Region:Middle East

Author(s):Rebecca

Product Code:KRAD1470

Pages:93

Published On:November 2025

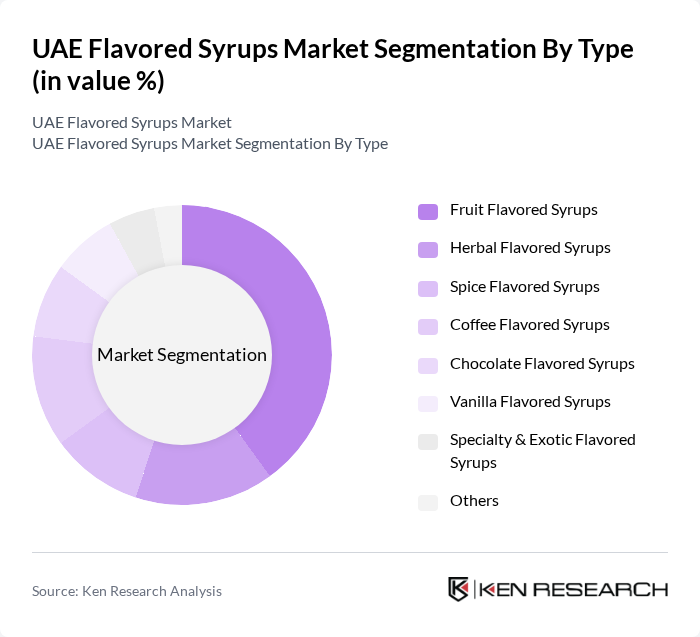

By Type:The flavored syrups market is segmented into fruit flavored syrups, herbal flavored syrups, spice flavored syrups, coffee flavored syrups, chocolate flavored syrups, vanilla flavored syrups, specialty & exotic flavored syrups, and others. Fruit flavored syrups continue to dominate due to their versatility and broad acceptance in both food service and retail channels. Consumers increasingly prefer natural and fruity flavors, often perceived as healthier choices, a trend reinforced by the popularity of fruit-based beverages and desserts. Innovation in flavor profiles, such as exotic fruit blends and reduced-sugar options, is also shaping the segment .

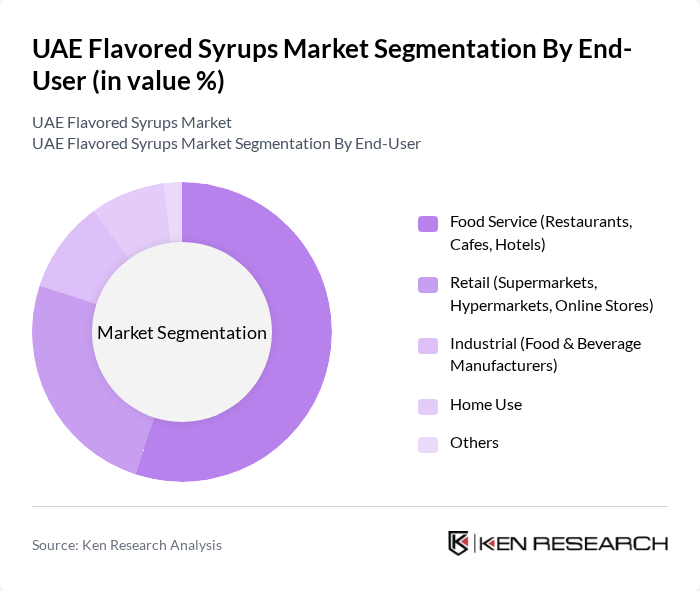

By End-User:The market is segmented by end-user into food service (restaurants, cafes, hotels), retail (supermarkets, hypermarkets, online stores), industrial (food & beverage manufacturers), home use, and others. The food service segment leads, driven by the vibrant café culture and the proliferation of dining establishments in the UAE. Growth is further supported by the trend toward specialty coffee and unique beverage offerings that require a variety of flavored syrups for enhanced taste and presentation. Retail and home use segments are also expanding, fueled by consumer interest in home mixology and premium beverage experiences .

The UAE Flavored Syrups Market is characterized by a dynamic mix of regional and international players. Leading participants such as Monin, DaVinci Gourmet, Torani, Fabbri 1905, 1883 Maison Routin, Sweetbird, Kerry Group (Owner of DaVinci Gourmet), Giffard, Al Douri Group (UAE), IFFCO Group (UAE), Bickford’s Australia, Jordan’s Skinny Mixes, Finest Call, Funkin, Maison Routin 1883 contribute to innovation, geographic expansion, and service delivery in this space.

The UAE flavored syrups market is poised for significant growth, driven by evolving consumer preferences towards healthier, natural ingredients and innovative beverage options. As the tourism sector continues to thrive, the demand for unique flavored drinks in cafes and restaurants is expected to rise. Additionally, the increasing penetration of e-commerce platforms will facilitate broader access to flavored syrups, enabling brands to reach a wider audience and capitalize on the growing trend of home beverage preparation.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruit Flavored Syrups Herbal Flavored Syrups Spice Flavored Syrups Coffee Flavored Syrups Chocolate Flavored Syrups Vanilla Flavored Syrups Specialty & Exotic Flavored Syrups Others |

| By End-User | Food Service (Restaurants, Cafes, Hotels) Retail (Supermarkets, Hypermarkets, Online Stores) Industrial (Food & Beverage Manufacturers) Home Use Others |

| By Packaging Type | Glass Bottles Plastic Bottles Pouches Portion-Control Packs Others |

| By Distribution Channel | Direct Sales Online Retail Wholesalers/Distributors Hypermarkets/Supermarkets Others |

| By Flavor Profile | Sweet Savory Spicy Mint Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Lifestyle (Health-conscious, Indulgent, Trend-seeking) Nationality (UAE Nationals, Expatriates) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Flavored Syrups Sales | 150 | Store Managers, Category Buyers |

| Food Service Industry Usage | 100 | Restaurant Owners, Beverage Managers |

| Consumer Preferences Survey | 120 | General Consumers, Health-Conscious Shoppers |

| Distribution Channel Insights | 80 | Distributors, Wholesalers |

| Market Trend Analysis | 100 | Market Analysts, Industry Experts |

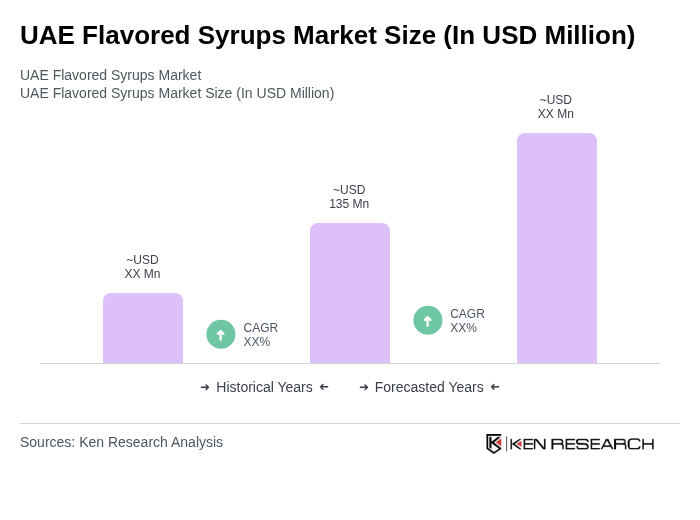

The UAE Flavored Syrups Market is valued at approximately USD 135 million, reflecting a growing demand for flavored beverages in the food service sector and home mixology trends.