Region:North America

Author(s):Dev

Product Code:KRAC8015

Pages:97

Published On:November 2025

By Type:The market is segmented into various types of filtration solutions, including air filtration, liquid filtration, dust collectors, bag filters, cartridge filters, HEPA & ULPA filters, electrostatic precipitators, depth filters, and others. Each of these sub-segments plays a crucial role in addressing specific filtration needs across different industries. Liquid filtration remains the largest segment by revenue, while air filtration is the fastest-growing segment, reflecting the increasing focus on air quality and emission control .

By End-User:The end-user segmentation includes manufacturing, oil & gas, food & beverage, pharmaceuticals, automotive, chemicals & petrochemicals, power generation, metal & mining, pulp & paper, and others. Each sector has unique filtration requirements, driving the demand for tailored solutions. The manufacturing sector remains the largest end-user, followed by oil & gas and food & beverage, with pharmaceuticals and power generation showing strong growth due to regulatory and operational demands .

The United States Industrial Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Donaldson Company, Inc., 3M Company, Camfil AB, AAF International (Daikin Group), Parker Hannifin Corporation, Filtration Group Corporation, Eaton Corporation, Graver Technologies LLC, Pentair PLC, CLARCOR Inc. (now part of Parker Hannifin), MANN+HUMMEL Group, SUEZ Water Technologies & Solutions, Alfa Laval AB, Veolia Environnement S.A., ITT Inc., Filtration Technology Corporation, Pall Corporation (Danaher Corporation), Koch Separation Solutions, Lydall, Inc. (now part of MANN+HUMMEL), Pullner Filtration Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States industrial filtration market appears promising, driven by increasing environmental awareness and technological advancements. As industries adapt to stringent regulations, the demand for innovative filtration solutions is expected to rise. Furthermore, the integration of smart technologies and IoT in filtration systems will enhance operational efficiency and monitoring capabilities. Companies that invest in sustainable practices and advanced filtration technologies are likely to gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Filtration Liquid Filtration Dust Collectors Bag Filters Cartridge Filters HEPA & ULPA Filters Electrostatic Precipitators Depth Filters Others |

| By End-User | Manufacturing Oil & Gas Food & Beverage Pharmaceuticals Automotive Chemicals & Petrochemicals Power Generation Metal & Mining Pulp & Paper Others |

| By Industry | Chemical Processing Power Generation Water Treatment Mining Pulp & Paper Automotive Manufacturing Food & Beverage Processing Pharmaceuticals & Biotechnology Oil & Gas Others |

| By Filtration Method | Mechanical Filtration Chemical Filtration Biological Filtration Electrostatic Filtration Membrane Filtration Others |

| By Material Type | Fiberglass Polypropylene Activated Carbon/Charcoal Metal Mesh Filter Paper Non-Woven Fabric Others |

| By Application | Air Pollution Control Water Filtration Process Filtration Wastewater Treatment Chemical & Petrochemical Processing Food & Beverage Processing Power Generation Others |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Filtration Systems | 60 | Process Engineers, Operations Managers |

| Pharmaceutical Filtration Solutions | 50 | Quality Control Managers, R&D Managers |

| Food & Beverage Filtration Applications | 55 | Production Supervisors, Compliance Officers |

| Water Treatment Filtration Technologies | 45 | Environmental Engineers, Project Managers |

| Industrial Air Filtration Systems | 40 | Facility Managers, Safety Officers |

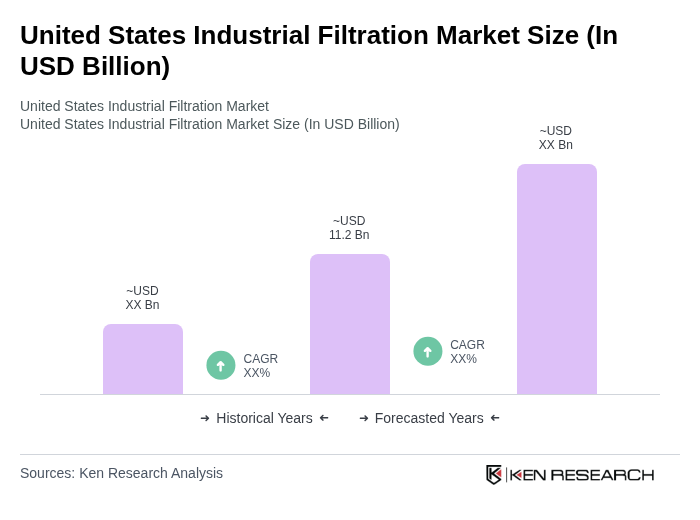

The United States Industrial Filtration Market is valued at approximately USD 11.2 billion, reflecting a significant growth trend driven by increasing environmental regulations and the demand for cleaner production processes across various industries.