Middle East Specialty Coffee Market Overview

- The Middle East Specialty Coffee Market is valued at USD 1.2 billion, based on a five-year historical analysis within the broader Middle East & Africa specialty coffee and coffee markets. This growth is primarily driven by the increasing consumer preference for high-quality coffee, the rapid expansion of specialty coffee shops, and a deepening culture of out-of-home coffee consumption in the region, particularly in branded cafés. The market has seen a pronounced shift towards premium products, with consumers willing to pay more for unique flavor profiles, single-origin coffees, and sustainably sourced beans, supported by a growing third?wave coffee movement and the rise of local roasteries.

- Countries such as the United Arab Emirates, Saudi Arabia, and Lebanon dominate the Middle East Specialty Coffee Market due to their vibrant café culture, high disposable incomes, and strong inclination towards premium coffee experiences. The UAE has become one of the region’s most dynamic specialty coffee hubs, with its overall coffee market exceeding the equivalent of about USD 3.2 billion and Dubai ranking among the most café?dense cities globally, where out?of?home consumption represents around 93% of total coffee spending. Saudi Arabia is the largest branded coffee shop market in the Middle East, with more than 5,100 branded cafés and over 61,000 registered cafés overall, and its young population increasingly views coffee shops as social and workspaces, driving strong demand for specialty formats.

- In 2022, the Saudi Arabian government introduced a dedicated sustainable coffee framework under the Saudi Coffee Sustainability Strategy, supported by the Saudi Coffee Company, alongside compliance requirements linked to Vision 2030 initiatives for domestic coffee value chains. In parallel, the Saudi Green Initiative and the Environmental Protection Law, 2021 issued by the Ministry of Environment, Water and Agriculture and related authorities set binding environmental standards that apply to agricultural production, processing, and supply chains, including coffee, covering resource efficiency, emissions, and sustainable land use. These frameworks guide coffee importers, roasters, and producers to align sourcing and production practices with environmental and quality standards, encouraging ethically sourced beans, supporting local farmers in regions such as Jazan, and promoting higher?quality specialty coffee in the domestic market.

