Region:Middle East

Author(s):Shubham

Product Code:KRAD6686

Pages:84

Published On:December 2025

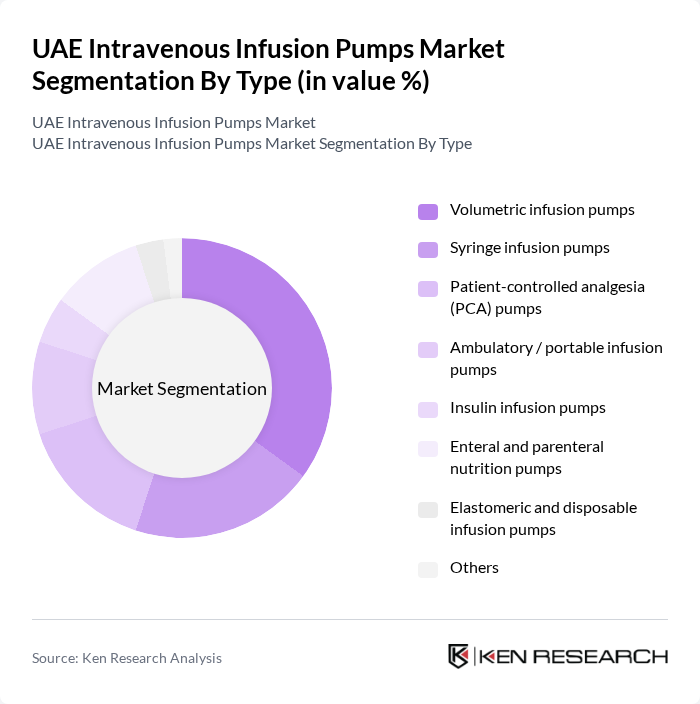

By Type:The market is segmented into various types of infusion pumps, each catering to specific medical needs. The subsegments include volumetric infusion pumps, syringe infusion pumps, patient-controlled analgesia (PCA) pumps, ambulatory/portable infusion pumps, insulin infusion pumps, enteral and parenteral nutrition pumps, elastomeric and disposable infusion pumps, and others. Among these, volumetric infusion pumps are the most widely used in hospital settings due to their versatility and reliability in delivering precise fluid volumes for continuous infusions in intensive care, perioperative care, and general wards. Syringe pumps and PCA pumps are extensively used in anesthesia, critical care, and pain management, while ambulatory and portable pumps, including insulin and home infusion pumps, are gaining traction with the expansion of homecare and outpatient therapies in the UAE.

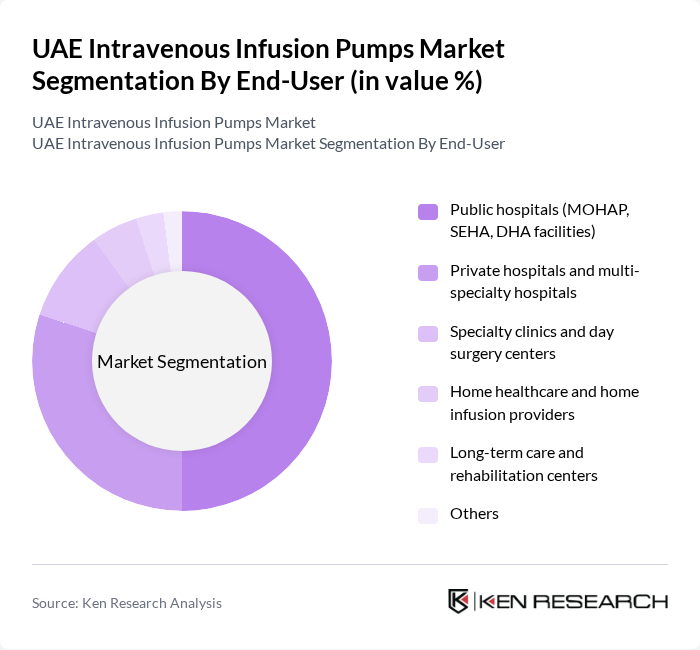

By End-User:The end-user segmentation includes public hospitals (MOHAP, SEHA, DHA facilities), private hospitals and multi-specialty hospitals, specialty clinics and day surgery centers, home healthcare and home infusion providers, long-term care and rehabilitation centers, and others. Public hospitals dominate the market due to their extensive patient base, large ICU and oncology capacities, and government funding that supports bulk procurement of advanced infusion devices, including smart pumps with connectivity and safety features. Private hospitals and specialty centers, particularly in Dubai and Abu Dhabi, are rapidly increasing adoption of networked and interoperable infusion systems to support medical tourism, international accreditation, and value?based care initiatives.

The UAE Intravenous Infusion Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Medtronic plc, Smiths Medical (ICU Medical, Inc.), Terumo Corporation, ICU Medical, Inc., Becton, Dickinson and Company (BD), Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nipro Corporation, Moog Inc., Zyno Medical, Mindray Medical International Limited, JMS Co., Ltd., Hospira, Inc. (Pfizer Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE intravenous infusion pumps market appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare facilities expand and integrate smart technologies, the demand for innovative infusion solutions is expected to rise. Additionally, the growing emphasis on home healthcare will likely create new avenues for market growth. Stakeholders must remain agile to adapt to evolving regulations and consumer preferences, ensuring they capitalize on emerging trends in the healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Volumetric infusion pumps Syringe infusion pumps Patient-controlled analgesia (PCA) pumps Ambulatory / portable infusion pumps Insulin infusion pumps Enteral and parenteral nutrition pumps Elastomeric and disposable infusion pumps Others |

| By End-User | Public hospitals (MOHAP, SEHA, DHA facilities) Private hospitals and multi-specialty hospitals Specialty clinics and day surgery centers Home healthcare and home infusion providers Long-term care and rehabilitation centers Others |

| By Application | Oncology and chemotherapy Analgesia and pain management Anesthesia and perioperative care Critical care and intensive care (ICU / NICU / PICU) Parenteral nutrition and fluid management Others |

| By Technology | Conventional electronic infusion pumps Smart infusion pumps with drug libraries Wireless / connected infusion pumps (EMR / HIS integrated) Mechanical and non-programmable pumps Others |

| By Distribution Channel | Direct sales to healthcare providers Local medical device distributors and agents Group purchasing organizations (GPOs) and tenders Online and e-procurement platforms Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah & Umm Al Quwain |

| By Policy Support | Federal and emirate-level healthcare spending Medical device registration and fast-track approvals Incentives for medical tourism and private sector investment Support for digital health and smart hospital initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Clinical Staff Using Infusion Pumps | 80 | Nurses, Anesthetists, Physicians |

| Biomedical Engineering Teams | 60 | Biomedical Engineers, Technical Support Staff |

| Home Healthcare Providers | 50 | Home Care Managers, Patient Care Coordinators |

| Regulatory and Compliance Officers | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

The UAE Intravenous Infusion Pumps Market is valued at approximately USD 50 million, reflecting a five-year historical analysis of national-level revenues for infusion pumps and accessories, driven by the rising prevalence of chronic diseases and advancements in infusion technologies.