Region:Middle East

Author(s):Rebecca

Product Code:KRAD6085

Pages:83

Published On:December 2025

By Solution Type:The solution type segmentation includes various subsegments such as Mobile Identity & Access Management (IAM), Multi-Factor & Strong Customer Authentication, Mobile ID Wallets & Digital Identity Platforms, Biometric Authentication (Face, Fingerprint, Liveness), Mobile Device & Application Management–Integrated Identity, and Others (Risk-Based & Adaptive Authentication). This segmentation is consistent with global mobile identity management solution categories that distinguish IAM, MFA, mobile ID wallets, and biometric authentication as core components. Among these, Mobile Identity & Access Management (IAM) is the leading subsegment, driven by the increasing need for secure access to cloud, mobile, and on-premise applications, single sign-on, and centralized policy enforcement for users across government, BFSI, and enterprise environments. Organizations are prioritizing IAM solutions to protect sensitive data, support zero-trust security models, and ensure compliance with data protection and authentication-related regulations.

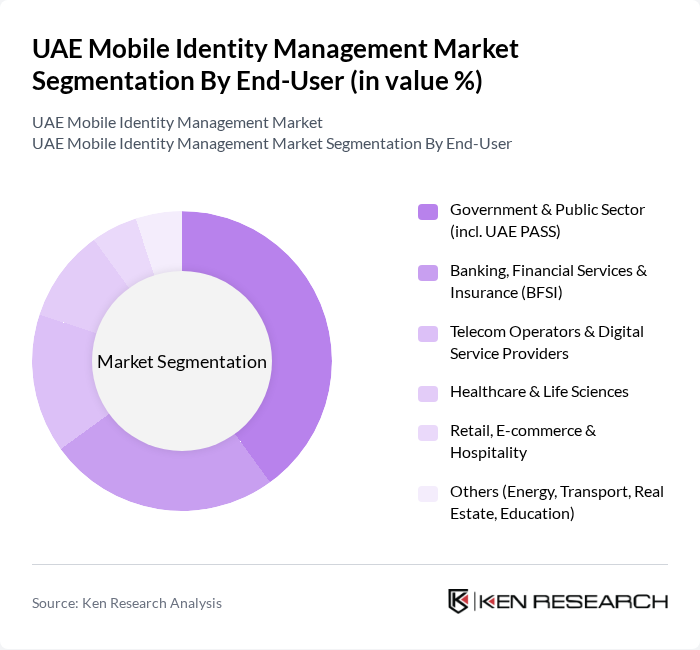

By End-User:The end-user segmentation encompasses Government & Public Sector (including UAE PASS), Banking, Financial Services & Insurance (BFSI), Telecom Operators & Digital Service Providers, Healthcare & Life Sciences, Retail, E-commerce & Hospitality, and Others (Energy, Transport, Real Estate, Education). This aligns with the main verticals globally adopting mobile identity and authentication solutions, notably government, BFSI, telecom, and healthcare. The Government & Public Sector is the dominant subsegment, primarily due to the UAE government's strong push towards digital transformation and the implementation of initiatives like UAE PASS, which provide a single trusted digital identity for residents and citizens to access hundreds of federal and local services via mobile channels.

The UAE Mobile Identity Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Telecommunications Group Company PJSC (e&), Emirates Integrated Telecommunications Company PJSC (du), UAE PASS (Telecommunications and Digital Government Regulatory Authority – TDRA), Abu Dhabi Digital Authority (ADDA), Dubai Digital Authority (Digital Dubai), IDEMIA, Thales Group, Microsoft, IBM, Oracle, PwC Middle East, Accenture Middle East, DarkMatter Group (Digital14), Injazat (a G42 company), Huawei UAE contribute to innovation, geographic expansion, and service delivery in this space, including mobile identity wallets, IAM platforms, strong customer authentication, and biometric-based verification used across government, BFSI, telecom, and large enterprises.

The UAE mobile identity management market is poised for significant evolution, driven by technological advancements and regulatory changes. As organizations increasingly prioritize user experience, the shift towards mobile-first identity solutions will gain momentum. Furthermore, the integration of emerging technologies such as artificial intelligence and blockchain will enhance security and efficiency. With the government's commitment to digital transformation, the market is expected to witness robust growth, fostering innovation and collaboration among stakeholders in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Mobile Identity & Access Management (IAM) Multi-Factor & Strong Customer Authentication Mobile ID Wallets & Digital Identity Platforms Biometric Authentication (Face, Fingerprint, Liveness) Mobile Device & Application Management–Integrated Identity Others (Risk-Based & Adaptive Authentication) |

| By End-User | Government & Public Sector (incl. UAE PASS) Banking, Financial Services & Insurance (BFSI) Telecom Operators & Digital Service Providers Healthcare & Life Sciences Retail, E-commerce & Hospitality Others (Energy, Transport, Real Estate, Education) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Technology | Biometrics & Liveness Detection Artificial Intelligence & Machine Learning Analytics Blockchain & Decentralized Identity (DID) PKI, Digital Certificates & Cryptography Others (FIDO, Risk-Based Scoring) |

| By Industry Vertical | Banking and Financial Services Telecommunications Government & Smart City Services Healthcare Retail & E-commerce Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Emirate | Abu Dhabi Dubai Sharjah Rest of UAE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Identity Management Initiatives | 100 | Policy Makers, IT Directors |

| Banking Sector Mobile Identity Solutions | 80 | Chief Technology Officers, Security Managers |

| Healthcare Mobile Identity Applications | 70 | Healthcare IT Managers, Compliance Officers |

| Telecommunications Identity Verification Services | 90 | Product Managers, Network Security Analysts |

| Consumer Adoption of Mobile Identity Solutions | 120 | End-users, Mobile App Developers |

The UAE Mobile Identity Management Market is valued at approximately USD 600 million, reflecting a significant growth driven by the increasing demand for secure digital identity solutions across various sectors, including government, BFSI, telecom, and healthcare.