Middle East Specialty Coffee Market Segmentation

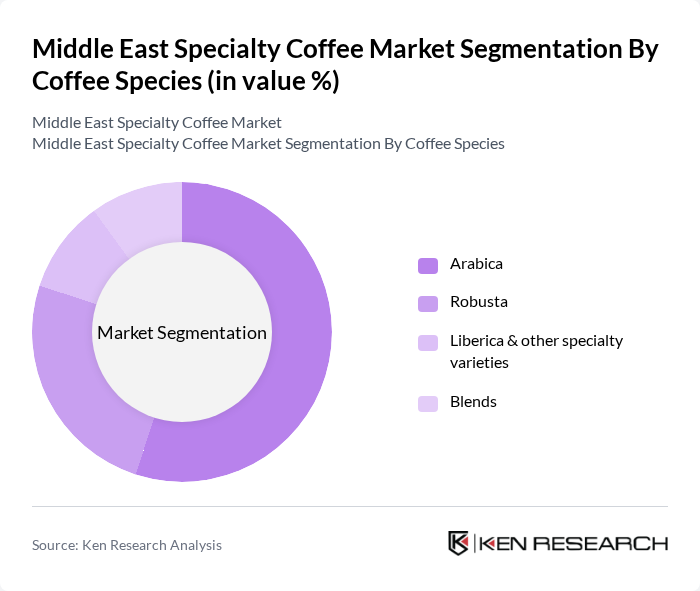

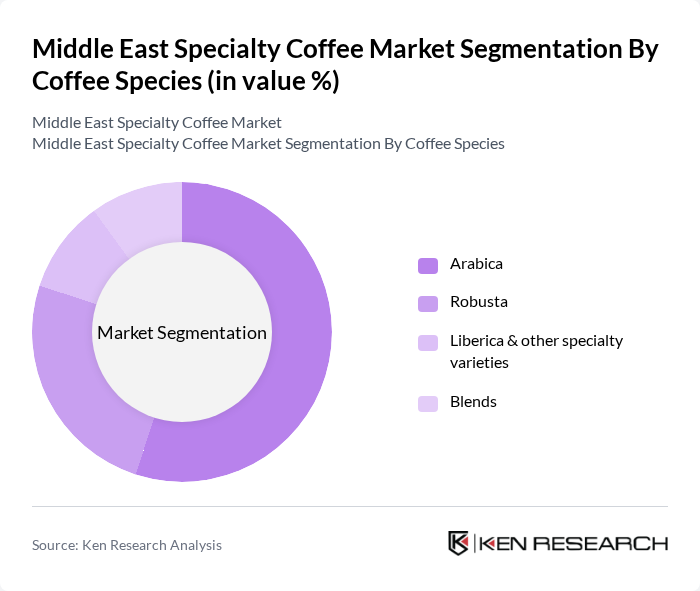

By Coffee Species:The specialty coffee market is segmented into various species, including Arabica, Robusta, Liberica and other specialty varieties, and Blends. Arabica coffee is the most popular globally and across the Middle East due to its smoother flavor, higher perceived quality, and aromatic complexity, which aligns with specialty café menus and single?origin offerings. Robusta, known for its higher caffeine content and stronger, more bitter taste, is widely used in espresso blends and certain traditional preparations, especially where crema and intensity are prioritized. Liberica and other specialty varieties are gaining traction among enthusiasts seeking rare, distinctive flavor notes and experimental offerings featured by third?wave roasters, while blends remain important for achieving consistent taste profiles tailored to local preferences in premium and branded cafés.

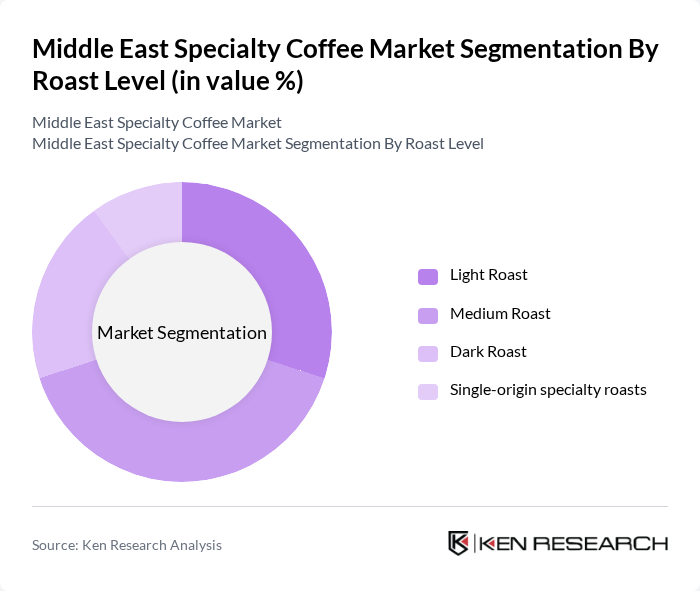

By Roast Level:The market is also segmented by roast level, which includes Light Roast, Medium Roast, Dark Roast, and Single-origin specialty roasts. Light roast coffee is favored among specialty consumers for its higher acidity, lighter body, and ability to showcase origin?specific fruity or floral notes, making it popular in third?wave cafés and pour?over preparations. Medium roast offers a balance between origin character and caramelized sweetness and is widely preferred by mainstream consumers and branded chains across the Middle East. Dark roast remains important for traditional tastes and espresso?based beverages that require a bold, intense profile, while single-origin specialty roasts—often light to medium roasted—appeal to connoisseurs seeking traceable, high?scoring coffees from specific farms or regions, which are increasingly showcased at events such as World of Coffee Dubai.

