Region:Asia

Author(s):Rebecca

Product Code:KRAE2878

Pages:97

Published On:February 2026

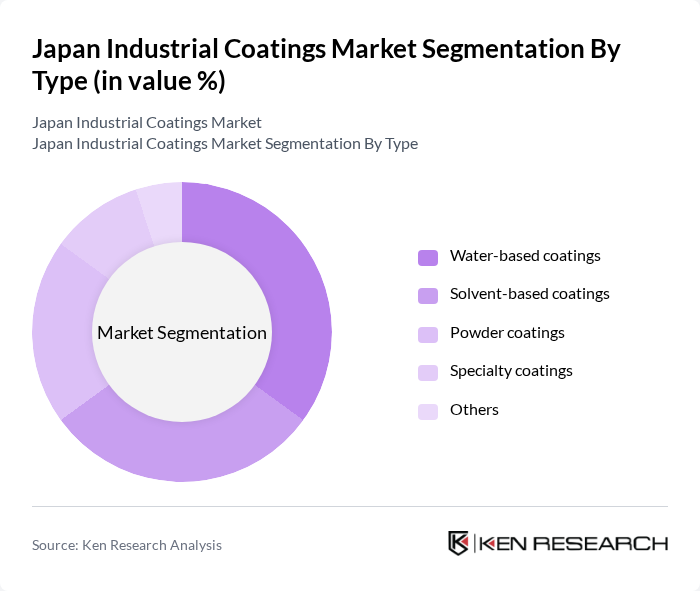

By Type:The market is segmented into various types of coatings, including water-based coatings, solvent-based coatings, powder coatings, specialty coatings, and others. Water-based coatings are gaining traction due to their low environmental impact and compliance with regulations. Solvent-based coatings, while still significant, are facing challenges due to increasing environmental concerns. Powder coatings are popular for their durability and efficiency, while specialty coatings cater to niche applications.

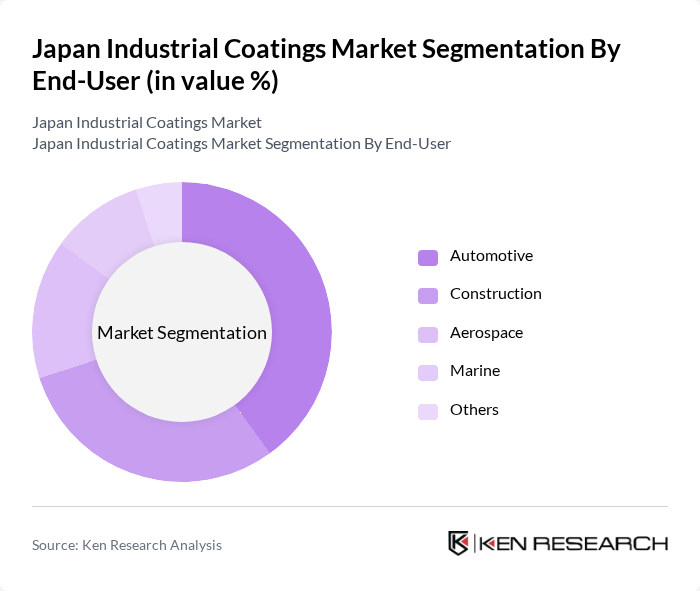

By End-User:The end-user segmentation includes automotive, construction, aerospace, marine, and others. The automotive sector is the largest consumer of industrial coatings, driven by the need for protective and aesthetic finishes. The construction industry follows closely, with coatings used for both interior and exterior applications. Aerospace and marine sectors also contribute significantly, requiring specialized coatings for durability and performance.

The Japan Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun A/S, Sherwin-Williams Company, AkzoNobel N.V., PPG Industries, Inc., BASF SE, RPM International Inc., Tikkurila Oyj, Hempel A/S, Asian Paints Ltd., Valspar Corporation, Benjamin Moore & Co., DuPont de Nemours, Inc., 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan industrial coatings market appears promising, driven by ongoing technological advancements and a strong push towards sustainability. As manufacturers increasingly adopt eco-friendly practices, the market is likely to see a rise in innovative products that meet both regulatory standards and consumer preferences. Additionally, the anticipated growth in the automotive and construction sectors will further bolster demand, creating a dynamic environment for industry players to explore new opportunities and enhance their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based coatings Solvent-based coatings Powder coatings Specialty coatings Others |

| By End-User | Automotive Construction Aerospace Marine Others |

| By Application | Protective coatings Decorative coatings Industrial coatings Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | Kanto Kansai Chubu Others |

| By Product Formulation | Epoxy coatings Polyurethane coatings Acrylic coatings Others |

| By Performance Characteristics | High durability Chemical resistance Heat resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Production Managers, Quality Control Supervisors |

| Construction Coatings | 80 | Project Managers, Procurement Officers |

| Marine Coatings | 60 | Marine Engineers, Fleet Managers |

| Electronics Coatings | 70 | R&D Managers, Product Development Engineers |

| Industrial Equipment Coatings | 90 | Operations Managers, Maintenance Supervisors |

The Japan Industrial Coatings Market is valued at approximately USD 8.5 billion, reflecting a robust growth trajectory driven by increasing demand for protective and decorative coatings across various sectors, including automotive, construction, and aerospace.