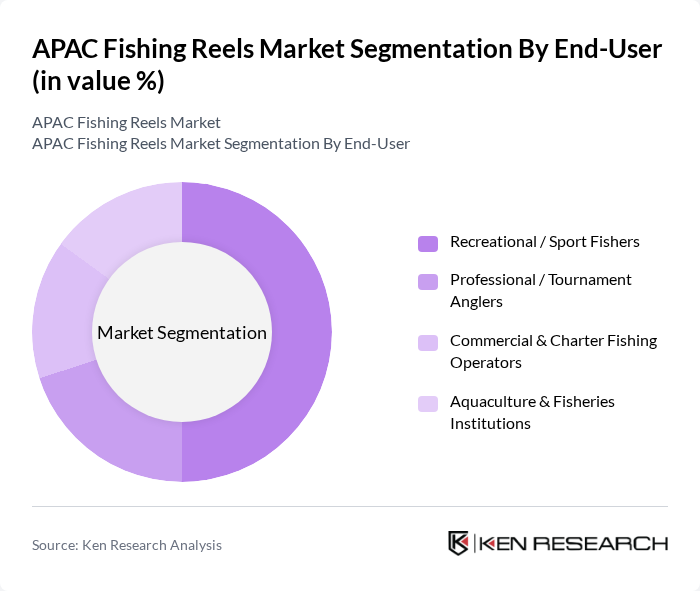

By End-User:The end-user segmentation includes recreational/sport fishers, professional/tournament anglers, commercial & charter fishing operators, and aquaculture & fisheries institutions. Recreational fishers dominate the market, driven by the growing trend of fishing as a leisure activity and the increasing number of fishing enthusiasts participating in local and international tournaments.

The APAC Fishing Reels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shimano Inc., Daiwa Corporation, Pure Fishing Inc. (Abu Garcia, Penn, Pflueger), Okuma Fishing Tackle Co., Ltd., Rapala VMC Corporation, Globeride, Inc. (Daiwa Brand, Japan), Haibo Fishing Tackle Co., Ltd. (China), KastKing (Eposeidon Outdoor Adventure Ltd.), Banax Co., Ltd. (South Korea), Ryobi Limited (Fishing Tackle Division, China), Major Craft Co., Ltd. (Japan), Zhejiang Weida Fishing Tackle Co., Ltd. (SeaKnight), SureCatch World Sdn. Bhd. (APAC), 13 Fishing (Asia-Pacific Distribution), Savage Gear (A Brands / Pure Fishing, APAC Presence) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC fishing reels market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As recreational fishing continues to gain traction, manufacturers are likely to focus on developing innovative, lightweight, and eco-friendly products. Additionally, the integration of smart technology into fishing reels is expected to enhance user experience, attracting tech-savvy consumers. The market will also benefit from increased collaboration with fishing tourism operators, creating new avenues for growth and engagement in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Spinning Reels Baitcasting Reels Fly Reels Trolling Reels Spincast Reels |

| By End-User | Recreational / Sport Fishers Professional / Tournament Anglers Commercial & Charter Fishing Operators Aquaculture & Fisheries Institutions |

| By Country | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Philippines, Others) Rest of APAC |

| By Material | Aluminum Graphite / Carbon Fiber Stainless Steel Composite & Polymer Materials Others |

| By Price Range | Entry-Level / Budget Reels (Mass Market) Mid-Range Reels Premium & Professional-Grade Reels Custom & Limited-Edition Reels |

| By Distribution Channel | Online Retail & Marketplaces (e.g., Tmall, Rakuten, Amazon) Specialty Fishing & Outdoor Stores General Sporting Goods Retailers Supermarkets / Hypermarkets Others (Direct Sales, Fishing Clubs, Events) |

| By Consumer Profile | Brand-Loyal / Enthusiast Anglers Price-Sensitive / Occasional Anglers Performance- & Quality-Driven Anglers Beginners & Youth Anglers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fishing Equipment Sales | 120 | Store Managers, Sales Representatives |

| Professional Anglers Insights | 100 | Competitive Anglers, Fishing Guides |

| Manufacturers of Fishing Reels | 80 | Product Development Managers, Marketing Directors |

| Fishing Equipment Distributors | 70 | Distribution Managers, Supply Chain Coordinators |

| Fishing Enthusiasts and Hobbyists | 100 | Recreational Fishers, Fishing Club Members |

The APAC Fishing Reels Market is valued at approximately USD 4.5 billion, reflecting a significant growth driven by factors such as increased recreational fishing popularity, advancements in fishing technology, and rising disposable incomes among consumers.