Region:Middle East

Author(s):Shubham

Product Code:KRAD5328

Pages:83

Published On:December 2025

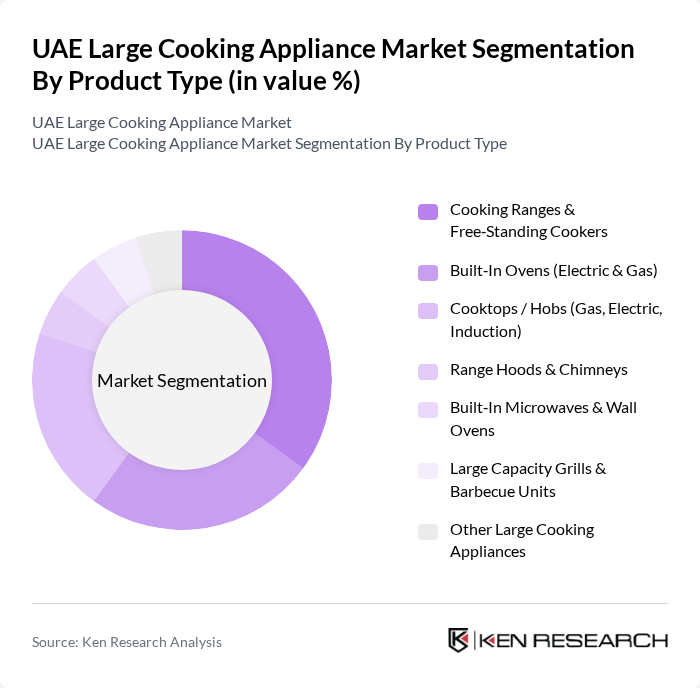

By Product Type:The product type segmentation includes various categories of large cooking appliances, each catering to different consumer needs and preferences. The subsegments include Cooking Ranges & Free-Standing Cookers, Built-In Ovens (Electric & Gas), Cooktops / Hobs (Gas, Electric, Induction), Range Hoods & Chimneys, Built-In Microwaves & Wall Ovens, Large Capacity Grills & Barbecue Units, and Other Large Cooking Appliances. Within the wider household kitchen appliances market, cooking appliances are identified as the largest revenue-generating product group, and in the UAE large cooking appliance category, Cooking Ranges & Free-Standing Cookers typically account for the highest volume due to their versatility and widespread use in both residential and commercial settings.

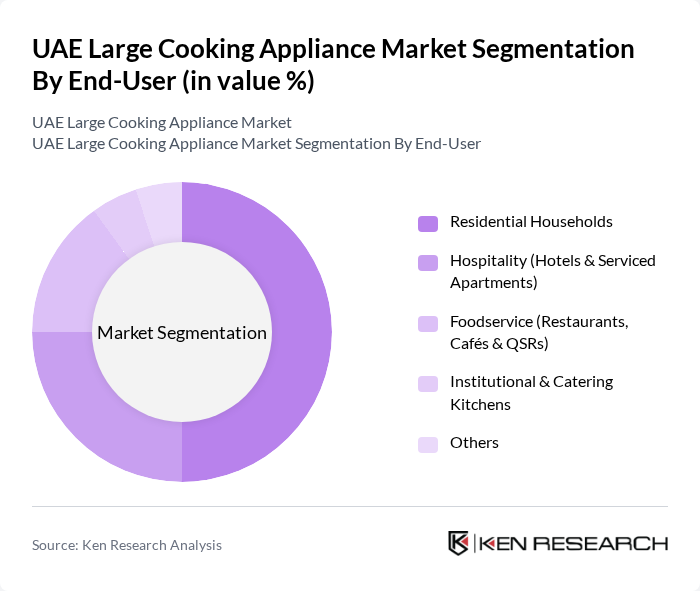

By End-User:The end-user segmentation encompasses various categories, including Residential Households, Hospitality (Hotels & Serviced Apartments), Foodservice (Restaurants, Cafés & QSRs), Institutional & Catering Kitchens, and Others. The Residential Households segment leads the market, supported by a growing base of urban households upgrading to modern, energy-efficient and smart cooking appliances, while the hospitality and foodservice sectors also represent significant demand centres in line with the broader commercial kitchen appliances market in the UAE.

