Region:Middle East

Author(s):Dev

Product Code:KRAD7763

Pages:100

Published On:December 2025

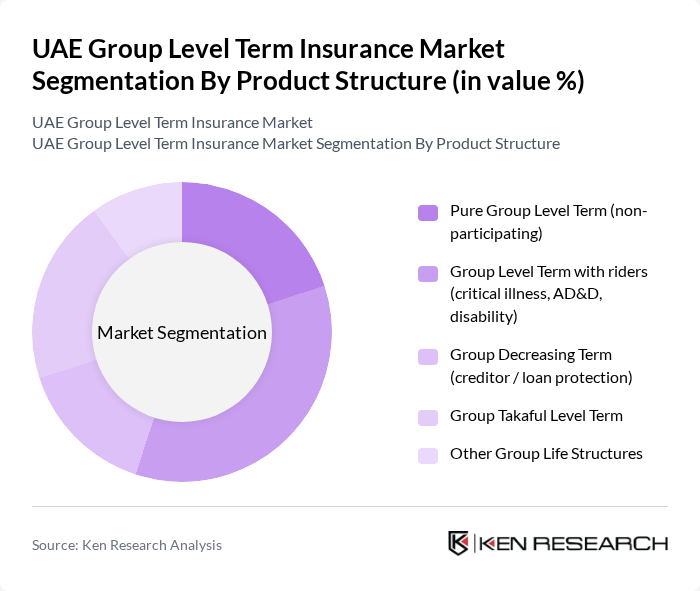

By Product Structure:The product structure segmentation includes various types of group level term insurance products designed to meet the diverse needs of employers and employees. The subsegments include Pure Group Level Term (non-participating), Group Level Term with riders (critical illness, AD&D, disability), Group Decreasing Term (creditor/loan protection), Group Takaful Level Term, and Other Group Life Structures. Among these, Group Level Term with riders is gaining traction due to its flexibility and added benefits, appealing to employers looking to enhance their employee benefits package and align life cover with critical illness, disability, and accident protection in a single, bundled program.

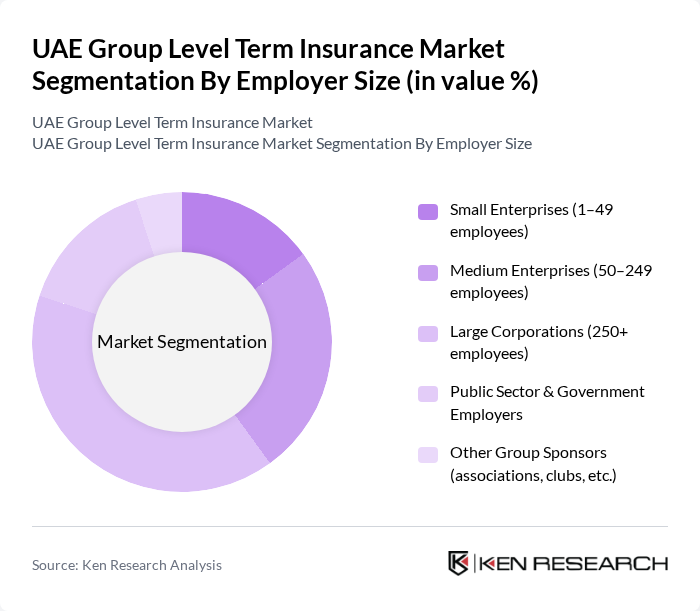

By Employer Size:This segmentation categorizes the market based on the size of the employing organization, which influences the type of group insurance products purchased. The subsegments include Small Enterprises (1–49 employees), Medium Enterprises (50–249 employees), Large Corporations (250+ employees), Public Sector & Government Employers, and Other Group Sponsors (associations, clubs, etc.). Large Corporations dominate the market due to their ability to offer comprehensive benefits and their higher employee counts, which lead to greater insurance needs, more complex risk management requirements, and multi-tier benefits structures across grades and geographies.

The UAE Group Level Term Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Insurance Company (ADNIC), Dubai Insurance Company PSC, Oman Insurance Company P.S.C. (Sukoon Insurance), AXA Green Crescent Insurance Company PJSC, MetLife Gulf (MetLife UAE), Zurich International Life Limited (Dubai Branch), Orient Insurance PJSC, National General Insurance Company (NGI), Emirates Insurance Company PJSC, Noor Takaful (owned by Dar Al Takaful), Salama Islamic Arab Insurance Company (SALAMA), Takaful Emarat – Insurance PSC, Dubai Islamic Insurance & Reinsurance Co. (AMAN), Union Insurance Company PJSC, RAK Insurance PJSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE group level term insurance market appears promising, driven by ongoing digital transformation and a growing emphasis on employee wellness. As companies increasingly adopt technology-driven solutions, the integration of AI and data analytics in underwriting processes is expected to enhance efficiency and customer experience. Furthermore, the rising focus on sustainability will likely lead to innovative insurance products that align with corporate social responsibility goals, creating new avenues for growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Structure | Pure Group Level Term (non-participating) Group Level Term with riders (critical illness, AD&D, disability) Group Decreasing Term (creditor / loan protection) Group Takaful Level Term Other Group Life Structures |

| By Employer Size | Small Enterprises (1–49 employees) Medium Enterprises (50–249 employees) Large Corporations (250+ employees) Public Sector & Government Employers Other Group Sponsors (associations, clubs, etc.) |

| By Industry Sector | Construction & Contracting Healthcare & Life Sciences Financial Services & Professional Services Retail, Hospitality & Tourism Transport, Logistics & Industrial Information Technology & Telecom Other Sectors |

| By Sum Assured per Employee | Up to 24 months’ basic salary equivalent –48 months’ basic salary equivalent Above 48 months’ basic salary equivalent / fixed high limits Custom & Executive Schemes |

| By Policy Term | Annual Renewable Group Term Multi-year Group Term (2–5 years) Long-term Group Term (more than 5 years) Credit-linked Term Tenors (aligned to loan maturity) |

| By Distribution Channel | Direct Corporate Sales (insurer-employed sales force) Insurance Brokers Bancassurance (corporate & SME segments) Digital & Online Platforms Other Intermediaries & Affinity Partners |

| By Scheme Type | Conventional Group Life (non?takaful) Takaful Group Life (Sharia?compliant) Voluntary / Employee?paid Group Term Employer?paid / Compulsory Group Term |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Group Term Insurance Providers | 45 | Product Managers, Underwriters |

| Insurance Brokers and Agents | 80 | Sales Executives, Business Development Managers |

| Policyholders in Corporate Sector | 120 | HR Managers, Employee Benefits Coordinators |

| Regulatory Bodies and Associations | 35 | Policy Analysts, Compliance Officers |

| Financial Advisors and Consultants | 65 | Financial Planners, Investment Advisors |

The UAE Group Level Term Insurance Market is valued at approximately AED 3.8 billion, reflecting a significant growth driven by increasing awareness of employee benefits and the rising number of businesses providing comprehensive insurance coverage for their workforce.