Region:Middle East

Author(s):Dev

Product Code:KRAC8709

Pages:85

Published On:November 2025

By Type:The flywheel energy storage market is segmented into four main types: Mechanical Flywheels, Magnetic Bearing Flywheels, Composite Material Flywheels, and Hybrid Flywheels. Each type has unique characteristics and applications, catering to different energy storage needs. Mechanical Flywheels are widely used for their durability and efficiency, while Magnetic Bearing Flywheels offer reduced friction and maintenance. Composite Material Flywheels are gaining traction due to their lightweight and high-strength properties, and Hybrid Flywheels combine the benefits of both mechanical and battery systems.

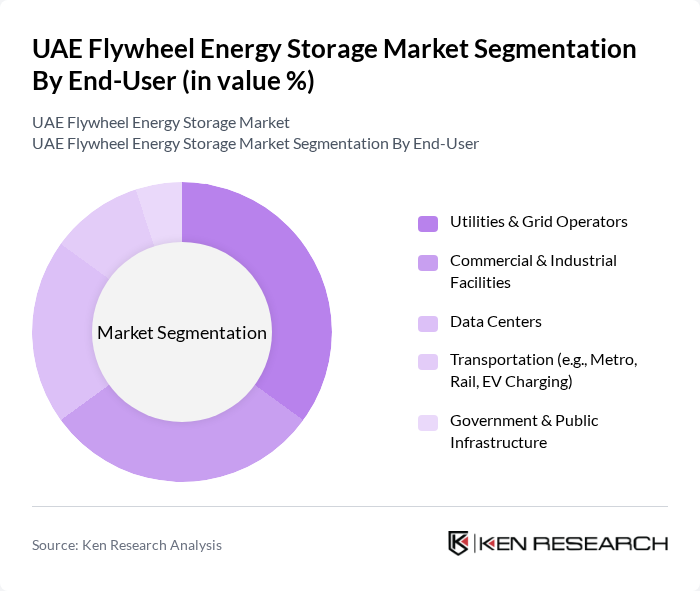

By End-User:The end-user segmentation includes Utilities & Grid Operators, Commercial & Industrial Facilities, Data Centers, Transportation (e.g., Metro, Rail, EV Charging), and Government & Public Infrastructure. Utilities and grid operators are the largest consumers due to the need for grid stability and frequency regulation. Commercial and industrial facilities are increasingly adopting flywheel systems for backup power and load leveling, while data centers require reliable energy storage solutions to ensure uninterrupted operations.

The UAE Flywheel Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beacon Power, Active Power, Amber Kinetics, Siemens AG, General Electric (GE Power), ABB Ltd., Mitsubishi Electric, TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation), VYCON, Powerthru, Stornetic GmbH, Piller Power Systems, Kinetic Traction Systems, Temporal Power, Emirates Electrical Engineering LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE flywheel energy storage market appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to support energy storage initiatives, the market is likely to witness a surge in adoption rates. Additionally, the integration of smart grid technologies will enhance operational efficiency, allowing for better management of energy resources. This evolving landscape presents significant opportunities for innovation and collaboration within the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Flywheels Magnetic Bearing Flywheels Composite Material Flywheels Hybrid Flywheels |

| By End-User | Utilities & Grid Operators Commercial & Industrial Facilities Data Centers Transportation (e.g., Metro, Rail, EV Charging) Government & Public Infrastructure |

| By Application | Frequency Regulation & Grid Stabilization Uninterruptible Power Supply (UPS) Renewable Energy Integration Regenerative Braking (Transport) Load Leveling & Peak Shaving Backup Power |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Technology | Flywheel Energy Storage Systems Hybrid Flywheel-Battery Systems Advanced Control & Monitoring Solutions Others |

| By Market Segment | Utility-Scale Commercial & Industrial Scale Data Center & Mission Critical Transportation & Mobility Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 60 | Energy Managers, Operations Directors |

| Energy Storage Technology Providers | 50 | Product Development Managers, Sales Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Energy Analysts |

| Research Institutions | 40 | Research Scientists, Academic Professors |

| End-Users in Renewable Energy Sector | 45 | Project Managers, Sustainability Officers |

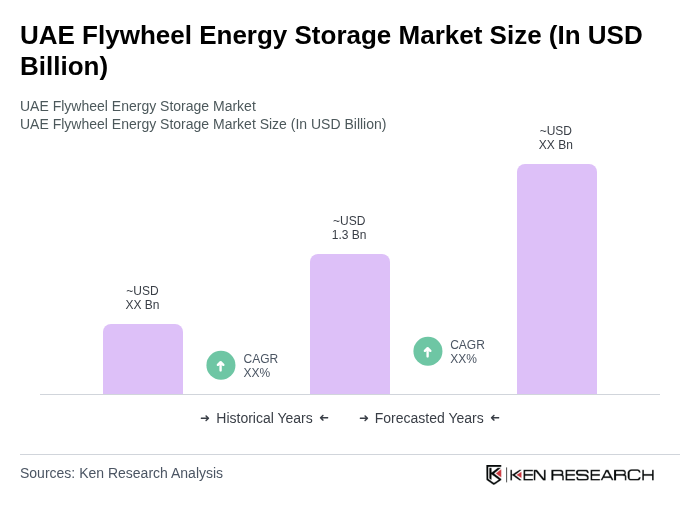

The UAE Flywheel Energy Storage Market is valued at approximately USD 1.3 billion, driven by the increasing demand for renewable energy integration, grid stability, and advancements in flywheel technology that enhance energy efficiency and reduce operational costs.