Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6057

Pages:92

Published On:December 2025

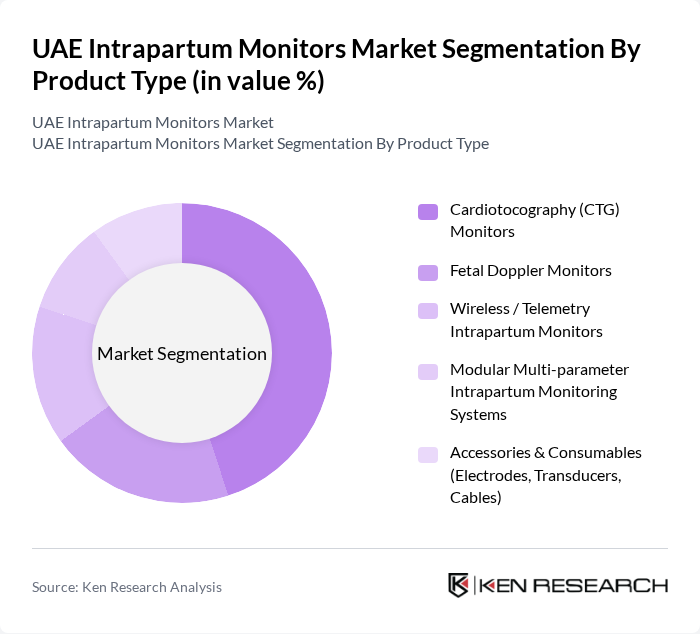

By Product Type:The product type segmentation includes various subsegments such as Cardiotocography (CTG) Monitors, Fetal Doppler Monitors, Wireless / Telemetry Intrapartum Monitors, Modular Multi-parameter Intrapartum Monitoring Systems, and Accessories & Consumables (Electrodes, Transducers, Cables). Among these, Cardiotocography (CTG) Monitors are the most dominant due to their widespread use in monitoring fetal heart rate and uterine contractions during labor. The increasing preference for non-invasive monitoring techniques and the integration of advanced technologies in CTG systems have further solidified their market position.

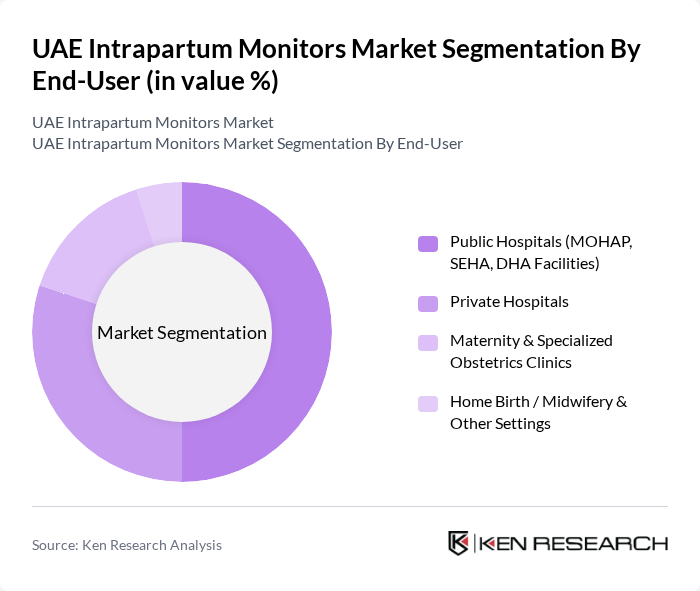

By End-User:The end-user segmentation comprises Public Hospitals (MOHAP, SEHA, DHA Facilities), Private Hospitals, Maternity & Specialized Obstetrics Clinics, and Home Birth / Midwifery & Other Settings. Public Hospitals are the leading segment, driven by government regulations mandating the use of advanced monitoring systems. The increasing number of births in public facilities and the availability of comprehensive maternal care services contribute to their dominance in the market.