The UAE Large Cooking Appliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beko (Arçelik A.?.), Bosch Home Appliances (BSH Hausgeräte GmbH), Siemens Home Appliances (BSH Hausgeräte GmbH), LG Electronics, Samsung Electronics, Whirlpool Corporation, Midea Group, Electrolux Group, Haier Smart Home Co., Ltd., Gorenje (Hisense Europe), SMEG S.p.A., Frigidaire (Electrolux Brand), Teka Group, Ariston (Ariston Thermo Group), and Zanussi contribute to innovation, geographic expansion, and service delivery in this space.

The UAE large cooking appliance market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As smart home integration becomes more prevalent, manufacturers are expected to innovate with connected appliances that enhance user convenience. Additionally, the focus on sustainability will likely lead to increased demand for eco-friendly products, aligning with government initiatives aimed at reducing environmental impact. These trends will shape the market landscape, presenting both challenges and opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cooking Ranges & Free?Standing Cookers Built?In Ovens (Electric & Gas) Cooktops / Hobs (Gas, Electric, Induction) Range Hoods & Chimneys Built?In Microwaves & Wall Ovens Large Capacity Grills & Barbecue Units Other Large Cooking Appliances |

| By End-User | Residential Households Hospitality (Hotels & Serviced Apartments) Foodservice (Restaurants, Cafés & QSRs) Institutional & Catering Kitchens Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain & Others |

| By Fuel / Power Source | Electric Gas (LPG & Piped Gas) Induction Dual?Fuel / Hybrid Others |

| By Installation Type | Built?In / Integrated Free?Standing Countertop (Large Format) Others |

| By Price Band | Economy Mid?Range Premium Luxury / Professional?Grade Others |

| By Connectivity & Feature Set | Conventional (Non?Smart) Smart / Wi?Fi?Enabled Energy?Efficient / High Star?Rating Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Cooking Appliances | 150 | Homeowners, Renters, Kitchen Renovators |

| Retail Insights on Large Cooking Appliances | 120 | Store Managers, Sales Representatives |

| Market Trends in Commercial Cooking Equipment | 80 | Restaurant Owners, Catering Managers |

| Technological Innovations in Cooking Appliances | 70 | Product Development Engineers, R&D Managers |

| Consumer Feedback on Energy Efficiency | 90 | Environmentally Conscious Consumers, Energy Auditors |

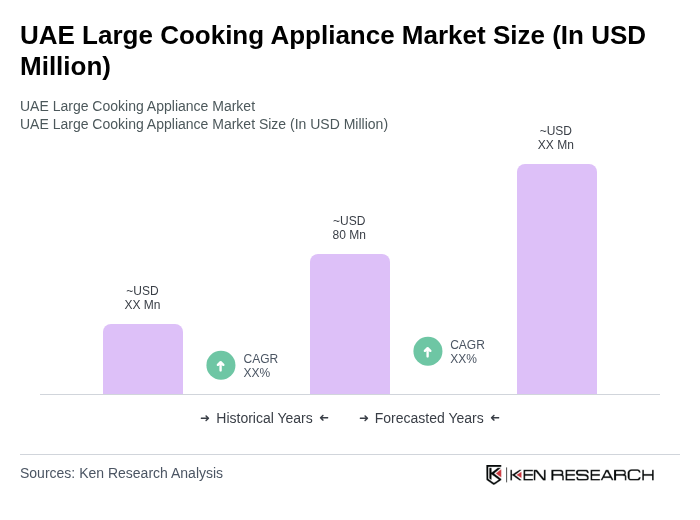

The UAE Large Cooking Appliance Market is valued at approximately USD 80 million, reflecting a five-year historical analysis. This growth is driven by urbanization, rising living standards, and a preference for modern kitchen solutions among consumers.