Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4040

Pages:80

Published On:December 2025

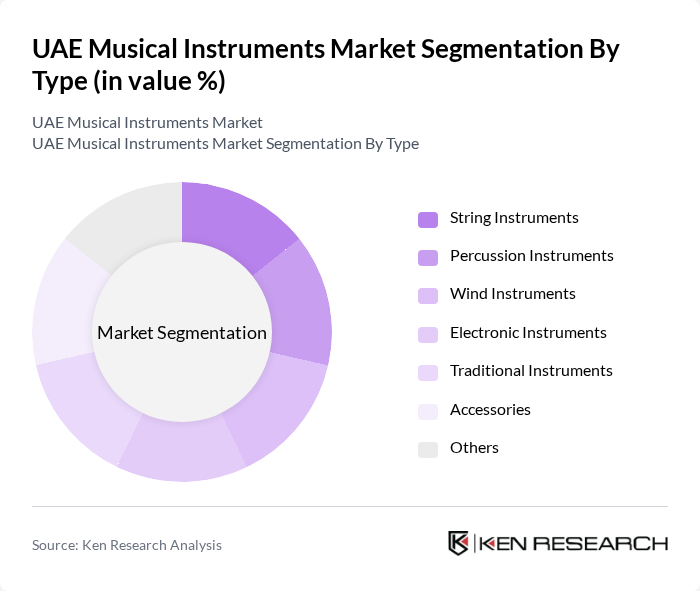

By Type:The market is segmented into various types of musical instruments, including string instruments, percussion instruments, wind instruments, electronic instruments, traditional instruments, accessories, and others. Among these, electronic instruments and keyboards have gained significant traction due to technological advancements, the growth of home studios, and the increasing popularity of digital music production and DJ culture in the UAE’s nightlife and event scene. The demand for electronic instruments is driven by both professional musicians and hobbyists who seek innovative ways to create and perform music, supported by greater availability of software, recording interfaces and online tutorials.

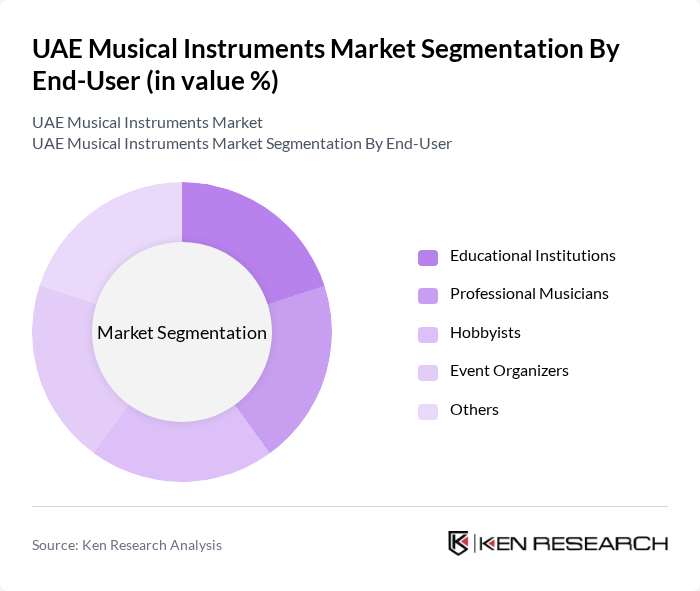

By End-User:The end-user segmentation includes educational institutions, professional musicians, hobbyists, event organizers, and others. Educational institutions are a significant segment, as music education is increasingly integrated into school activities and extracurricular programs, supported by private international schools and specialized music academies that purchase instruments in bulk. This trend is supported by broader government and private?sector initiatives to build the creative economy and promote arts education, alongside a growing recognition among parents and schools of the importance of music in child development, leading to a higher demand for various musical instruments for classroom, ensemble and exam use.

The UAE Musical Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamaha Corporation, Roland Corporation, Korg Inc., Fender Musical Instruments Corporation, Gibson Brands, Inc., Casio Computer Co., Ltd., Steinway & Sons, Pearl Musical Instruments, Zildjian Company, C.F. Martin & Company, D'Addario & Company, Inc., Shure Incorporated, Behringer, Ibanez, Native Instruments, Al Nafis Musical Instruments, Music House UAE, Music World UAE, Al Ghurair Music Center, Music Zone UAE contribute to innovation, geographic expansion, and service delivery in this space through branded showrooms, dealer networks, and online sales channels.

The UAE musical instruments market is poised for significant growth, driven by increasing interest in music education and a vibrant live music scene. As digital platforms continue to gain traction, musicians are likely to invest in high-quality instruments, further stimulating demand. Additionally, government initiatives aimed at promoting cultural events will enhance market visibility. The combination of these factors suggests a robust future for the industry, with opportunities for innovation and expansion in both local and online markets.

| Segment | Sub-Segments |

|---|---|

| By Type | String Instruments Percussion Instruments Wind Instruments Electronic Instruments Traditional Instruments Accessories Others |

| By End-User | Educational Institutions Professional Musicians Hobbyists Event Organizers Others |

| By Distribution Channel | Online Retail Physical Retail Stores Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Instruments Mid-Range Instruments Premium Instruments Custom Instruments Others |

| By Brand Preference | International Brands Local Brands Emerging Brands Others |

| By Usage Frequency | Daily Users Weekly Users Monthly Users Occasional Users Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Musical Instruments | 120 | Store Owners, Sales Managers |

| Music Education Sector | 100 | Music Teachers, School Administrators |

| Local Instrument Manufacturers | 80 | Production Managers, Business Owners |

| Event Organizers and Musicians | 70 | Event Coordinators, Professional Musicians |

| Online Retail Platforms | 90 | E-commerce Managers, Marketing Directors |

The UAE Musical Instruments Market is valued at approximately USD 110 million, reflecting a significant growth driven by increased interest in music education, cultural events, and a vibrant music scene, particularly in major cities like Dubai and Abu Dhabi.