Region:Middle East

Author(s):Rebecca

Product Code:KRAB0217

Pages:92

Published On:August 2025

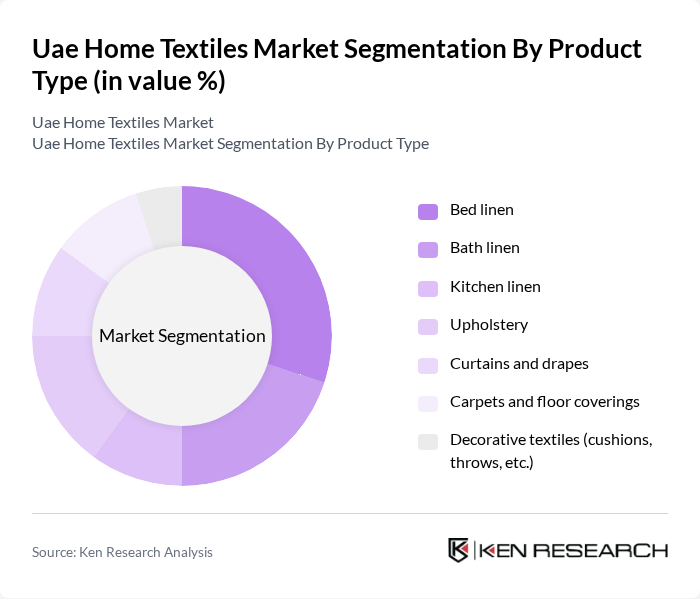

By Product Type:The product type segmentation includes categories such as bed linen, bath linen, kitchen linen, upholstery, curtains and drapes, carpets and floor coverings, and decorative textiles. Bed linen is the leading sub-segment, supported by increasing consumer preference for premium quality and stylish designs. The trend of home personalization, the influence of social media, and the rise in e-commerce have further fueled demand for diverse bed linen options .

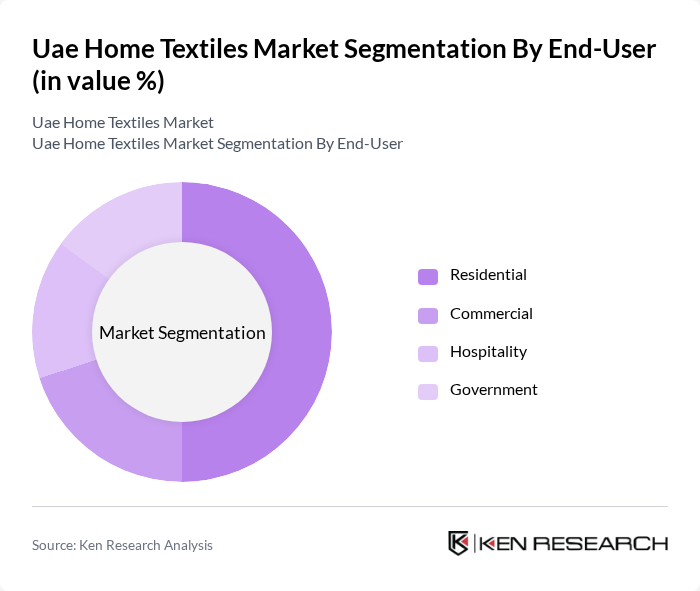

By End-User:The end-user segmentation covers residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by the increasing trend of home renovations, growing interest in interior design, and the influence of digital platforms on home aesthetics. The hospitality sector also represents a significant share, reflecting the UAE's robust tourism and hotel industry .

The UAE Home Textiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Zahra Textiles, Dubai Textile Merchants Association (DTMA), Emirates Textile Factory, Al Ain Textiles, Al Mufeed Textiles, Al Futtaim Group, Home Centre, IKEA, Landmark Group, LuLu Hypermarket, Pan Emirates Home Furnishings, Danube Home, Home Box, Al Homaizi Group, and Jashanmal National Company contribute to innovation, geographic expansion, and service delivery in this space.

The UAE home textiles market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart textiles, which offer functionalities like temperature regulation and stain resistance, is expected to gain traction. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly products. As the market adapts to these trends, companies that innovate and align with consumer values will likely capture a larger share of the market, ensuring robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bed linen Bath linen Kitchen linen Upholstery Curtains and drapes Carpets and floor coverings Decorative textiles (cushions, throws, etc.) |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores Online Others |

| By Price Range | Budget Mid-range Premium |

| By Material | Cotton Polyester Linen Silk Wool Blended fabrics |

| By Design Style | Traditional Modern Bohemian Minimalist |

| By Functionality | Decorative Functional Multi-functional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Home Textiles Sales | 100 | Store Managers, Sales Executives |

| Consumer Preferences in Home Textiles | 120 | Homeowners, Renters |

| Interior Design Trends | 80 | Interior Designers, Decorators |

| Manufacturing Insights | 60 | Production Managers, Quality Control Officers |

| Online Retail Dynamics | 60 | E-commerce Managers, Digital Marketing Specialists |

The UAE Home Textiles Market is valued at approximately USD 390 million, driven by factors such as increasing disposable incomes, urbanization, and a growing interest in home decor and interior design.