Region:Middle East

Author(s):Rebecca

Product Code:KRAA3347

Pages:84

Published On:September 2025

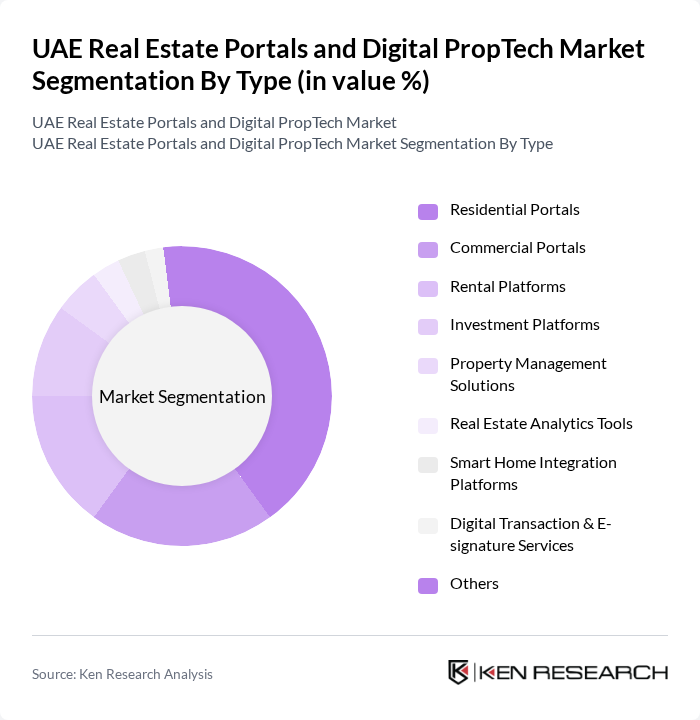

By Type:The market is segmented into various types, including Residential Portals, Commercial Portals, Rental Platforms, Investment Platforms, Property Management Solutions, Real Estate Analytics Tools, Smart Home Integration Platforms, Digital Transaction & E-signature Services, and Others. Among these, Residential Portals are the most prominent, driven by the high demand for residential properties in urban areas. The increasing trend of online property searches and the convenience of digital transactions, enhanced by VR and AR technologies that enable smarter, faster, and more efficient project delivery, have further solidified their market position.

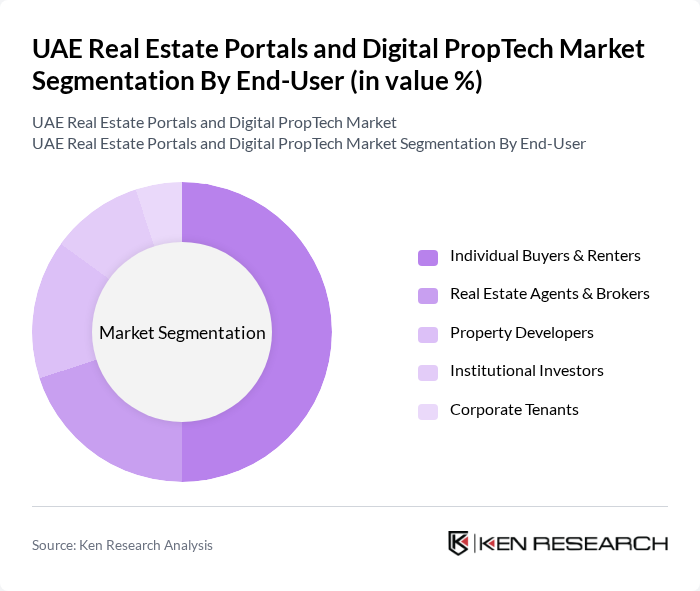

By End-User:The end-user segmentation includes Individual Buyers & Renters, Real Estate Agents & Brokers, Property Developers, Institutional Investors, and Corporate Tenants. Individual Buyers & Renters dominate the market, driven by the growing trend of homeownership and the increasing number of expatriates seeking rental properties. The ease of access to online platforms, enhanced by AI-powered platforms optimizing energy consumption and predictive maintenance, and blockchain technology facilitating transparent green building certifications, has made it simpler for individuals to explore various options, leading to a surge in demand.

The UAE Real Estate Portals and Digital PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, Dubizzle, JustProperty, Houza, YallaDeals, Mubawab, Zawya, Property Monitor, SmartCrowd, Asteco, Emaar Properties, Aldar Properties, DAMAC Properties, Metropolitan Premium Properties contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE real estate portals and digital PropTech market appears promising, driven by ongoing technological advancements and increasing urbanization. As the population continues to grow, the demand for innovative housing solutions will rise. Additionally, the integration of AI and big data analytics will enhance decision-making processes for buyers and investors. The market is expected to adapt to evolving consumer preferences, emphasizing sustainability and smart home technologies, which will further shape its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Platforms Investment Platforms Property Management Solutions Real Estate Analytics Tools Smart Home Integration Platforms Digital Transaction & E-signature Services Others |

| By End-User | Individual Buyers & Renters Real Estate Agents & Brokers Property Developers Institutional Investors Corporate Tenants |

| By Sales Channel | Online Marketplaces Direct Sales (B2B) Mobile Applications Social Media Platforms Agency Partnerships |

| By Geographic Focus | Dubai Abu Dhabi Sharjah Ajman Ras Al Khaimah Fujairah & Umm Al Quwain |

| By Customer Segment | First-Time Buyers Luxury Buyers Commercial Investors International Buyers Tenants (Residential/Commercial) |

| By Service Type | Listing Services Valuation & Appraisal Services Marketing & Lead Generation Services Consulting & Advisory Services Transaction Management Services |

| By Investment Type | Residential Investments Commercial Investments Mixed-Use Developments Off-Plan Investments REITs & Crowdfunding Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Portals | 120 | Real Estate Agents, Property Managers |

| Commercial Real Estate Platforms | 85 | Commercial Brokers, Investment Analysts |

| PropTech Startups | 65 | Founders, Product Managers |

| Digital Marketing in Real Estate | 55 | Marketing Directors, Digital Strategists |

| Government Initiatives in Real Estate | 45 | Policy Makers, Urban Planners |

The UAE Real Estate Portals and Digital PropTech Market is valued at approximately USD 610 million, reflecting significant growth driven by the adoption of digital technologies and increased consumer demand for online property listings.