Region:Middle East

Author(s):Rebecca

Product Code:KRAC9856

Pages:85

Published On:November 2025

By Treatment Type:The treatment type segmentation includes various approaches to managing Parkinson's disease, such as medications, surgical interventions, and therapies. Medications like Levodopa/Carbidopa and Dopamine Agonists are widely used due to their effectiveness in managing symptoms. Surgical interventions, particularly Deep Brain Stimulation, are gaining traction for patients with advanced disease. Physical, occupational, and speech therapies are also essential components of comprehensive care, focusing on improving patients' quality of life. The Levodopa/Carbidopa segment is expected to remain dominant due to its proven efficacy, while the adoption of advanced surgical techniques and multidisciplinary therapies is increasing in specialized centers .

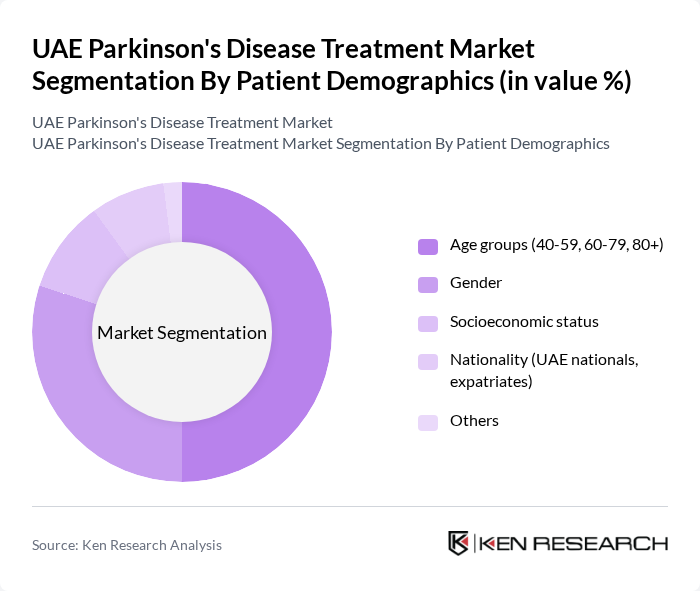

By Patient Demographics:This segmentation focuses on the characteristics of patients receiving treatment for Parkinson's disease. Age groups, gender, socioeconomic status, and nationality play significant roles in determining treatment approaches and accessibility. The majority of patients fall within the 60-79 age group, with a notable prevalence among expatriates due to the demographic composition of the UAE. Understanding these demographics helps tailor treatment plans and healthcare services to meet the specific needs of different patient populations. The UAE’s expatriate-heavy population structure results in a higher proportion of non-nationals among Parkinson’s patients, and older adults (60+) represent the largest affected group .

The UAE Parkinson's Disease Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, AbbVie Inc., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Amgen Inc., UCB S.A., Lundbeck A/S, Boehringer Ingelheim GmbH, Pfizer Inc., GlaxoSmithKline plc (GSK), Acorda Therapeutics, Inc., Sunovion Pharmaceuticals Inc., Zambon S.p.A., Neurocrine Biosciences, Inc., Acadia Pharmaceuticals Inc., Bayer AG, Hikma Pharmaceuticals PLC, Julphar (Gulf Pharmaceutical Industries), Neopharma LLC, AstraZeneca PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Parkinson's Disease treatment market appears promising, driven by technological advancements and increased healthcare investments. The integration of digital health solutions is expected to enhance patient monitoring and treatment adherence. Furthermore, the collaboration between local healthcare providers and international organizations will likely foster innovation in treatment protocols. As awareness continues to grow, the market is poised for significant developments that will improve patient care and outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Medications (Levodopa/Carbidopa, Dopamine Agonists, MAO-B Inhibitors, COMT Inhibitors, Anticholinergics) Surgical interventions (Deep Brain Stimulation, Lesioning Procedures) Physical therapy Occupational therapy Speech therapy Others |

| By Patient Demographics | Age groups (40-59, 60-79, 80+) Gender Socioeconomic status Nationality (UAE nationals, expatriates) Others |

| By Distribution Channel | Hospitals (Public, Private) Specialty clinics (Neurology centers) Online pharmacies Retail pharmacies Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Others |

| By Treatment Setting | Inpatient Outpatient Home care Others |

| By Stage of Disease | Early stage Mid stage Late stage Advanced stage Others |

| By Research and Development Focus | Drug development Clinical trials Patient support programs Digital therapeutics and remote monitoring Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurologist Insights | 50 | Neurologists, Movement Disorder Specialists |

| Pharmaceutical Sales Data | 40 | Sales Representatives, Product Managers |

| Patient Experience Surveys | 100 | Parkinson's Disease Patients, Caregivers |

| Healthcare Provider Feedback | 60 | General Practitioners, Rehabilitation Specialists |

| Policy Maker Interviews | 40 | Health Policy Analysts, Government Officials |

The UAE Parkinson's Disease Treatment Market is valued at approximately USD 120 million, reflecting a significant growth driven by the increasing prevalence of Parkinson's disease, an aging population, and advancements in treatment options.