Region:Middle East

Author(s):Shubham

Product Code:KRAD5390

Pages:98

Published On:December 2025

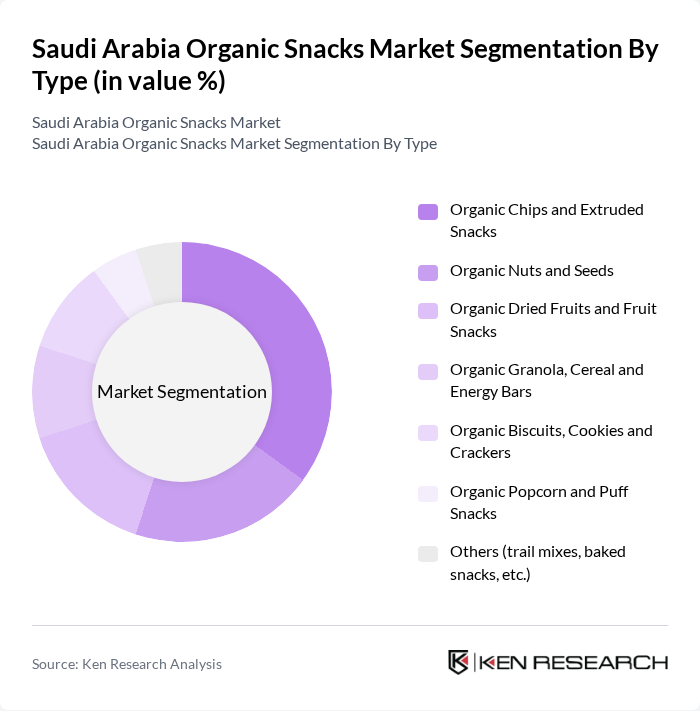

By Type:The organic snacks market is segmented into various types, including Organic Chips and Extruded Snacks, Organic Nuts and Seeds, Organic Dried Fruits and Fruit Snacks, Organic Granola, Cereal and Energy Bars, Organic Biscuits, Cookies and Crackers, Organic Popcorn and Puff Snacks, and Others (trail mixes, baked snacks, etc.). Among these, Organic Chips and Extruded Snacks have emerged as the leading sub-segment due to their popularity among consumers seeking convenient and tasty snack options. The increasing demand for healthier alternatives to traditional snacks has further propelled the growth of this category.

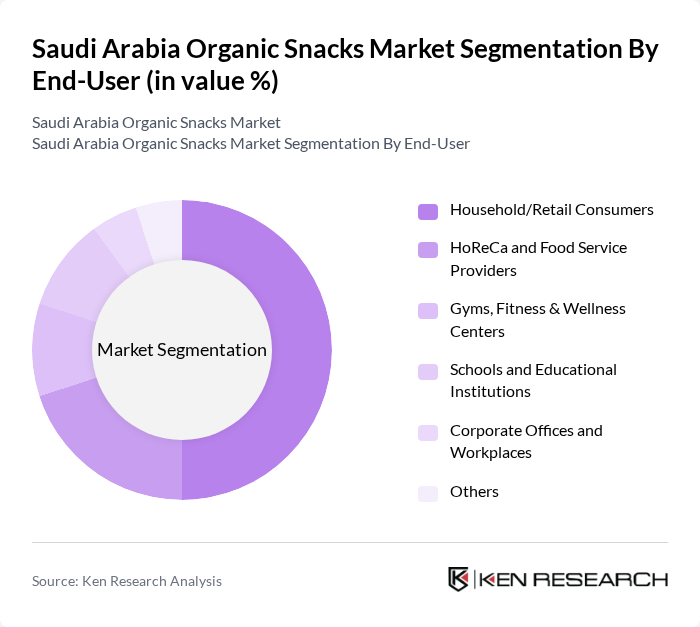

By End-User:The market is segmented by end-user into Household/Retail Consumers, HoReCa and Food Service Providers, Gyms, Fitness & Wellness Centers, Schools and Educational Institutions, Corporate Offices and Workplaces, and Others. The Household/Retail Consumers segment dominates the market, driven by the increasing trend of health-conscious eating habits among families. This segment's growth is supported by the rising availability of organic snacks in retail outlets and online platforms, making it easier for consumers to access these products.

The Saudi Arabia Organic Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group (including Afia, Panda retail private labels), Panda Retail Company (Panda, HyperPanda – private label organic snacks), Tamimi Markets (organic and health-focused private label ranges), Carrefour Saudi Arabia (Majid Al Futtaim Retail – organic snack assortments), Danube & BinDawood (BinDawood Holding), Al Othaim Markets (Abdullah Al Othaim Markets Company), Organic Foods & Café (regional organic retailer and brand), Nabat Organic, Healthy Basket, Saudi Organic Farms (SOFCO), Bateel International (dates and premium organic date-based snacks), Tamimi Global Co. – Snackify / related healthy snack brands, Local Online Subscription Players (e.g., Wateen, Nuun Box and similar), International Organic Snack Brands Active in KSA (e.g., MadeGood, Nakd, Clif Bar, etc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic snacks market in Saudi Arabia appears promising, driven by increasing health awareness and a shift towards natural ingredients. As e-commerce continues to expand, more consumers will have access to a variety of organic snack options. Additionally, collaborations with health institutions can enhance credibility and consumer trust. The market is likely to see innovative product developments that cater to evolving consumer preferences, further solidifying the organic snacks segment's position in the food industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Chips and Extruded Snacks Organic Nuts and Seeds Organic Dried Fruits and Fruit Snacks Organic Granola, Cereal and Energy Bars Organic Biscuits, Cookies and Crackers Organic Popcorn and Puff Snacks Others (trail mixes, baked snacks, etc.) |

| By End-User | Household/Retail Consumers HoReCa and Food Service Providers Gyms, Fitness & Wellness Centers Schools and Educational Institutions Corporate Offices and Workplaces Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail and Subscription Boxes Organic & Health Food Stores Convenience Stores Specialty Stores and Pharmacies Others |

| By Packaging Type | Flexible Packaging (pouches, sachets, bags) Rigid Packaging (boxes, tubs, jars) Bulk and HoReCa Packaging Sustainable/Eco-friendly Packaging Others |

| By Price Range | Premium Mid-Range Economy Private Label |

| By Organic Certification | Saudi Organic Farming Association (SOFA) / Local Organic Certification SFDA-Recognized International Certifications (e.g., USDA Organic) EU Organic Halal-Certified Organic Others |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Al Khobar) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Snacks | 120 | Health-conscious Consumers, Parents, Young Professionals |

| Retailer Insights on Organic Snack Sales | 80 | Store Managers, Category Buyers, Retail Analysts |

| Manufacturer Perspectives on Market Trends | 60 | Product Development Managers, Marketing Directors |

| Distribution Channel Effectiveness | 50 | Logistics Managers, Supply Chain Coordinators |

| Impact of Health Trends on Purchasing Decisions | 70 | Nutritionists, Health Coaches, Fitness Enthusiasts |

The Saudi Arabia Organic Snacks Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness and the rising demand for organic food products among consumers.