Region:Middle East

Author(s):Rebecca

Product Code:KRAD6150

Pages:90

Published On:December 2025

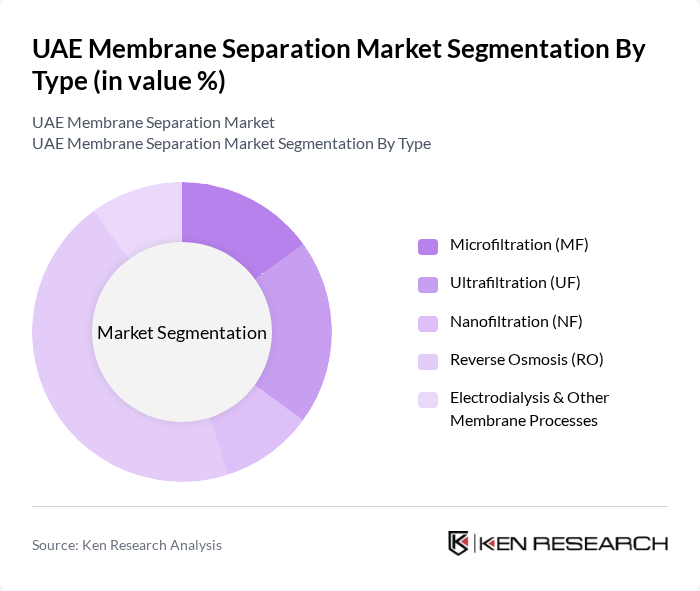

By Type:

The membrane separation market is segmented into various types, including Microfiltration (MF), Ultrafiltration (UF), Nanofiltration (NF), Reverse Osmosis (RO), and Electrodialysis & Other Membrane Processes, which is consistent with standard industry categorization. Among these, Reverse Osmosis (RO) is the leading sub-segment, primarily due to its widespread application in seawater desalination and its ability to produce high-quality potable water. The increasing demand for freshwater in arid regions such as the UAE, coupled with advancements in RO technology that reduce specific energy consumption and improve membrane durability, has significantly contributed to its dominance in the market.

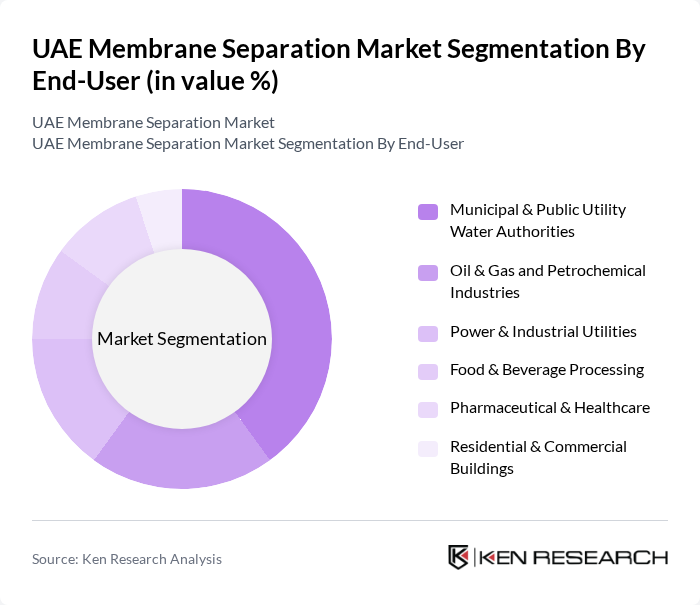

By End-User:

The end-user segmentation includes Municipal & Public Utility Water Authorities, Oil & Gas and Petrochemical Industries, Power & Industrial Utilities, Food & Beverage Processing, Pharmaceutical & Healthcare, and Residential & Commercial Buildings, which aligns with the key application areas of membrane separation technologies in the UAE. The Municipal & Public Utility Water Authorities segment is the largest, driven by the increasing need for efficient water treatment solutions in urban areas, especially for seawater desalination, municipal drinking water treatment, and wastewater reuse. The growing population and urbanization in the UAE, supported by large-scale infrastructure and smart city projects, necessitate advanced water treatment technologies such as RO, UF, and MF to ensure a sustainable and reliable water supply.

The UAE Membrane Separation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont Water Solutions (incl. former Dow Water & Process Solutions), Veolia Water Technologies & Solutions (incl. former SUEZ WTS), Hydranautics – A Nitto Group Company, Toray Membrane Middle East LLC (TMME), LG Chem / LG Water Solutions, Koch Separation Solutions (KSS), Pall Corporation, Pentair, Xylem Inc., 3M (Water & Filtration Solutions), Alfa Laval, Aquatech International LLC, Metito (Overseas) Limited, IDE Technologies, ACCIONA Agua contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE membrane separation market appears promising, driven by increasing investments in water treatment and industrial applications. As the government continues to prioritize sustainability, the integration of innovative technologies will likely enhance operational efficiencies. Additionally, the growing focus on energy-efficient solutions and the adoption of IoT in membrane systems will further propel market growth. Collaborative partnerships between industry players and research institutions are expected to foster advancements in membrane technology, ensuring a competitive edge in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Microfiltration (MF) Ultrafiltration (UF) Nanofiltration (NF) Reverse Osmosis (RO) Electrodialysis & Other Membrane Processes |

| By End-User | Municipal & Public Utility Water Authorities Oil & Gas and Petrochemical Industries Power & Industrial Utilities Food & Beverage Processing Pharmaceutical & Healthcare Residential & Commercial Buildings |

| By Application | Seawater Desalination Municipal Wastewater Treatment & Reuse Industrial Process Water & Wastewater Treatment Brackish Water Treatment Gas Separation & VOC Removal |

| By Material | Polymeric Membranes (e.g., PA, PES, PVDF) Inorganic & Ceramic Membranes Composite & Thin-Film Composite (TFC) Membranes Others (Metallic, Ion-Exchange, etc.) |

| By System Configuration | Spiral-Wound Modules Hollow Fiber Modules Plate & Frame / Flat Sheet Modules Tubular Modules |

| By Region | Abu Dhabi Dubai Sharjah Ras Al Khaimah, Fujairah & Umm Al Quwain Ajman & Other Emirates |

| By Policy Support / Project Ownership | Federal Government-Owned Utilities (e.g., EWEC, TRANSCO) Emirate-Level Water & Power Authorities (e.g., DEWA, SEWA, FEWA/Etihad Water) Public–Private Partnership (PPP / IWPP / BOO) Projects Private Industrial & Commercial Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Facilities | 120 | Plant Managers, Environmental Engineers |

| Food and Beverage Industry | 100 | Quality Control Managers, Production Supervisors |

| Pharmaceutical Manufacturing | 80 | Process Engineers, Compliance Officers |

| Desalination Projects | 110 | Project Managers, Technical Directors |

| Research Institutions | 70 | Research Scientists, Academic Professors |

The UAE Membrane Separation Market is valued at approximately USD 200 million, driven by the increasing demand for water treatment solutions, particularly in desalination and wastewater treatment, as the region faces significant water scarcity challenges.