Region:Middle East

Author(s):Shubham

Product Code:KRAD6757

Pages:82

Published On:December 2025

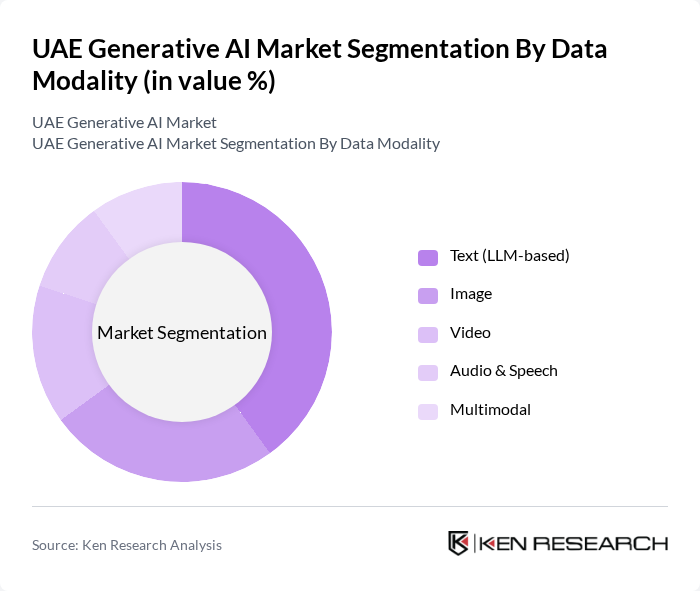

By Data Modality:The data modality segmentation includes various forms of data that Generative AI can process and generate. The subsegments are Text (LLM-based), Image, Video, Audio & Speech, and Multimodal. Among these, Text (LLM-based) is currently the leading subsegment due to the increasing demand for natural language processing applications in customer service, content creation, and virtual assistants, in line with strong software-led and text-centric use cases reported for the UAE generative AI market. The rapid rise of chatbots, AI copilots, document automation, and AI-driven content generation tools in both public and private sectors has significantly contributed to the growth of this subsegment.

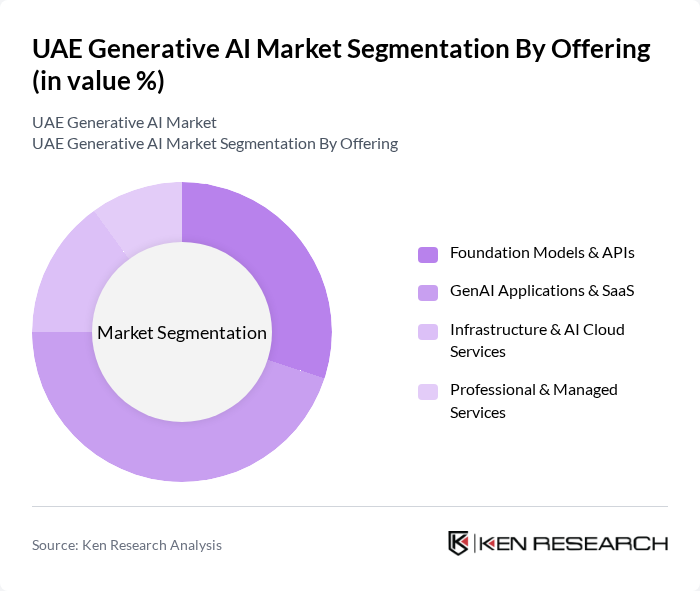

By Offering:The offering segmentation encompasses the various products and services available in the Generative AI market. This includes Foundation Models & APIs, GenAI Applications & SaaS, Infrastructure & AI Cloud Services, and Professional & Managed Services. The GenAI Applications & SaaS subsegment is currently leading the market, consistent with findings that software is the largest revenue-generating component in the UAE generative AI market, driven by the increasing demand for ready-to-use AI solutions that can be integrated into workflows such as marketing, customer service, coding assistance, and analytics. Organizations are increasingly adopting cloud-delivered applications, copilots, and industry-specific SaaS offerings to enhance productivity, reduce time-to-market, and accelerate innovation without building models from scratch.

The UAE Generative AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Gulf FZ LLC (Azure AI & Copilot), Amazon Web Services MENA FZ LLC, Google Cloud MENA (Google DeepMind & Gemini), IBM Middle East FZ-LLC (IBM watsonx), Oracle Corporation UAE (Oracle Cloud Infrastructure & GenAI), NVIDIA Corporation (AI Infrastructure & Partner Ecosystem in UAE), G42 (including Core42 & Inception Institute of Artificial Intelligence), Technology Innovation Institute (TII) – Falcon Models, Etisalat by e& (e& enterprise AI & Digital Solutions), du (Emirates Integrated Telecommunications Company), SAP Middle East & North Africa LLC, Salesforce UAE (Einstein & GenAI CRM), OpenAI (via Regional Partnerships & Integrations), Huawei Cloud Middle East (ModelArts & Pangu Models), Local & Regional GenAI Startups (e.g., Presight AI, Mozn, Other UAE-based Ventures) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE generative AI market is poised for significant advancements, driven by ongoing technological innovations and increased collaboration between public and private sectors. As businesses increasingly recognize the value of AI in enhancing operational efficiency, the demand for tailored AI solutions is expected to rise. Furthermore, the integration of AI with emerging technologies, such as blockchain and IoT, will create new avenues for growth, positioning the UAE as a leader in the global AI landscape by future.

| Segment | Sub-Segments |

|---|---|

| By Data Modality | Text (LLM-based) Image Video Audio & Speech Multimodal |

| By Offering | Foundation Models & APIs GenAI Applications & SaaS Infrastructure & AI Cloud Services Professional & Managed Services |

| By Deployment Model | Public Cloud Private Cloud Hybrid / On-Premises |

| By Application Use Case | Content Creation & Marketing Code Generation & DevOps Customer Service & Virtual Agents Knowledge Management & Enterprise Search Risk, Compliance & Document Automation Design, Digital Twins & Simulation |

| By End-User Sector | Government & Smart City Programs Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Telecom & Technology Retail, E-commerce & Consumer Energy, Utilities & Industrial Media, Advertising & Entertainment Education & EdTech |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region (Within UAE) | Dubai Abu Dhabi Sharjah & Northern Emirates Others (Free Zones & Innovation Hubs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 120 | Healthcare IT Managers, Medical Directors |

| Financial Services AI Integration | 90 | Chief Technology Officers, Risk Management Officers |

| Retail AI Solutions | 100 | Marketing Managers, E-commerce Directors |

| Manufacturing AI Innovations | 80 | Operations Managers, Production Supervisors |

| Education Sector AI Tools | 70 | Curriculum Developers, IT Coordinators |

The UAE Generative AI Market is valued at approximately USD 260 million, reflecting a five-year historical analysis and aligning with recent revenue estimates for generative AI solutions and software in the region.