Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7496

Pages:85

Published On:October 2025

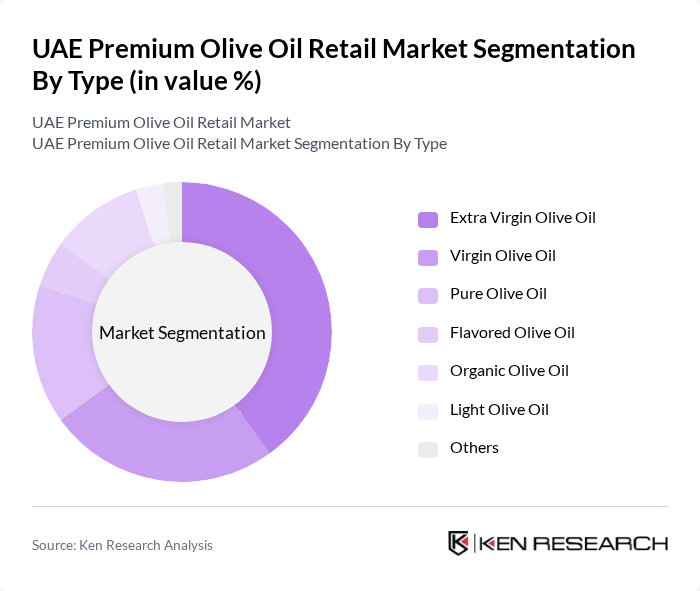

By Type:The market is segmented into various types of olive oil, including Extra Virgin Olive Oil, Virgin Olive Oil, Pure Olive Oil, Flavored Olive Oil, Organic Olive Oil, Light Olive Oil, and Others. Among these, Extra Virgin Olive Oil is the most popular due to its superior quality and health benefits, driving consumer preference. The demand for Organic Olive Oil is also on the rise as health-conscious consumers seek natural and chemical-free options.

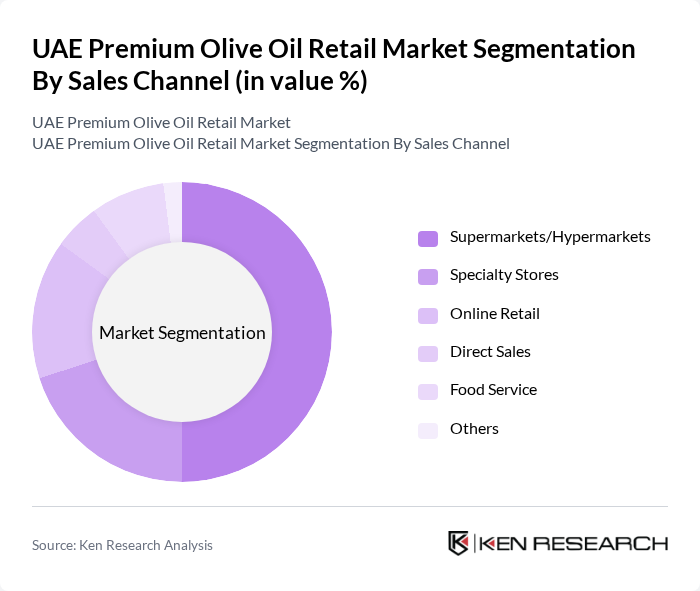

By Sales Channel:The sales channels for olive oil in the UAE include Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Direct Sales, Food Service, and Others. Supermarkets and hypermarkets dominate the market due to their wide reach and the convenience they offer to consumers. Online retail is also gaining traction as more consumers prefer the convenience of shopping from home.

The UAE Premium Olive Oil Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Watania Olive Oil, Al Mazra'a Olive Oil, Al Ain Olive Oil, Al Ghurair Foods, Al Oula Olive Oil contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE premium olive oil market appears promising, driven by increasing health awareness and a growing preference for gourmet products. As consumers continue to prioritize quality and authenticity, brands that emphasize organic and sustainable sourcing are likely to thrive. Additionally, the expansion of e-commerce will facilitate greater access to premium olive oils, allowing for innovative marketing strategies that cater to the health-conscious demographic, ultimately enhancing market growth and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Extra Virgin Olive Oil Virgin Olive Oil Pure Olive Oil Flavored Olive Oil Organic Olive Oil Light Olive Oil Others |

| By Sales Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Direct Sales Food Service Others |

| By Packaging Type | Glass Bottles Plastic Bottles Tins Pouches Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Origin | Italian Olive Oil Spanish Olive Oil Greek Olive Oil Local UAE Olive Oil Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| By Usage Occasion | Cooking Salad Dressings Dipping Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Olive Oil Retailers | 100 | Store Managers, Category Buyers |

| Health Food Stores | 80 | Product Managers, Nutritionists |

| Online Grocery Platforms | 70 | E-commerce Managers, Marketing Directors |

| Food Service Industry | 60 | Chefs, Restaurant Owners |

| Consumer Focus Groups | 50 | Health-conscious Consumers, Gourmet Food Enthusiasts |

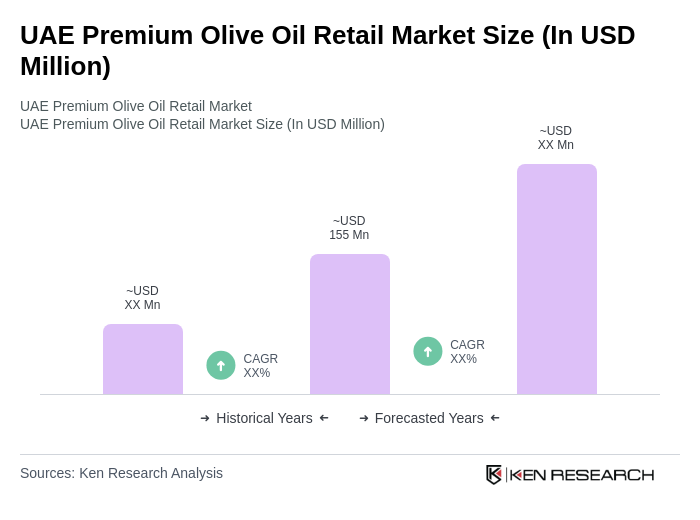

The UAE Premium Olive Oil Retail Market is valued at approximately USD 155 million, reflecting a significant growth trend driven by health consciousness, rising disposable incomes, and the popularity of Mediterranean diets among consumers.