Region:Middle East

Author(s):Rebecca

Product Code:KRAB7523

Pages:92

Published On:October 2025

By Type:The market is segmented into various types of luxury home décor products, including furniture, lighting, textiles, wall art, decorative accessories, rugs and carpets, and others. Among these, furniture and lighting are the most prominent segments, driven by consumer demand for both functional and aesthetic enhancements in their living spaces. The increasing trend of home renovation and interior design has further fueled the growth of these segments.

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by homeowners' increasing interest in luxury home décor to enhance their living environments. The commercial and hospitality sectors also contribute significantly, as businesses seek to create inviting atmospheres for clients and guests.

The UAE Online Luxury Home Décor Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Luxury Home Décor Co., Elegant Interiors LLC, Opulent Living Group, The Design Atelier, Luxe Home Furnishings, Chic Décor Solutions, Prestige Home Styles, Grand Décor Emporium, Elite Home Accents, Majestic Interiors, Regal Home Décor, Signature Designs, The Luxe Collection, Modern Elegance, Timeless Interiors contribute to innovation, geographic expansion, and service delivery in this space.

The UAE online luxury home décor market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As e-commerce continues to expand, retailers will increasingly leverage augmented reality and virtual showrooms to enhance the shopping experience. Furthermore, the growing emphasis on sustainability will likely lead to a rise in eco-friendly product offerings, aligning with consumer values. This dynamic environment presents opportunities for brands to innovate and capture the attention of discerning consumers seeking unique and responsible home décor solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Furniture Lighting Textiles Wall Art Decorative Accessories Rugs and Carpets Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Premium Mid-Range Budget |

| By Material | Wood Metal Glass Fabric |

| By Design Style | Modern Traditional Contemporary Minimalist |

| By Distribution Mode | Home Delivery Click and Collect In-Store Pickup Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Home Décor Retailers | 100 | Retail Managers, E-commerce Directors |

| Affluent Consumers | 150 | Homeowners, Interior Design Enthusiasts |

| Interior Designers | 80 | Freelance Designers, Design Firm Owners |

| Manufacturers of Luxury Décor Items | 70 | Product Development Managers, Sales Executives |

| Online Marketplaces | 60 | Marketplace Managers, Digital Marketing Specialists |

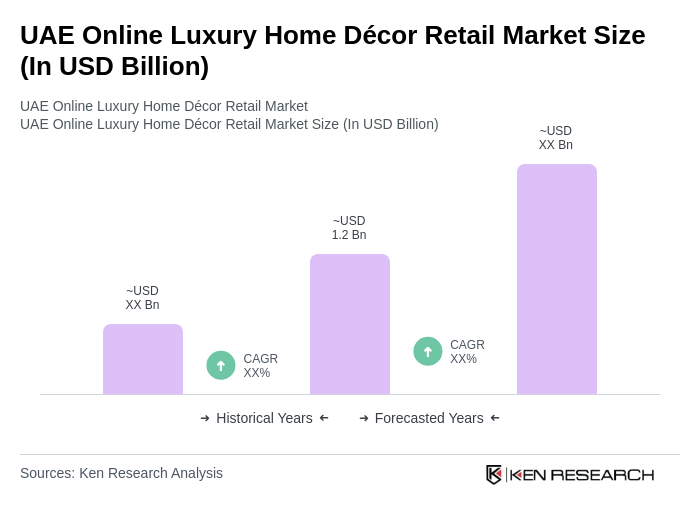

The UAE Online Luxury Home Décor Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes and a rising preference for online shopping among consumers seeking unique, high-quality products for their homes.