Region:Asia

Author(s):Rebecca

Product Code:KRAC2539

Pages:81

Published On:October 2025

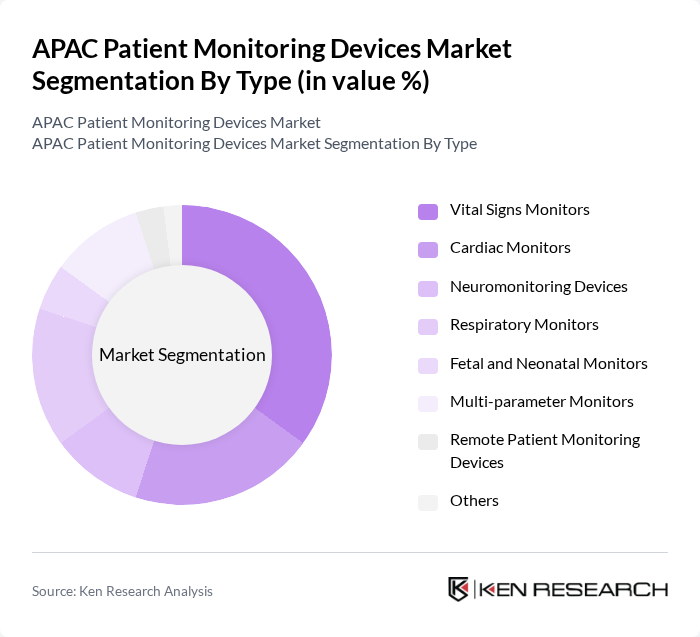

By Type:The market is segmented into various types of monitoring devices, including vital signs monitors, cardiac monitors, neuromonitoring devices, respiratory monitors, fetal and neonatal monitors, multi-parameter monitors, remote patient monitoring devices, and others. Among these, vital signs monitors and cardiac monitors are leading the market due to their essential role in continuous patient assessment and the growing demand for real-time health monitoring solutions. The increasing prevalence of cardiovascular diseases, respiratory disorders, and the adoption of remote monitoring technologies further drive the uptake of these devices .

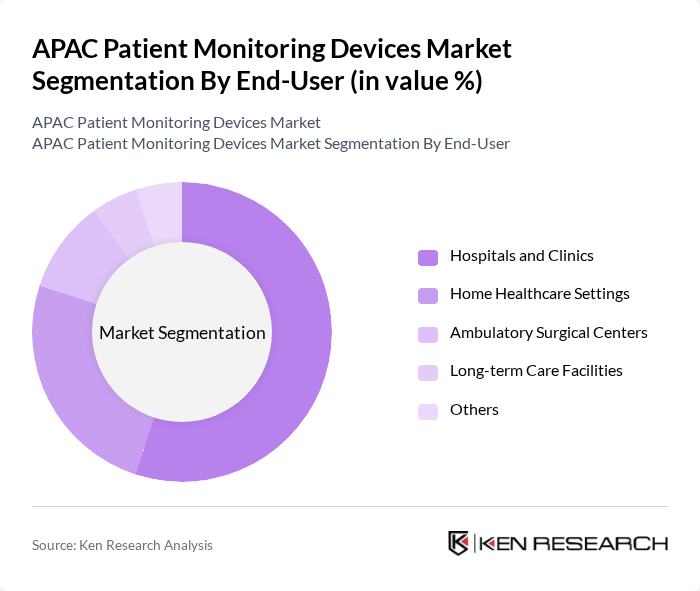

By End-User:The end-user segmentation includes hospitals and clinics, home healthcare settings, ambulatory surgical centers, long-term care facilities, and others. Hospitals and clinics dominate this segment, accounting for over half of the market share, due to the high demand for patient monitoring in critical care and inpatient settings. The increasing focus on patient safety, the need for continuous monitoring, and the modernization of healthcare infrastructure drive the growth of this segment, while the rise of home healthcare and remote patient monitoring solutions is also gaining traction .

The APAC Patient Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, GE Healthcare, Siemens Healthineers, Medtronic, Abbott Laboratories, Nihon Kohden Corporation, Mindray Medical International Limited, Drägerwerk AG & Co. KGaA, Roche Diagnostics, Boston Scientific Corporation, Johnson & Johnson, B. Braun Melsungen AG, Zoll Medical Corporation, Welch Allyn (Hillrom/Baxter), Omron Healthcare, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Fukuda Denshi Co., Ltd., Contec Medical Systems Co., Ltd., Edan Instruments, Inc., Schiller AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC patient monitoring devices market appears promising, driven by the increasing integration of digital health technologies and a growing emphasis on preventive healthcare. As telehealth services expand, healthcare providers are likely to adopt remote monitoring solutions to enhance patient engagement and reduce hospital visits. Additionally, the rise of artificial intelligence in healthcare is expected to facilitate more personalized monitoring, improving patient outcomes and operational efficiency across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Vital Signs Monitors Cardiac Monitors Neuromonitoring Devices Respiratory Monitors Fetal and Neonatal Monitors Multi-parameter Monitors Remote Patient Monitoring Devices Others |

| By End-User | Hospitals and Clinics Home Healthcare Settings Ambulatory Surgical Centers Long-term Care Facilities Others |

| By Region | China Japan India Australia South Korea Southeast Asia Rest of Asia-Pacific |

| By Application | Cardiology Neurology Respiratory Maternal and Fetal Health Weight Management and Fitness Monitoring Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Component | Hardware Software Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement for Monitoring Devices | 120 | Procurement Managers, Supply Chain Directors |

| Home Healthcare Monitoring Solutions | 80 | Home Care Managers, Patient Care Coordinators |

| Wearable Health Technology Adoption | 60 | Health Tech Innovators, Product Managers |

| Telehealth Integration in Hospitals | 100 | IT Managers, Telehealth Coordinators |

| Patient Experience with Monitoring Devices | 70 | Patients, Caregivers, Health Advocates |

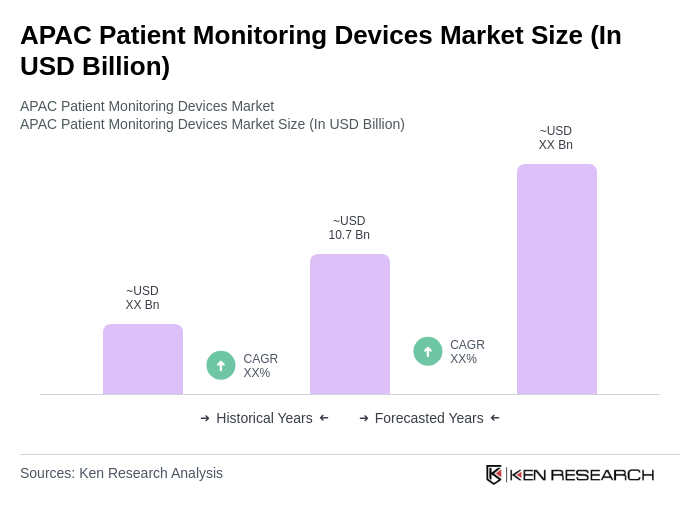

The APAC Patient Monitoring Devices Market is valued at approximately USD 10.7 billion, driven by the increasing prevalence of chronic diseases, advancements in digital health technologies, and a growing demand for home healthcare solutions.