Region:Middle East

Author(s):Shubham

Product Code:KRAA8576

Pages:97

Published On:November 2025

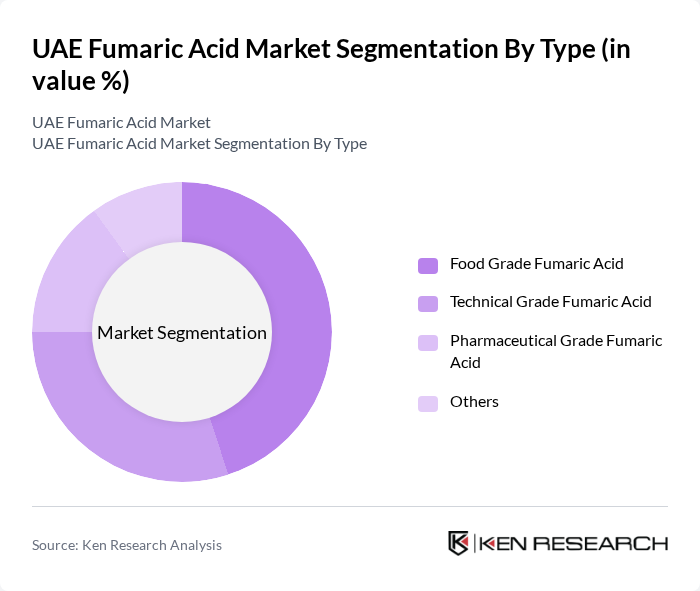

By Type:

The market is segmented into four main types: Food Grade Fumaric Acid, Technical Grade Fumaric Acid, Pharmaceutical Grade Fumaric Acid, and Others. Among these, Food Grade Fumaric Acid is the leading subsegment, driven by its extensive use as a food additive and preservative in various food products. The increasing consumer preference for natural and safe food ingredients has further propelled the demand for food-grade variants. Technical Grade Fumaric Acid follows closely, primarily used in industrial applications such as resins and coatings.

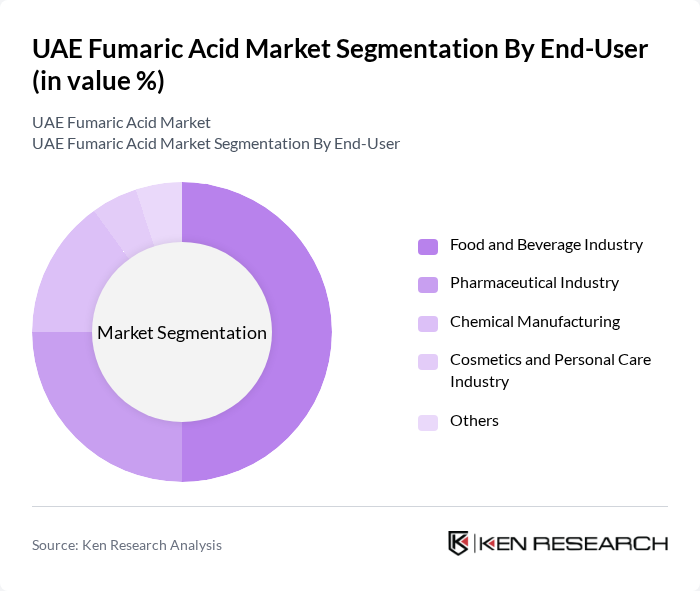

By End-User:

The end-user segmentation includes the Food and Beverage Industry, Pharmaceutical Industry, Chemical Manufacturing, Cosmetics and Personal Care Industry, and Others. The Food and Beverage Industry is the dominant segment, as fumaric acid is widely used as a food additive and preservative. The growing trend towards processed and packaged foods has significantly increased the demand for fumaric acid in this sector. The Pharmaceutical Industry also plays a crucial role, utilizing fumaric acid in various formulations and drug manufacturing processes.

The UAE Fumaric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Thirumalai Chemicals Ltd., Polynt-Reichhold Group, DSM Nutritional Products, Maoming Yunlong Industrial Development Co., Ltd., Hubei Shunhui Technology Co., Ltd., Anhui Aokai Chemical Co., Ltd., Hunan Jisheng Chemical Co., Ltd., Hubei Greenhome Chemical Co., Ltd., Hubei Yihua Chemical Industry Co., Ltd., Jiangsu Jiamai Chemical Co., Ltd., Jiangsu Jintong Chemical Co., Ltd., Jiangsu Huachang Chemical Co., Ltd., Shandong Kunda Biotechnology Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Huntsman Corporation, Fuso Chemical Co., Ltd., Bartek Ingredients Inc., Emirates National Chemical Industries LLC, Redox Pty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fumaric acid market is poised for growth, driven by increasing demand across various sectors, particularly food and pharmaceuticals. The trend towards sustainable and bio-based products is expected to shape future developments, with companies investing in innovative production methods. Additionally, the expansion of e-commerce platforms for chemical sales will enhance market accessibility. As the industry adapts to regulatory changes and consumer preferences, the market is likely to witness significant transformations in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Grade Fumaric Acid Technical Grade Fumaric Acid Pharmaceutical Grade Fumaric Acid Others |

| By End-User | Food and Beverage Industry Pharmaceutical Industry Chemical Manufacturing Cosmetics and Personal Care Industry Others |

| By Application | Food Additives Resins and Polymers (Unsaturated Polyester Resin, Alkyd Resin) Coatings and Adhesives Animal Feed Rosin Paper Sizing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Product Form | Powder Form Liquid Form Granular Form Others |

| By Extraction Type | Maleic Anhydride Process Fermentation Process Fumaria Officinalis Extraction Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 60 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector | 50 | Regulatory Affairs Managers, R&D Directors |

| Plastics and Polymers | 40 | Procurement Managers, Production Supervisors |

| Cosmetics and Personal Care | 40 | Formulation Chemists, Marketing Managers |

| Textile Industry | 40 | Supply Chain Managers, Product Line Managers |

The UAE Fumaric Acid Market is valued at approximately USD 45 million, reflecting a five-year historical analysis and regional share of the global market. This valuation highlights the market's growth driven by demand in various sectors, particularly food and pharmaceuticals.