Region:Middle East

Author(s):Dev

Product Code:KRAB7549

Pages:80

Published On:October 2025

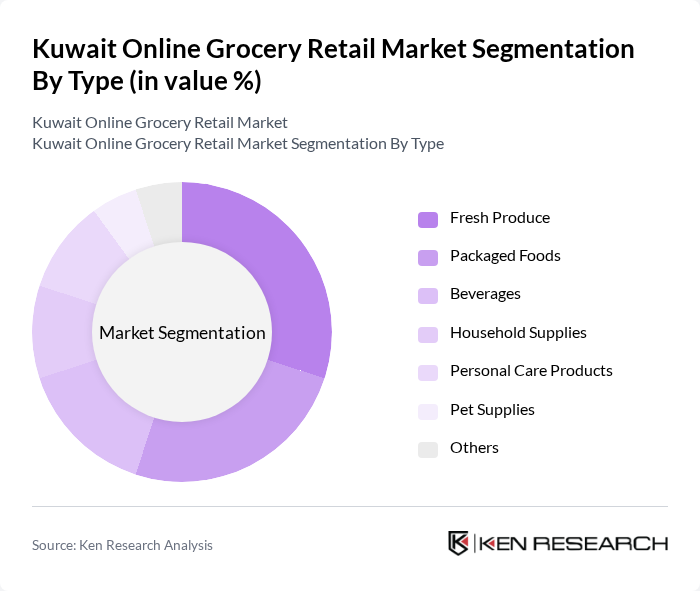

By Type:The online grocery retail market can be segmented into various types, including Fresh Produce, Packaged Foods, Beverages, Household Supplies, Personal Care Products, Pet Supplies, and Others. Each of these subsegments caters to different consumer needs and preferences, with Fresh Produce and Packaged Foods being particularly popular due to their essential nature in daily consumption.

The Fresh Produce segment leads the market, driven by the increasing demand for healthy and organic food options among consumers. The trend towards healthier eating habits has resulted in a surge in online purchases of fresh fruits and vegetables. Additionally, the convenience of home delivery services has made it easier for consumers to access fresh produce, further solidifying its dominance in the online grocery retail market.

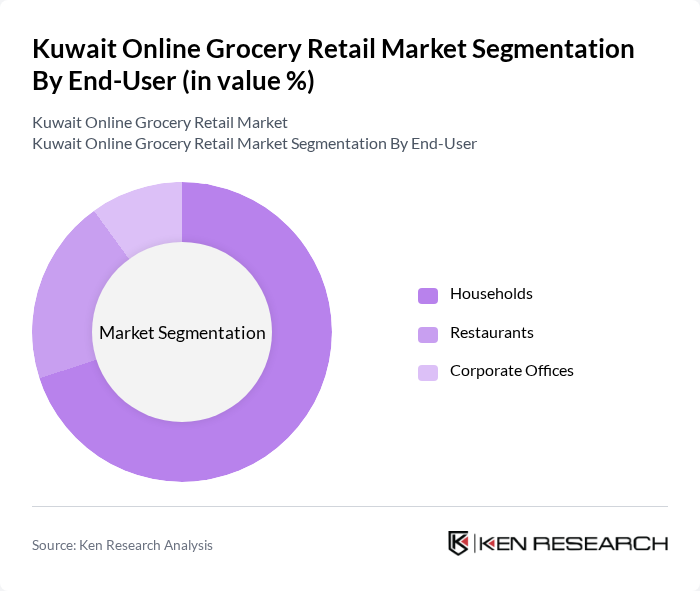

By End-User:The market can also be segmented by end-users, which include Households, Restaurants, and Corporate Offices. Each segment has distinct purchasing behaviors, with households being the largest segment due to the increasing trend of online shopping for daily essentials.

The Households segment dominates the market, accounting for a significant share due to the growing preference for convenience and time-saving solutions among consumers. The rise in dual-income families and busy lifestyles has led to an increased reliance on online grocery shopping, making it the primary driver of market growth.

The Kuwait Online Grocery Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour, Lulu Hypermarket, Monoprix, Nana, Talabat, Carrefour Express, Fadfada, Bazarak, Fresh Basket, Kooora, Qasar Al-Halal, Al-Muhalab, Al-Dar Grocery, Zain Grocery, Al-Masaleh contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online grocery retail market in Kuwait appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI-driven solutions for inventory management and customer service, operational efficiencies are expected to improve. Additionally, the growing trend of health-conscious consumers will likely lead to a surge in demand for organic and locally sourced products, further shaping the market landscape. Retailers that adapt to these trends will be well-positioned for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Foods Beverages Household Supplies Personal Care Products Pet Supplies Others |

| By End-User | Households Restaurants Corporate Offices |

| By Sales Channel | Direct-to-Consumer Third-Party Platforms |

| By Distribution Mode | Home Delivery Click and Collect |

| By Price Range | Budget Mid-Range Premium |

| By Product Origin | Local Products Imported Products |

| By Customer Demographics | Age Group Income Level Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Shoppers | 150 | Frequent online grocery users, varied demographics |

| Retail Executives | 100 | CEOs, COOs, and Marketing Directors of online grocery platforms |

| Logistics Providers | 80 | Operations Managers, Supply Chain Analysts |

| Consumer Behavior Analysts | 60 | Market Researchers, Consumer Insights Managers |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

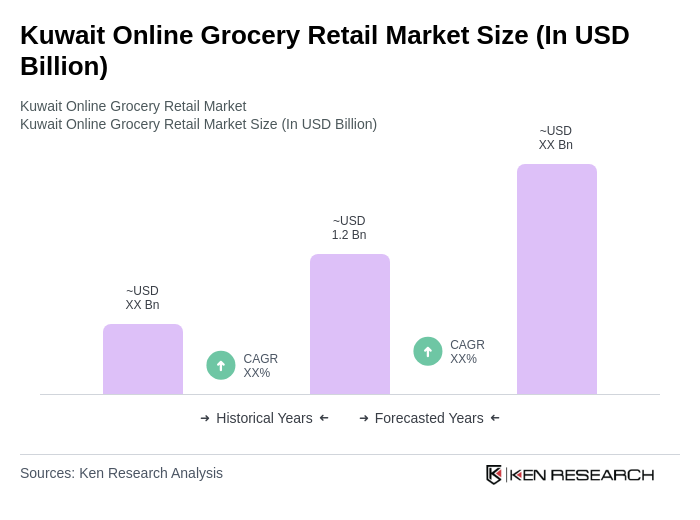

The Kuwait Online Grocery Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital shopping adoption and changing consumer preferences towards convenience, particularly during the pandemic.