Region:Middle East

Author(s):Dev

Product Code:KRAD7745

Pages:95

Published On:December 2025

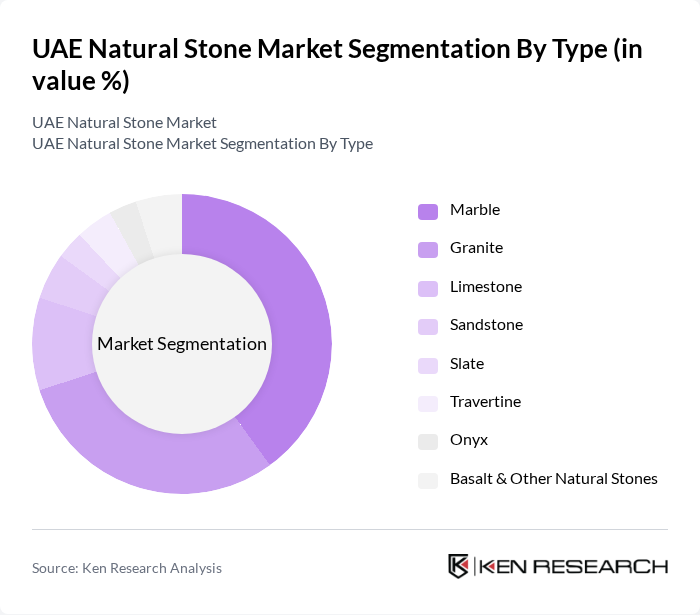

By Type:The natural stone market is segmented into various types, including marble, granite, limestone, sandstone, slate, travertine, onyx, and basalt & other natural stones. Among these, marble and granite are the most popular due to their versatility and aesthetic appeal. Marble is often favored for its luxurious appearance, making it a preferred choice for high-end residential and commercial projects. Granite, on the other hand, is known for its durability and resistance to wear, making it suitable for both interior and exterior applications. The demand for these stones is driven by consumer preferences for quality and design in construction and renovation projects.

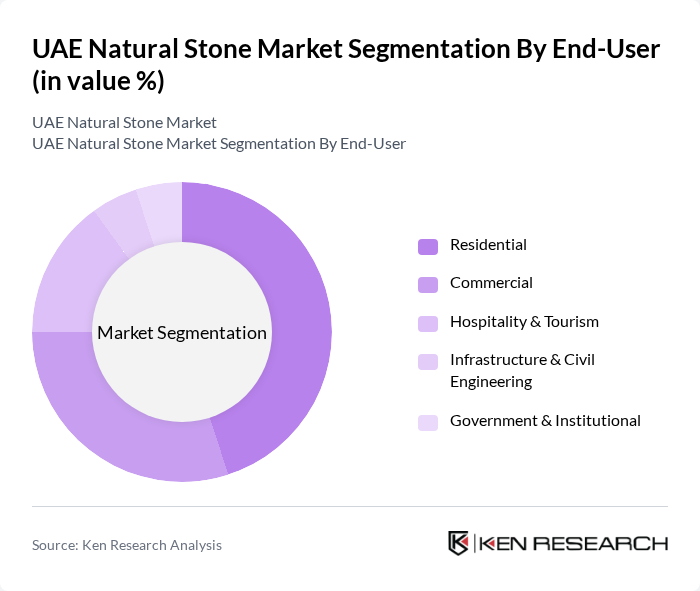

By End-User:The end-user segmentation includes residential, commercial, hospitality & tourism, infrastructure & civil engineering, and government & institutional sectors. The residential segment is currently the largest, driven by the increasing number of luxury housing projects and renovations. The commercial sector follows closely, with a growing demand for natural stones in office buildings, retail spaces, and hotels. The hospitality sector also significantly contributes to the market, as high-end hotels and resorts often utilize natural stones for their aesthetic and durable qualities. This trend reflects a broader consumer preference for premium materials in both living and working environments.

The UAE Natural Stone Market is characterized by a dynamic mix of regional and international players. Leading participants such as Natural Stone Trading LLC, Al Asal Marble & Granite (Al Asal Marbles), Al Sahel Marble & Granite, RAK Rock LLC (Ras Al Khaimah Rock Company), National Quarries LLC, Al Shamsi Holdings – Marble & Granite Division, United Arab Emirates Marble & Granite (United Marble & Granite), Al Falah Group – Marble & Stone, Art Stone International, Melange Stone LLC, Al Ain Rock Supply LLC, Emirates Marble & Granite Factory LLC, Dubai Granite & Marble LLC, Al Milad Marble & Granite, Al Jazeera Marble & Granite contribute to innovation, geographic expansion, and service delivery in this space.

The UAE natural stone market is poised for significant growth, driven by increasing investments in sustainable construction and a booming luxury real estate sector. As consumer preferences shift towards eco-friendly materials, companies are likely to innovate in stone processing technologies. Additionally, the integration of smart technologies in construction will enhance the appeal of natural stone, making it a preferred choice for modern architectural designs. The market is expected to adapt to these trends, ensuring a robust future.

| Segment | Sub-Segments |

|---|---|

| By Type | Marble Granite Limestone Sandstone Slate Travertine Onyx Basalt & Other Natural Stones |

| By End-User | Residential Commercial Hospitality & Tourism Infrastructure & Civil Engineering Government & Institutional |

| By Application | Flooring Wall Cladding & Facades Countertops & Vanity Tops Paving & Landscaping Monuments & Decorative Applications |

| By Source | Domestic Production (Local Quarries) Imports from GCC Imports from Europe & Turkey Imports from Asia (India, China, Others) |

| By Distribution Channel | Direct Sales to Projects (B2B) Distributors & Wholesalers Specialized Stone Showrooms & Retail Outlets Online & E?Tender Platforms |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain & Others |

| By Price / Quality Segment | Premium & Luxury Segment Mid-Range Segment Economy Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Architects |

| Commercial Building Developments | 80 | Construction Managers, Developers |

| Infrastructure Projects | 70 | Government Officials, Civil Engineers |

| Natural Stone Suppliers | 60 | Sales Managers, Procurement Officers |

| Architectural Firms | 90 | Design Directors, Material Specialists |

The UAE Natural Stone Market is valued at approximately USD 70 million, driven by the booming construction sector and increasing demand for sustainable building materials, particularly marble and granite, which are favored for their aesthetic appeal and durability.