Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7477

Pages:88

Published On:October 2025

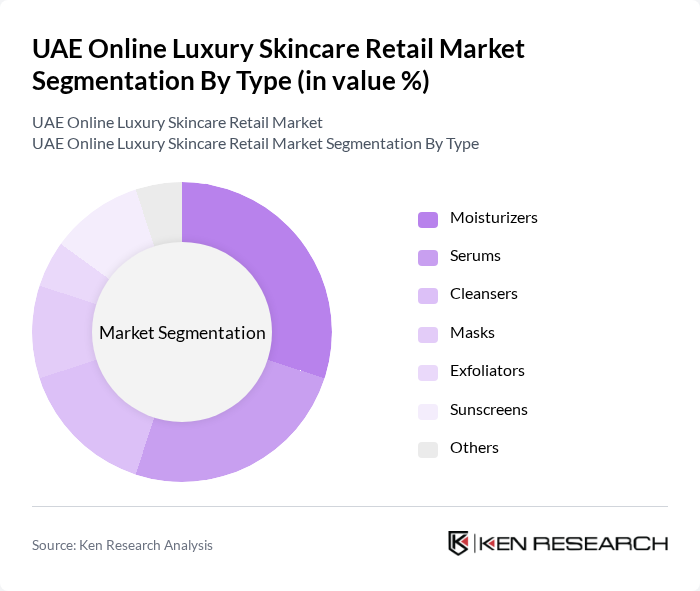

By Type:The market is segmented into various types of skincare products, including moisturizers, serums, cleansers, masks, exfoliators, sunscreens, and others. Among these, moisturizers and serums are particularly popular due to their essential roles in daily skincare routines. The increasing focus on skin health and the growing trend of personalized skincare solutions have led to a surge in demand for these products.

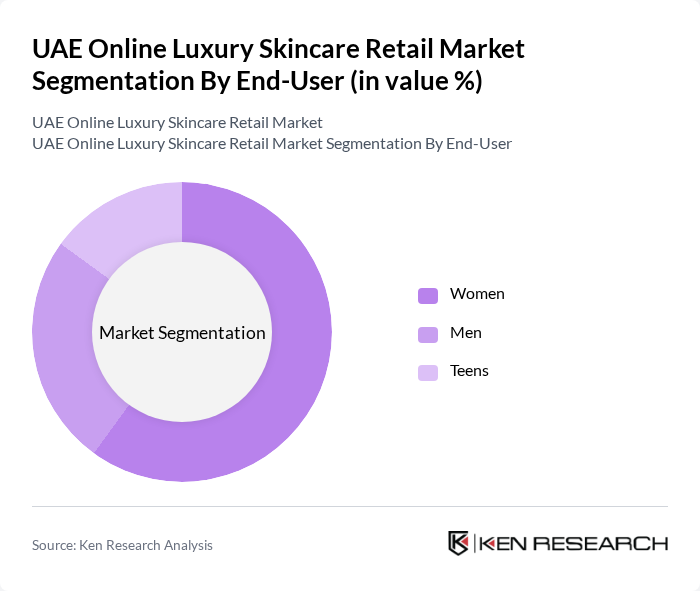

By End-User:The end-user segmentation includes women, men, and teens. Women represent the largest segment, driven by a strong inclination towards skincare and beauty products. The increasing awareness of skincare routines among men and teens is also contributing to the growth of these segments, with brands increasingly targeting these demographics through tailored marketing strategies.

The UAE Online Luxury Skincare Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Estée Lauder Companies Inc., L'Oréal S.A., Shiseido Company, Limited, Procter & Gamble Co., Coty Inc., Chanel S.A., Dior (Christian Dior SE), Lancôme (L'Oréal S.A.), Clarins Group, SK-II (Procter & Gamble Co.), Kiehl's (L'Oréal S.A.), La Mer (Estée Lauder Companies Inc.), Drunk Elephant, Tatcha, Fresh contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE online luxury skincare market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, brands are expected to leverage data analytics to tailor products to individual needs. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly brands. The integration of augmented reality in online shopping experiences is anticipated to enhance customer engagement, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Moisturizers Serums Cleansers Masks Exfoliators Sunscreens Others |

| By End-User | Women Men Teens |

| By Price Range | Premium Mid-Range Budget |

| By Sales Channel | Brand Websites E-commerce Platforms Social Media |

| By Distribution Mode | Direct Sales Third-Party Retailers |

| By Packaging Type | Bottles Jars Tubes |

| By Brand Origin | Local Brands International Brands Niche Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Brand Managers | 100 | Brand Managers, Marketing Directors |

| Online Retail Consumers | 150 | Frequent Online Shoppers, Skincare Enthusiasts |

| Beauty Influencers and Bloggers | 50 | Social Media Influencers, Content Creators |

| Market Analysts and Consultants | 30 | Industry Analysts, Market Research Consultants |

| Retail Executives in E-commerce | 70 | E-commerce Managers, Operations Directors |

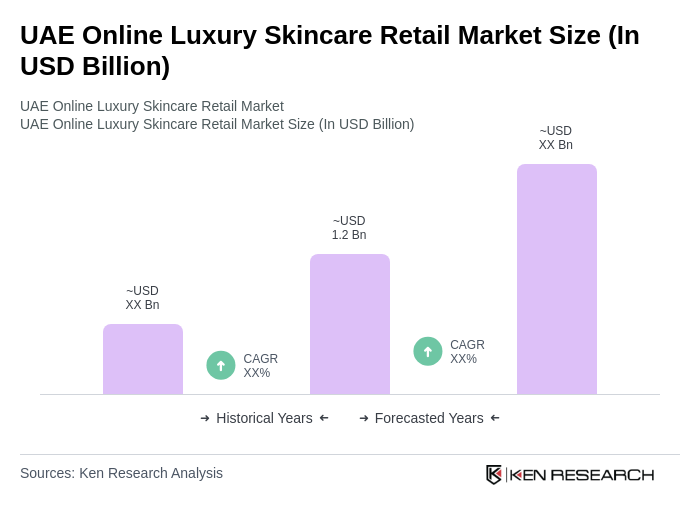

The UAE Online Luxury Skincare Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes, a rise in e-commerce, and heightened consumer awareness regarding skincare products.