Region:Middle East

Author(s):Dev

Product Code:KRAD3413

Pages:84

Published On:November 2025

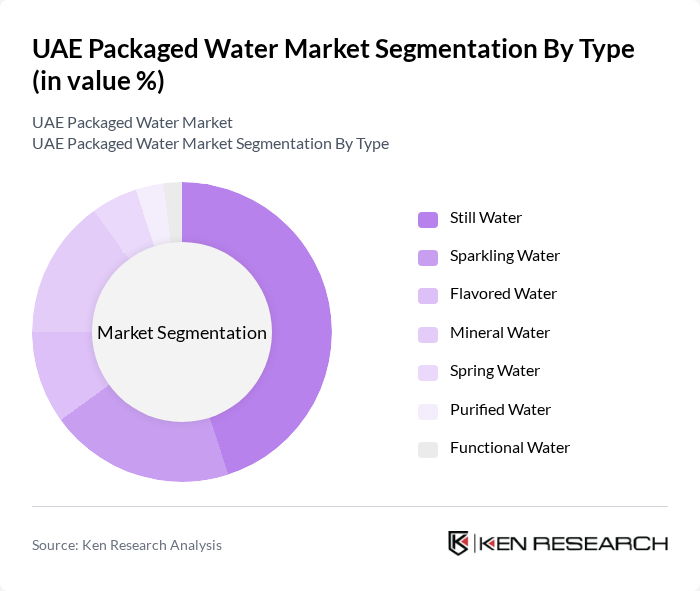

By Type:The packaged water market can be segmented into various types, including Still Water, Sparkling Water, Flavored Water, Mineral Water, Spring Water, Purified Water, and Functional Water. Each type caters to different consumer preferences and health trends, with Still Water being the most popular due to its simplicity and widespread availability. Sparkling and Flavored Water have also gained traction among health-conscious consumers looking for alternatives to sugary beverages. There is also a growing demand for premium, mineral-enriched, and alkaline water, as well as eco-friendly packaging options .

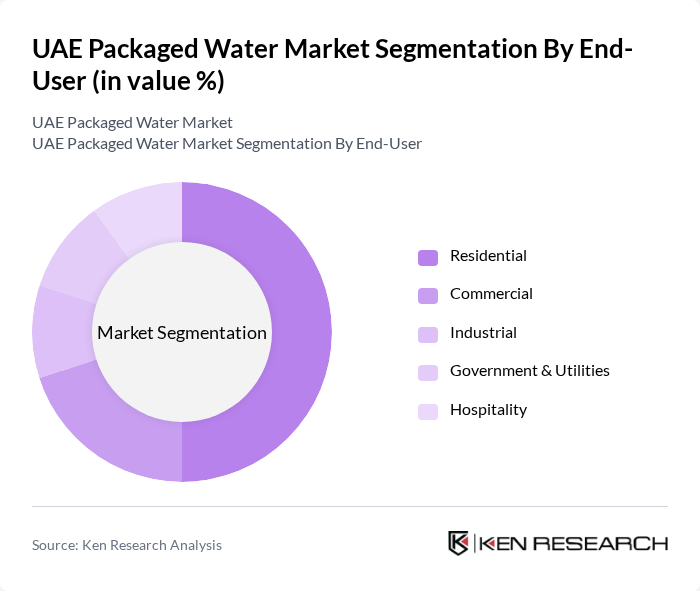

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Hospitality sectors. The Residential segment dominates the market, driven by increasing health awareness and the convenience of having bottled water at home. The Hospitality sector also plays a significant role, as hotels and restaurants require high-quality packaged water to meet the demands of their guests. Home and office delivery is a particularly strong distribution channel, accounting for a significant share of the market, reflecting the demand for convenience and bulk supply in both residential and commercial settings .

The UAE Packaged Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Water, Masafi, Oasis Water, Mai Dubai, Nestlé Pure Life, Aquafina, Evian, Perrier, Crystal Water, Dubai Refreshment, Al Jazeera Water, Al Waha Water, Al Falah Water, Al Mufeed Water, Pure Life Water, Al Rawabi Water, Al Safa Water, Al Khaleej Water, Al Manhal Water, Al Ghurair Water contribute to innovation, geographic expansion, and service delivery in this space .

The UAE packaged water market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health and wellness trends continue to dominate, brands are likely to innovate with premium and flavored water options. Additionally, the integration of smart technology in water bottles may enhance consumer engagement. Sustainability will also play a crucial role, with companies increasingly adopting eco-friendly practices to meet regulatory demands and consumer expectations, ensuring long-term growth and market resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Water Sparkling Water Flavored Water Mineral Water Spring Water Purified Water Functional Water |

| By End-User | Residential Commercial Industrial Government & Utilities Hospitality |

| By Packaging Type | PET Bottles Glass Bottles Aluminum Cans Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Vending Machines On-Trade (Hotels, Restaurants, Cafes) Direct Sales (Subscription, Home Delivery) |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Price Segment | Economy Mid-range Premium Luxury |

| By Brand Positioning | Local Brands International Brands Private Labels Functional & Specialty Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bottled Water Sales | 150 | Store Managers, Category Buyers |

| Consumer Preferences in Bottled Water | 150 | End Consumers, Health-Conscious Shoppers |

| Distribution Channel Insights | 100 | Logistics Coordinators, Distribution Managers |

| Environmental Impact Awareness | 80 | Sustainability Advocates, Eco-conscious Consumers |

| Market Trends and Innovations | 120 | Product Development Managers, Marketing Executives |

The UAE Packaged Water Market is valued at approximately USD 1.5 billion, driven by factors such as increasing health consciousness, rising disposable incomes, and a growing demand for convenient hydration solutions, particularly in urban areas and tourist hotspots.