Region:Middle East

Author(s):Dev

Product Code:KRAA8213

Pages:91

Published On:November 2025

By Type:The metering pump market can be segmented into various types, including diaphragm pumps, piston/plunger pumps, peristaltic pumps, gear pumps, rotary lobe pumps, and others. Diaphragm pumps are particularly popular due to their ability to handle corrosive and abrasive fluids, as well as their precise flow control. The increasing demand for accurate chemical dosing in water treatment, pharmaceuticals, and food processing is driving the growth of diaphragm pumps. Piston/plunger pumps are favored for high-pressure applications, while peristaltic pumps are valued for their ease of maintenance and suitability for shear-sensitive fluids .

By Drive Mechanism:The metering pump market is also categorized by drive mechanism, including motor-driven, solenoid-driven, pneumatic-driven, and others. Motor-driven pumps dominate due to their high reliability, efficiency, and suitability for a wide range of flow rates and pressures. Solenoid-driven pumps are increasingly used in low-flow and precise dosing applications, especially in laboratories and small-scale industrial processes. Pneumatic-driven pumps are preferred in hazardous or remote environments where electrical power is limited .

The UAE Metering Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos, Flowserve Corporation, KSB SE & Co. KGaA, ProMinent GmbH, Milton Roy, Iwaki Co., Ltd., Verder Group, Pulsafeeder, Inc., Cat Pumps, ARO (Ingersoll Rand), Watson-Marlow Fluid Technology Group, Tuthill Corporation, Bredel Pumps, LMI (A Brand of Milton Roy), Seko S.p.A., LEWA GmbH, IDEX Corporation, Dover Corporation, SPX FLOW, Inc., EMEC s.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE metering pump market appears promising, driven by technological advancements and increasing regulatory pressures for efficiency. The integration of IoT technologies is expected to enhance operational efficiency and data accuracy, while the shift towards sustainable practices will encourage the adoption of eco-friendly metering solutions. As industries increasingly prioritize automation and smart technologies, the demand for customized metering solutions will likely rise, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Diaphragm Pumps Piston/Plunger Pumps Peristaltic Pumps Gear Pumps Rotary Lobe Pumps Others |

| By Drive Mechanism | Motor-Driven Metering Pumps Solenoid-Driven Metering Pumps Pneumatic-Driven Metering Pumps Others |

| By End-User | Water and Wastewater Treatment Oil and Gas Chemical Processing Pharmaceuticals Food and Beverage Pulp and Paper Agriculture and Fertigation Others |

| By Application | Chemical Injection Water Treatment Fuel Transfer Disinfection Dosing and Blending Others |

| By Material | Stainless Steel Plastic Alloy Others |

| By Flow Rate | Low Flow Rate Medium Flow Rate High Flow Rate Others |

| By Pressure Rating | Up to 50 bar –100 bar Above 100 bar Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 60 | Procurement Managers, Operations Managers |

| Chemical Processing Industry | 40 | Plant Managers, Process Engineers |

| Water Treatment Facilities | 40 | Facility Managers, Environmental Engineers |

| Food & Beverage Sector | 40 | Quality Control Managers, Production Supervisors |

| Pharmaceutical Manufacturing | 40 | Regulatory Affairs Managers, R&D Managers |

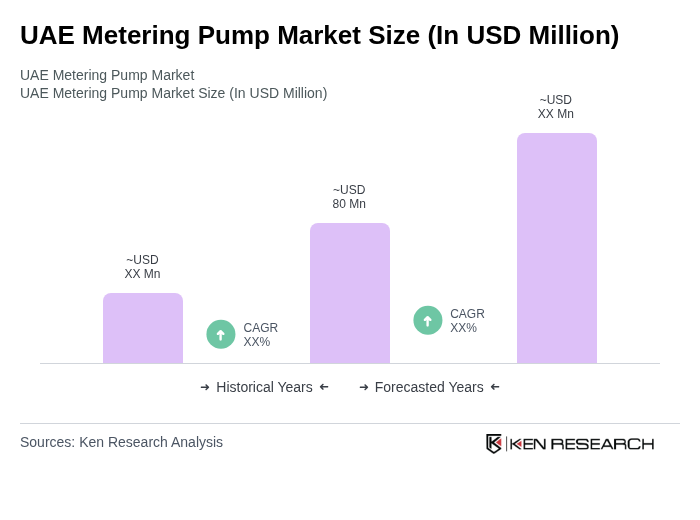

The UAE Metering Pump Market is valued at approximately USD 80 million, driven by the increasing demand for precise fluid handling in various industries, including water treatment, oil and gas, and chemical processing.