Region:Middle East

Author(s):Dev

Product Code:KRAD1814

Pages:80

Published On:November 2025

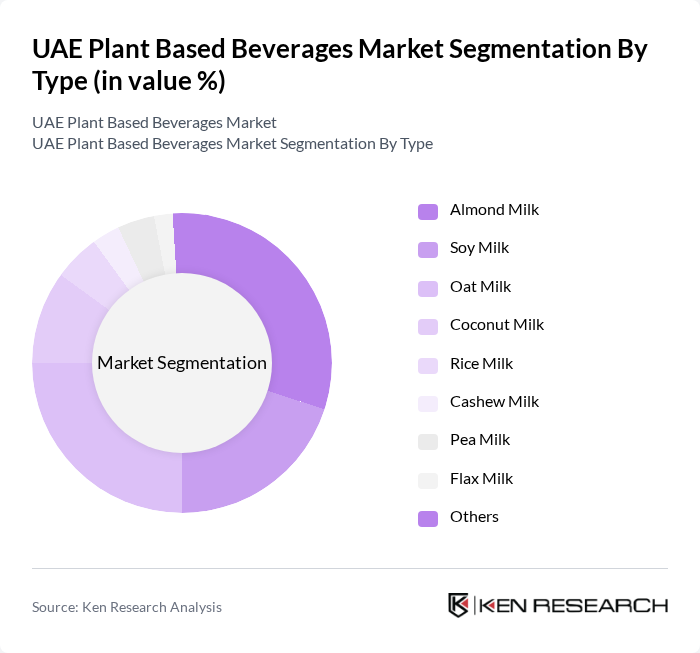

By Type:The market is segmented into various types of plant-based beverages, including almond milk, soy milk, oat milk, coconut milk, rice milk, cashew milk, pea milk, flax milk, and others. Among these, almond milk and oat milk have gained significant popularity due to their nutritional benefits and versatility in culinary applications. The increasing trend of health-conscious consumers is driving the demand for these beverages, with almond milk leading the market due to its rich flavor and health benefits. Soy milk remains a major segment due to its established presence, while coconut milk is the fastest-growing segment, favored for its taste and functional benefits .

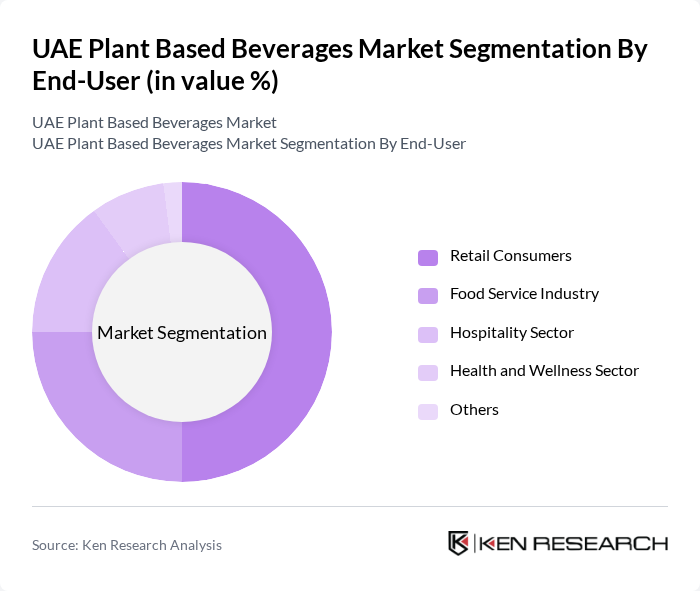

By End-User:The end-user segmentation includes retail consumers, the food service industry, the hospitality sector, the health and wellness sector, and others. Retail consumers dominate the market as they increasingly seek plant-based options for personal consumption. The food service industry is also a significant contributor, with restaurants and cafes expanding their menus to include plant-based beverages, catering to the growing demand for healthier options. The hospitality sector and health and wellness sector are also key segments, supported by the UAE’s robust tourism industry and the proliferation of wellness-focused establishments .

The UAE Plant Based Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro (Danone S.A.), Oatly Group AB, Califia Farms LLC, Vitasoy International Holdings Ltd, Silk (Danone S.A.), So Delicious (Danone S.A.), Pureharvest, Minor Figures Ltd, Blue Diamond Growers, The Hain Celestial Group, Inc., SunOpta Inc., Noumi Ltd (formerly Freedom Foods Group), Pacific Foods of Oregon, LLC, Harmless Harvest, Al Ain Farms (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE plant-based beverages market is poised for significant growth, driven by increasing health consciousness and a shift towards sustainable consumption. As consumers become more aware of the health benefits associated with plant-based diets, demand for these beverages is expected to rise. Additionally, the expansion of e-commerce and innovative product offerings will further enhance market accessibility. Companies that prioritize sustainability and consumer education will likely thrive in this evolving landscape, positioning themselves favorably for future opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Almond Milk Soy Milk Oat Milk Coconut Milk Rice Milk Cashew Milk Pea Milk Flax Milk Others |

| By End-User | Retail Consumers Food Service Industry Hospitality Sector Health and Wellness Sector Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Health Food Stores Specialty Stores Others |

| By Flavor | Original/Plain Vanilla Chocolate Fruit Infusions Coffee Others |

| By Packaging Type | Tetra Packs Bottles Cans Cartons Pouches Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Plant-Based Beverage Sales | 85 | Store Managers, Category Buyers |

| Health and Wellness Consumer Insights | 65 | Health Coaches, Nutritionists |

| Food Service Industry Trends | 55 | Restaurant Owners, Beverage Directors |

| Market Entry Strategies for New Brands | 50 | Entrepreneurs, Brand Managers |

| Consumer Preferences in Plant-Based Products | 75 | General Consumers, Health-Conscious Shoppers |

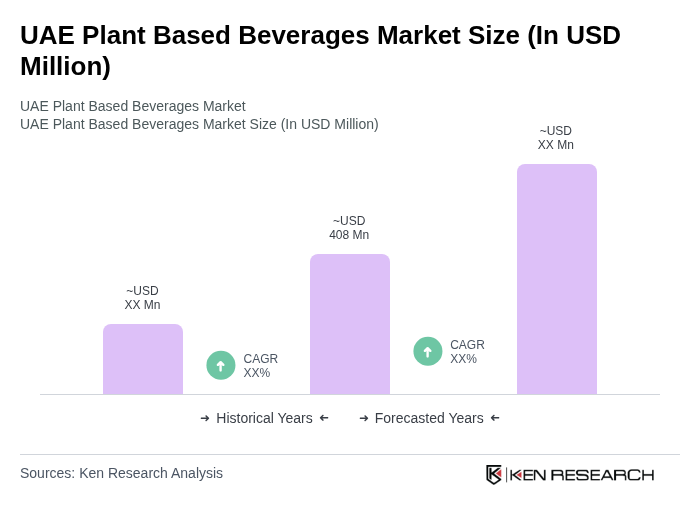

The UAE Plant Based Beverages Market is valued at approximately USD 408 million, reflecting a significant growth trend driven by increasing health consciousness, a shift towards veganism, and rising demand for lactose-free alternatives among consumers.