Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1007

Pages:99

Published On:October 2025

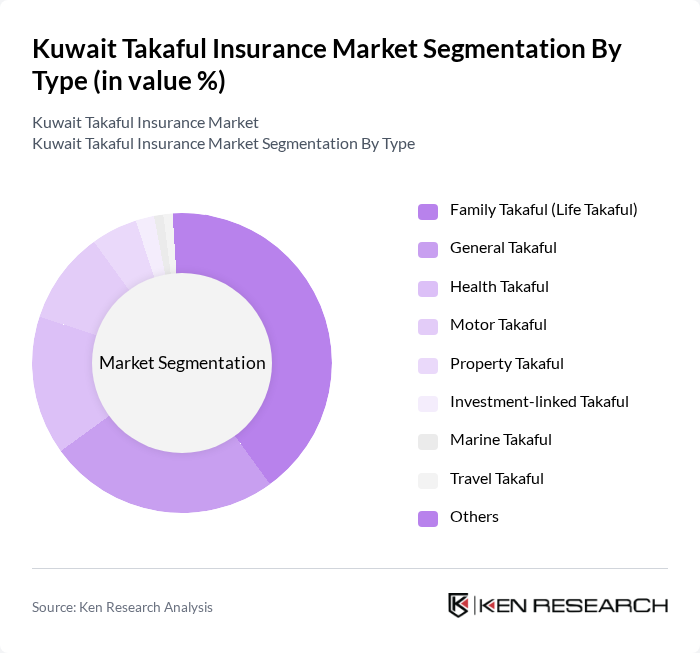

By Type:

The Takaful insurance market is segmented into Family Takaful (Life Takaful), General Takaful, Health Takaful, Motor Takaful, Property Takaful, Investment-linked Takaful, Marine Takaful, Travel Takaful, and Others. Family Takaful is the leading sub-segment, driven by rising demand for life insurance products that provide financial security for families and align with Islamic values. Enhanced consumer awareness, favorable demographics, and regulatory support have significantly boosted the uptake of Family Takaful products. General Takaful and Health Takaful also show robust performance, catering to diverse consumer needs including medical, property, and business risk coverage .

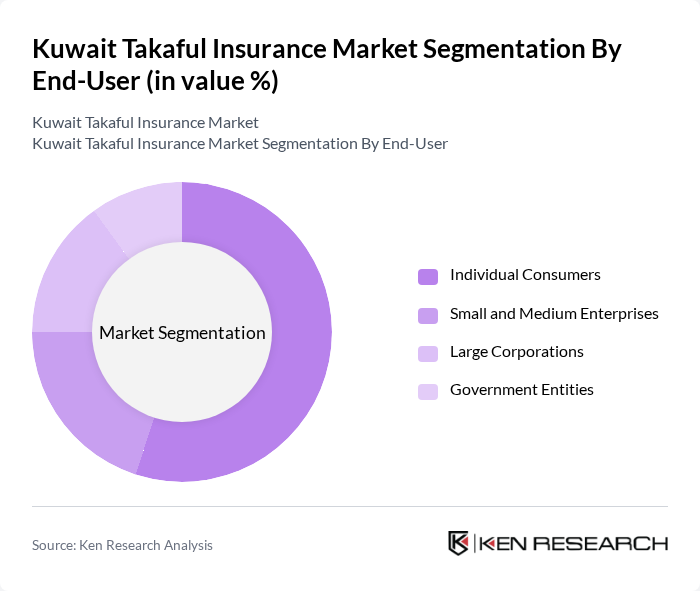

By End-User:

The end-user segmentation of the Takaful insurance market includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market, driven by increased awareness of personal financial planning, family protection, and the appeal of Sharia-compliant insurance. The rise in disposable income and evolving consumer attitudes have led to strong demand for Takaful products among individuals. SMEs and Large Corporations also contribute significantly, seeking comprehensive coverage to mitigate business risks and comply with regulatory requirements .

The Kuwait Takaful Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Takaful Insurance Company, Kuwait Insurance Company, Gulf Insurance Group, Warba Insurance Company, Takaful International Company, Al Sagr Insurance Company, Al-Ahlia Insurance Company, Kuwait Reinsurance Company, Al-Bilad Insurance Company, Al-Mawashi Insurance Company, Al-Hilal Insurance Company, Al-Jazeera Insurance Company, Al-Madina Insurance Company, Al Ahli United Bank (Takaful Division), National Takaful Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Takaful insurance market appears promising, driven by increasing consumer awareness and government support. As digitalization continues to reshape the industry, Takaful operators are expected to leverage technology to enhance customer experiences and streamline operations. Additionally, the growing demand for ethical and sustainable investment options will likely encourage the development of innovative Takaful products, catering to a broader audience and addressing the needs of under-served demographics in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Family Takaful (Life Takaful) General Takaful Health Takaful Motor Takaful Property Takaful Investment-linked Takaful Marine Takaful Travel Takaful Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Third-Party Coverage |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Region | Urban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Family Takaful Products | 100 | Policyholders, Financial Advisors |

| General Takaful Services | 80 | Insurance Brokers, Claims Adjusters |

| Investment-linked Takaful Plans | 70 | Investment Managers, Wealth Advisors |

| Takaful Market Trends | 90 | Market Analysts, Industry Experts |

| Customer Satisfaction in Takaful | 110 | Policyholders, Customer Service Representatives |

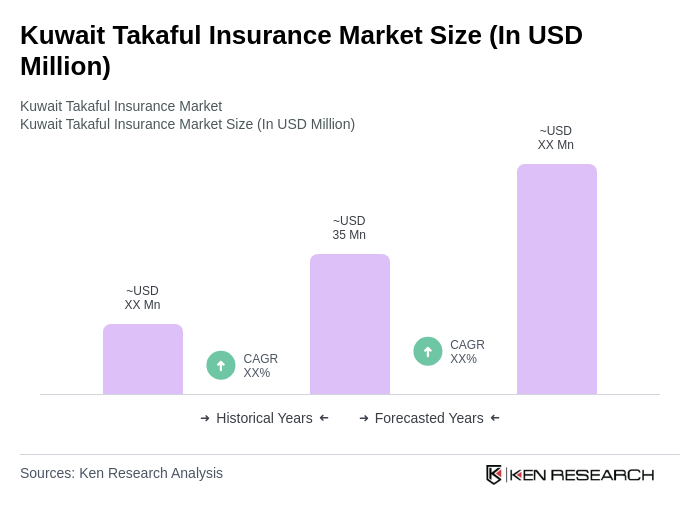

The Kuwait Takaful Insurance Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of Sharia-compliant financial products and regulatory reforms supporting Islamic insurance.