Middle East Specialty Coffee Market Competitive Landscape

The Middle East Specialty Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as RAW Coffee Company (UAE), Coffee Planet (UAE), The Espresso Lab (UAE), % Arabica (Regional Presence), Elixir Bunn Coffee Roasters (Saudi Arabia), Brew Café & Roastery (Saudi Arabia), Café Najjar (Lebanon), Boon Coffee (UAE), The Coffee Club (Regional Franchises), Seven Fortunes Coffee Roasters (UAE), Coffee Beans Market (Saudi Arabia), Attibassi Coffee (Regional Franchises), Barn's Coffee (Saudi Arabia), Mokha 1450 Coffee Lounge & Roastery (UAE), and other emerging specialty coffee roasters in the Middle East contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Specialty Coffee Market Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Premium Coffee:The Middle East has seen a significant shift towards premium coffee consumption, with the market for specialty coffee growing at an annual rate of 15% since 2020. In future, the region is expected to witness a consumption increase of approximately 1.5 million tons, driven by a growing middle class and a cultural shift towards coffee appreciation. This trend is supported by the rise of artisanal coffee brands, which have reported sales growth of 20% year-on-year, reflecting changing consumer tastes.

- Growth of Specialty Coffee Shops:The number of specialty coffee shops in the Middle East has surged, with over 1,200 new establishments opening in future alone. This growth is attributed to urbanization and a burgeoning café culture, particularly in cities like Dubai and Riyadh. The average revenue per coffee shop has reached $300,000 annually, indicating a robust market environment. Additionally, these shops are increasingly focusing on unique brewing methods and high-quality beans, further driving consumer interest and foot traffic.

- Expansion of E-commerce Platforms:E-commerce sales of coffee products in the Middle East are projected to reach $500 million in future, reflecting a 25% increase from the previous year. This growth is fueled by the rising popularity of online shopping and the convenience it offers consumers. Major platforms like Amazon and local startups are enhancing their coffee offerings, providing access to specialty brands that were previously unavailable. This shift is expected to attract a younger demographic, further boosting specialty coffee consumption.

Market Challenges

- High Competition from Established Brands:The specialty coffee market in the Middle East faces intense competition from established global brands, which dominate approximately 60% of the market share. These brands benefit from strong supply chains and brand loyalty, making it challenging for new entrants to gain traction. In future, the competitive landscape is expected to intensify, with established players investing heavily in marketing and product innovation to maintain their market positions.

- Fluctuating Coffee Bean Prices:The volatility of coffee bean prices poses a significant challenge for specialty coffee businesses in the Middle East. In future, prices fluctuated between $1.20 and $1.80 per pound due to supply chain disruptions and climate change impacts. This unpredictability affects profit margins and pricing strategies for specialty coffee retailers. As global demand continues to rise, the pressure on prices is expected to persist, complicating financial planning for businesses in the sector.

Middle East Specialty Coffee Market Future Outlook

The Middle East specialty coffee market is poised for continued growth, driven by evolving consumer preferences and an expanding café culture. As disposable incomes rise, consumers are increasingly willing to pay a premium for high-quality coffee experiences. Additionally, the integration of technology in coffee retail, such as mobile ordering and subscription services, is expected to enhance customer engagement. The focus on sustainability and ethical sourcing will also shape future market dynamics, encouraging brands to innovate and adapt to changing consumer values.

Market Opportunities

- Growth in the Organic Coffee Segment:The organic coffee segment is gaining traction, with sales projected to reach $150 million in future. This growth is driven by increasing consumer awareness of health and environmental issues, prompting a shift towards organic products. Brands that prioritize organic sourcing can tap into this lucrative market, appealing to health-conscious consumers and enhancing their brand image.

- Collaborations with Local Farmers:Collaborating with local farmers presents a significant opportunity for specialty coffee brands. By sourcing beans directly from local producers, companies can ensure quality and support local economies. This approach not only enhances product authenticity but also aligns with the growing consumer demand for transparency in sourcing. Such partnerships can lead to unique product offerings and strengthen brand loyalty among consumers.