Region:Middle East

Author(s):Shubham

Product Code:KRAB7463

Pages:87

Published On:October 2025

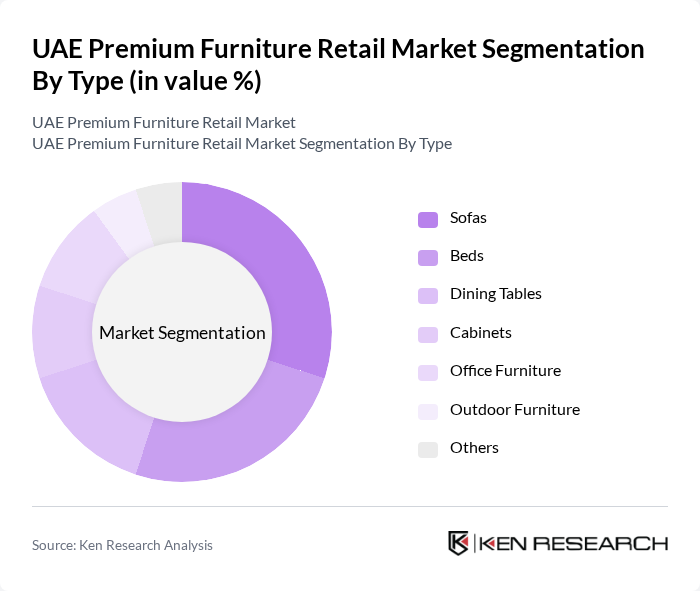

By Type:The market is segmented into various types of furniture, including sofas, beds, dining tables, cabinets, office furniture, outdoor furniture, and others. Among these, sofas and beds are the most popular due to their essential role in residential and commercial spaces. The demand for stylish and comfortable sofas has surged, driven by changing consumer preferences towards modern aesthetics and functionality.

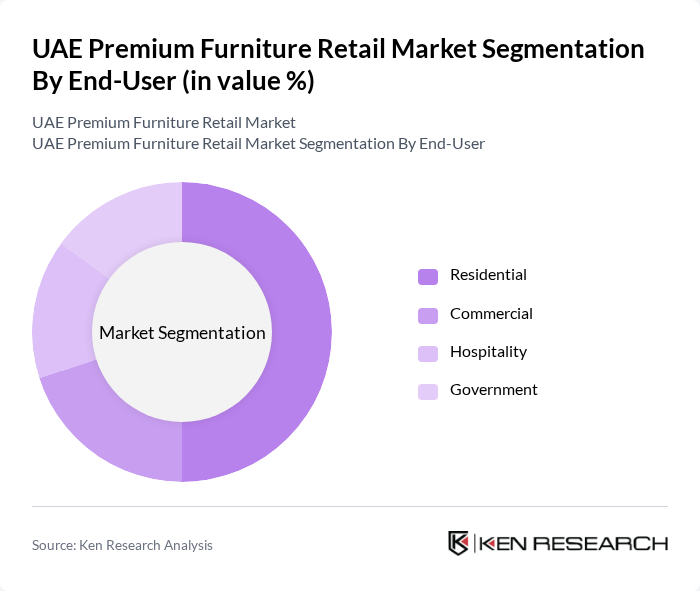

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by increasing home ownership and renovation activities. Consumers are increasingly investing in premium furniture to enhance their living spaces, reflecting a growing trend towards personalized and luxurious home environments.

The UAE Premium Furniture Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, The One, Marina Home, Danube Home, Royal Furniture, Al-Futtaim ACE, Interiors, Crate and Barrel, West Elm, CB2, Habitat, Muji, BoConcept contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium furniture market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are expected to adopt eco-friendly practices and materials, aligning with consumer demand for responsible products. Additionally, the integration of smart technology into furniture design will cater to the tech-savvy population, enhancing functionality and appeal. These trends will shape the market landscape, fostering innovation and attracting new customers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sofas Beds Dining Tables Cabinets Office Furniture Outdoor Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Luxury Mid-Range Budget |

| By Material | Wood Metal Upholstered Glass |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Brand Positioning | Premium Brands Mid-Tier Brands Value Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Furniture Retailers | 100 | Store Managers, Brand Owners |

| Consumer Preferences Survey | 150 | Homeowners, Interior Design Enthusiasts |

| Market Trends Analysis | 80 | Industry Analysts, Market Researchers |

| Architects and Designers Insights | 60 | Interior Designers, Architects |

| Retail Sales Performance | 90 | Sales Managers, Marketing Directors |

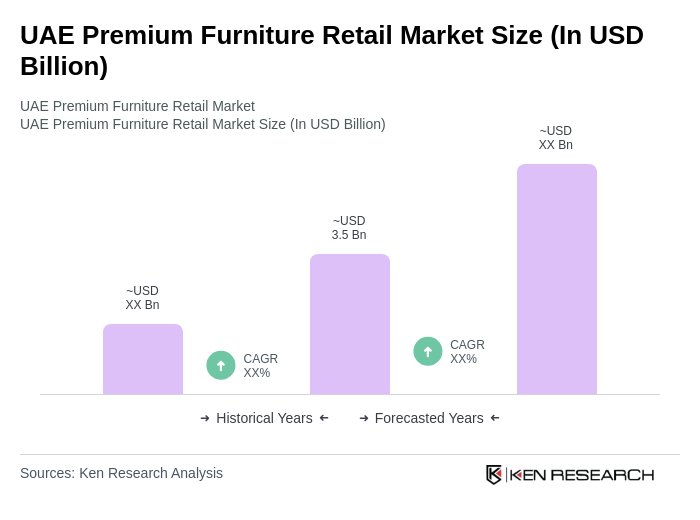

The UAE Premium Furniture Retail Market is valued at approximately USD 3.5 billion, driven by rising disposable incomes, a booming real estate sector, and increasing consumer preferences for high-quality and luxury furniture.