Region:Middle East

Author(s):Rebecca

Product Code:KRAB8345

Pages:90

Published On:October 2025

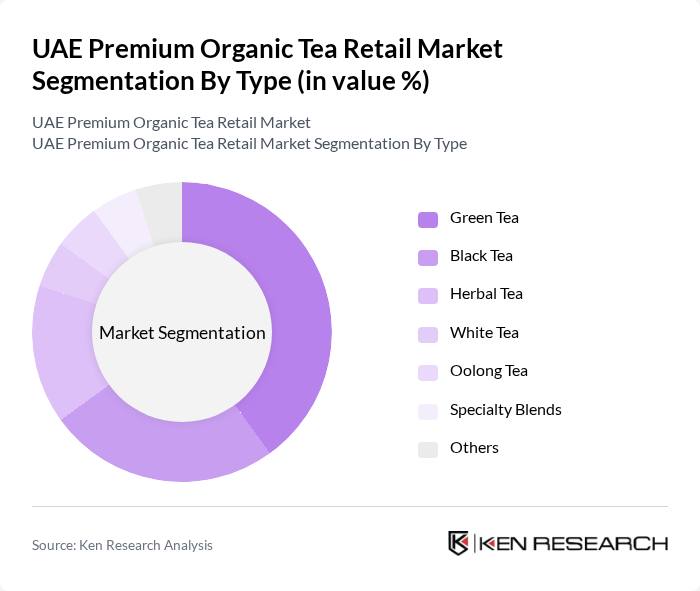

By Type:The market is segmented into various types of tea, including Green Tea, Black Tea, Herbal Tea, White Tea, Oolong Tea, Specialty Blends, and Others. Among these, Green Tea has emerged as the dominant segment due to its perceived health benefits and popularity among health-conscious consumers. The increasing trend of wellness and fitness has led to a surge in demand for Green Tea, making it a preferred choice for many consumers. Black Tea and Herbal Tea also hold significant market shares, driven by their unique flavors and health benefits.

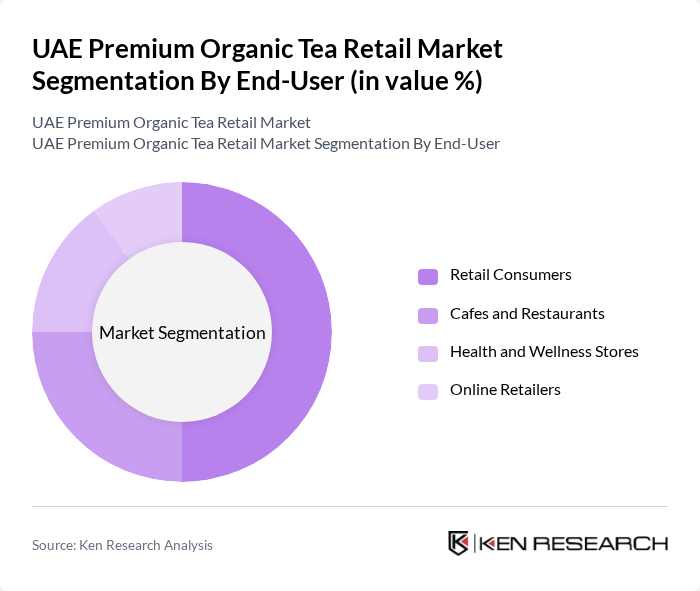

By End-User:The end-user segmentation includes Retail Consumers, Cafes and Restaurants, Health and Wellness Stores, and Online Retailers. Retail Consumers dominate the market, driven by the increasing trend of home brewing and the growing awareness of health benefits associated with organic tea. Cafes and Restaurants are also significant contributors, as they increasingly offer premium organic tea options to cater to health-conscious customers. Health and Wellness Stores play a crucial role in promoting organic tea, while Online Retailers are gaining traction due to the convenience of e-commerce.

The UAE Premium Organic Tea Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ahmad Tea, Twinings, Dilmah, Yogi Tea, Pukka Herbs, Harney & Sons, Teavana, Celestial Seasonings, T2 Tea, Stash Tea, Numi Organic Tea, Rishi Tea, The Republic of Tea, Kusmi Tea, Tea Forté contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE premium organic tea market appears promising, driven by evolving consumer preferences and increasing health awareness. As the market matures, brands are likely to focus on product innovation and sustainability initiatives to attract discerning consumers. Additionally, the rise of e-commerce will facilitate broader access to organic tea, enabling brands to reach a wider audience. Collaborations with health and wellness brands may further enhance market visibility, creating a dynamic environment for growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Tea Black Tea Herbal Tea White Tea Oolong Tea Specialty Blends Others |

| By End-User | Retail Consumers Cafes and Restaurants Health and Wellness Stores Online Retailers |

| By Sales Channel | Supermarkets Specialty Stores E-commerce Platforms Direct Sales |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Loose Leaf Tea Bags Ready-to-Drink |

| By Flavor Profile | Floral Fruity Spicy Classic |

| By Region | Dubai Abu Dhabi Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Organic Tea Retailers | 100 | Store Managers, Category Buyers |

| Organic Tea Producers | 75 | Farm Owners, Production Managers |

| Health and Wellness Influencers | 50 | Nutritionists, Lifestyle Coaches |

| Consumers of Premium Organic Tea | 150 | Health-Conscious Shoppers, Tea Enthusiasts |

| Retail Market Analysts | 30 | Market Researchers, Industry Analysts |

The UAE Premium Organic Tea Retail Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing health consciousness and a rising demand for organic products among consumers.