The UAE Intrapartum Monitors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koninklijke Philips N.V. (Philips Healthcare), GE HealthCare Technologies Inc., Siemens Healthineers AG, Mindray Medical International Limited, Nihon Kohden Corporation, Drägerwerk AG & Co. KGaA, Natus Medical Incorporated, EDAN Instruments, Inc., Huntleigh Healthcare Limited (Arjo Group), Spacelabs Healthcare (OSI Systems, Inc.), Medtronic plc, Fukuda Denshi Co., Ltd., Comen Medical Instruments Co., Ltd., Welch Allyn, Inc. (Hillrom, a Baxter company), Local & Regional Distributors (Gulf Drug LLC, Leader Healthcare, Mega Med) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE intrapartum monitors market appears promising, driven by ongoing technological advancements and increasing investments in healthcare infrastructure. As the government continues to prioritize maternal health, the integration of AI and telemedicine into monitoring systems is expected to enhance patient care. Additionally, the expansion of private healthcare facilities will likely create more opportunities for the adoption of advanced monitoring solutions, ensuring better maternal and fetal health outcomes in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cardiotocography (CTG) Monitors Fetal Doppler Monitors Wireless / Telemetry Intrapartum Monitors Modular Multi-parameter Intrapartum Monitoring Systems Accessories & Consumables (Electrodes, Transducers, Cables) |

| By End-User | Public Hospitals (MOHAP, SEHA, DHA Facilities) Private Hospitals Maternity & Specialized Obstetrics Clinics Home Birth / Midwifery & Other Settings |

| By Emirate | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Technology | Conventional (Wired) CTG Systems Wireless & Telemetry-Based Systems Integrated Maternal–Fetal Monitoring Platforms AI-Enabled / Decision-Support–Enabled Systems |

| By Clinical Application | Intrapartum Labor Monitoring Fetal Heart Rate & Uterine Contraction Monitoring High-Risk Pregnancy & Induction-of-Labor Monitoring Maternal Vital Signs & Hemodynamic Monitoring During Labor |

| By Procurement & Ownership Model | Direct Capital Purchase Operating Lease & Managed Equipment Services Group Purchasing / Centralized Procurement (MOHAP, SEHA, DHA) Others |

| By Installation Environment | Labor & Delivery Suites Emergency Departments & Triage Obstetrics Outpatient & Antenatal Assessment Units Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Maternity Units | 80 | Obstetricians, Hospital Administrators |

| Private Healthcare Facilities | 70 | Gynecologists, Procurement Officers |

| Midwifery Practices | 50 | Midwives, Clinical Coordinators |

| Healthcare Technology Providers | 40 | Product Managers, Sales Directors |

| Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

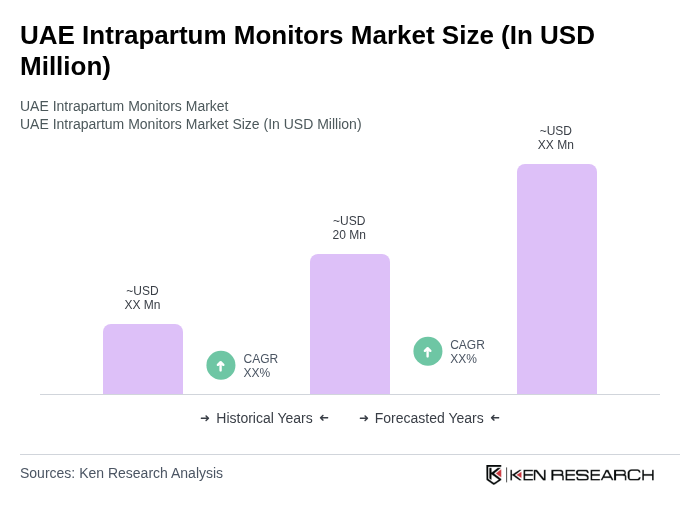

The UAE Intrapartum Monitors Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by increasing birth rates and advancements in medical technology focused on maternal and fetal health monitoring.