Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4875

Pages:81

Published On:December 2025

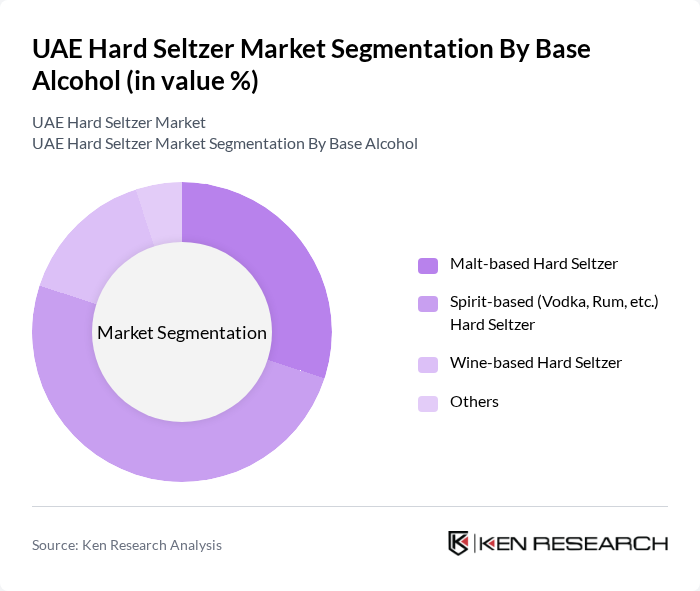

By Base Alcohol:The market is segmented based on the type of base alcohol used in hard seltzers. The subsegments include Malt-based Hard Seltzer, Spirit-based Hard Seltzer (Vodka, Rum, etc.), Wine-based Hard Seltzer, and Others. Each subsegment caters to different consumer preferences, with malt-based options appealing to traditional beer drinkers, while spirit-based varieties attract those seeking cleaner-tasting, low-sugar mixed drinks similar to vodka sodas, which aligns with global hard seltzer positioning.

The Spirit-based Hard Seltzer subsegment is currently dominating the market, accounting for a significant portion of sales, in line with global trends where spirit-based and higher-ABV RTDs are gaining share. This preference is driven by the appeal of cleaner flavor profiles, higher alcohol content per serving, and the versatility of citrus, tropical, and berry flavors that can be achieved with spirits. Consumers are increasingly gravitating towards these options for their refreshing taste, perceived better ingredient transparency, and lower calorie counts compared to many traditional mixed drinks, making them a popular choice in social and casual outdoor settings.

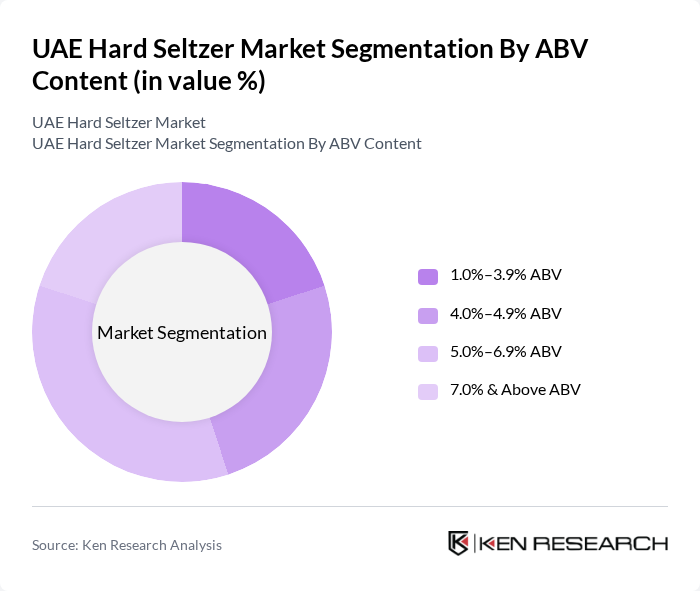

By ABV Content:The market is also segmented based on Alcohol by Volume (ABV) content, which includes 1.0%–3.9% ABV, 4.0%–4.9% ABV, 5.0%–6.9% ABV, and 7.0% & Above ABV. This segmentation reflects consumer preferences for varying levels of alcohol strength, with lower ABV options appealing to those seeking lighter beverages or extended drinking occasions, while mid-range ABV is favored for balancing sessionability and perceived value.

