Region:Middle East

Author(s):Shubham

Product Code:KRAB7434

Pages:91

Published On:October 2025

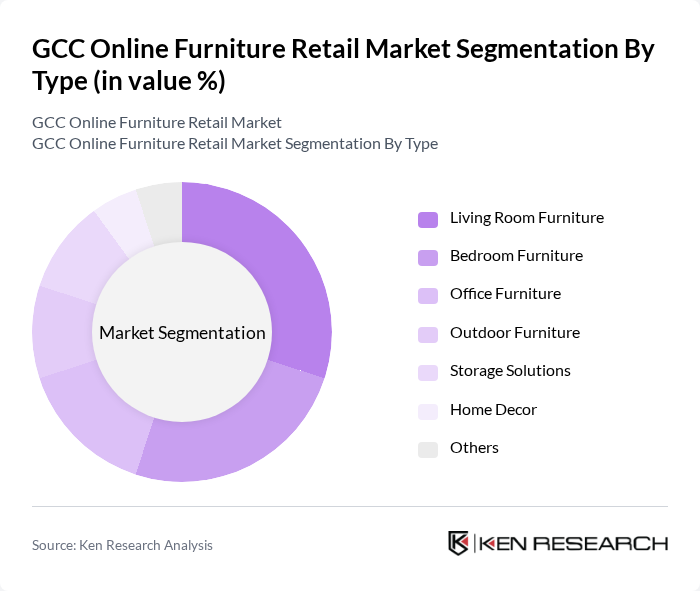

By Type:The market is segmented into various types of furniture, including Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Storage Solutions, Home Decor, and Others. Among these, Living Room Furniture and Bedroom Furniture are the most popular categories, driven by consumer preferences for stylish and functional home furnishings. The demand for Office Furniture has also seen a rise due to the increase in remote working trends.

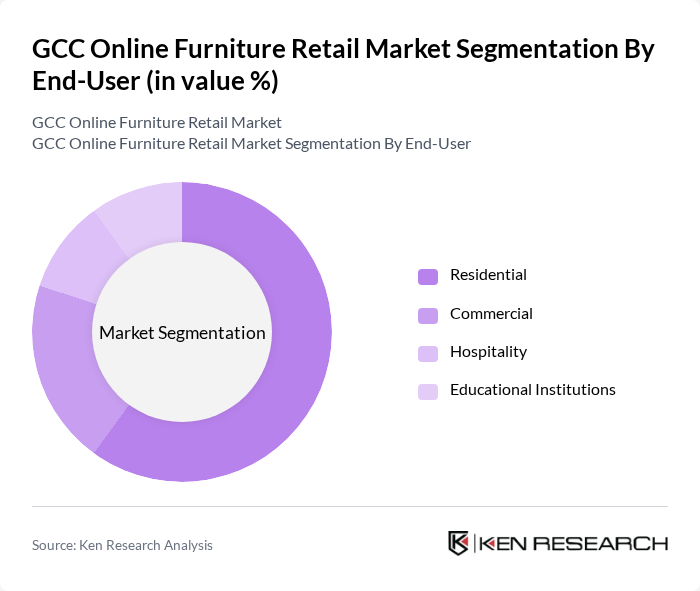

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, and Educational Institutions. The Residential segment dominates the market, driven by the growing trend of home decoration and renovation. The Commercial segment is also significant, as businesses increasingly invest in office aesthetics and functionality to enhance employee productivity.

The GCC Online Furniture Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, The One, Danube Home, Landmark Group, JYSK, Muji, Pottery Barn, West Elm, Home Box, Royal Furniture, Al-Futtaim Group, Mamas & Papas, KARE Design contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online furniture retail market is poised for continued growth, driven by technological advancements and changing consumer preferences. As augmented reality tools become more prevalent, they will enhance the online shopping experience, allowing customers to visualize furniture in their homes. Additionally, the increasing focus on sustainability will push retailers to adopt eco-friendly practices, appealing to environmentally conscious consumers. These trends indicate a dynamic market landscape that will evolve to meet the demands of modern shoppers.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Storage Solutions Home Decor Others |

| By End-User | Residential Commercial Hospitality Educational Institutions |

| By Sales Channel | Direct Online Sales Third-Party Marketplaces Social Media Platforms Mobile Applications |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Upholstered |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Furniture Retail Purchases | 150 | Recent Online Furniture Buyers, E-commerce Shoppers |

| Consumer Preferences in Furniture Design | 100 | Homeowners, Interior Design Enthusiasts |

| Market Trends in Sustainable Furniture | 80 | Sustainability Advocates, Eco-conscious Consumers |

| Impact of Social Media on Furniture Buying Decisions | 70 | Social Media Users, Influencers in Home Decor |

| Challenges Faced by Online Furniture Retailers | 60 | Retail Managers, E-commerce Business Owners |

The GCC Online Furniture Retail Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased e-commerce penetration, changing consumer preferences, and rising disposable incomes in the region.