The 5.0%–6.9% ABV segment is leading the market, as it strikes a balance between flavor intensity, alcohol strength, and calorie content, mirroring the dominant ABV band observed in the global hard seltzer category. This ABV range is particularly popular among young adults who enjoy socializing in bars, beach clubs, and home gatherings and prefer beverages that provide a moderate buzz without being overly intoxicating, while still fitting within wellness-oriented and moderation drinking trends.

The UAE Hard Seltzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mark Anthony Brands International (White Claw), The Boston Beer Company (Truly Hard Seltzer), Anheuser-Busch InBev (Bud Light Seltzer), Constellation Brands, Inc. (Corona Hard Seltzer), Diageo plc (Smirnoff Seltzer), Molson Coors Beverage Company (Vizzy & Coors Hard Seltzer), Heineken N.V. (Canijilla / Hard Seltzer Portfolio), Topo Chico Hard Seltzer (The Coca-Cola Company / Molson Coors JV), AB InBev – Local & Regional Hard Seltzer Extensions in GCC, Local & Regional Private Labels (UAE Retailers and Hospitality Groups), Independent Importers and Distributors of International Hard Seltzer Brands, Craft and Niche Hard Seltzer Brands Present in UAE, Ready-to-Drink Spirit-based Seltzer Brands Active in UAE, Travel Retail & Duty Free Operators’ In-house Seltzer Brands, Emerging Functional & Low-calorie RTD Brands Competing with Hard Seltzer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hard seltzer market in the UAE appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to introduce more diverse flavors and low-calorie options. Additionally, the increasing penetration of e-commerce platforms will facilitate broader market access, allowing consumers to explore new products. The focus on sustainability will also shape product development, as brands seek to align with eco-friendly practices and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Base Alcohol | Malt-based Hard Seltzer Spirit-based (Vodka, Rum, etc.) Hard Seltzer Wine-based Hard Seltzer Others |

| By ABV Content | %–3.9% ABV %–4.9% ABV %–6.9% ABV % & Above ABV |

| By Packaging Type | Cans Bottles Multipacks & Variety Packs Others |

| By Distribution Channel | Off-trade (Supermarkets/Hypermarkets) Off-trade (Specialty Liquor Stores) On-trade (Bars, Restaurants, Beach Clubs, Hotels) Online Retail & Marketplaces Duty Free & Travel Retail |

| By Flavor Profile | Citrus (Lemon, Lime, Grapefruit) Berry (Strawberry, Raspberry, Mixed Berry) Tropical (Mango, Pineapple, Passionfruit) Botanical & Exotic (Herbal, Floral, Regional Flavors) |

| By Consumer Segment | Residents (Expatriates) Residents (Locals – Non-Muslim) Tourists & Business Travelers Hospitality & Events Buyers (HoReCa) |

| By Price Range | Premium & Super-premium Mid-range Value/Budget Private Label & Exclusive On-trade SKUs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 120 | Store Managers, Beverage Category Buyers |

| Consumer Preferences Survey | 140 | Adult Consumers (21+), Mixed Gender |

| Distributor Feedback | 90 | Sales Representatives, Distribution Managers |

| Market Trend Analysis | 80 | Market Analysts, Industry Experts |

| Focus Group Discussions | 40 | Potential Hard Seltzer Consumers, Diverse Demographics |

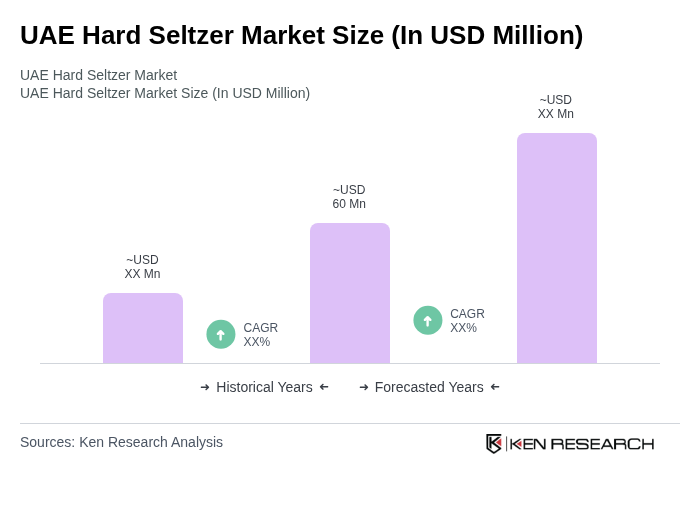

The UAE Hard Seltzer Market is valued at approximately USD 60 million, reflecting a growing trend towards low-calorie and low-sugar alcoholic beverages among health-conscious consumers in the region.