Region:Middle East

Author(s):Dev

Product Code:KRAA3569

Pages:87

Published On:September 2025

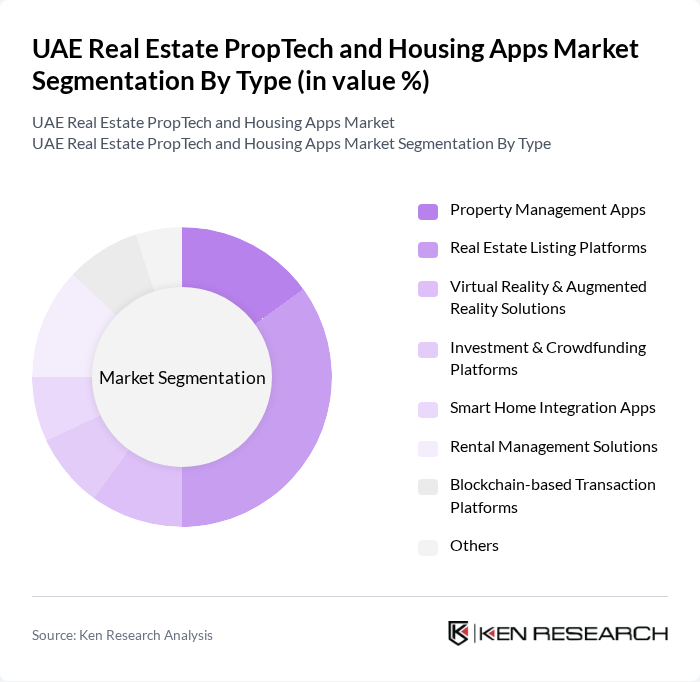

By Type:The market is segmented into various types, including Property Management Apps, Real Estate Listing Platforms, Virtual Reality & Augmented Reality Solutions, Investment & Crowdfunding Platforms, Smart Home Integration Apps, Rental Management Solutions, Blockchain-based Transaction Platforms, and Others. Among these, Real Estate Listing Platforms are currently dominating the market due to their essential role in connecting buyers and sellers, providing comprehensive property information, and facilitating transactions. The increasing reliance on digital platforms for property searches and the growing trend of online real estate transactions have further solidified their market position. The adoption of VR and AR solutions is accelerating, particularly in construction and property viewing, enhancing design accuracy and customer engagement.

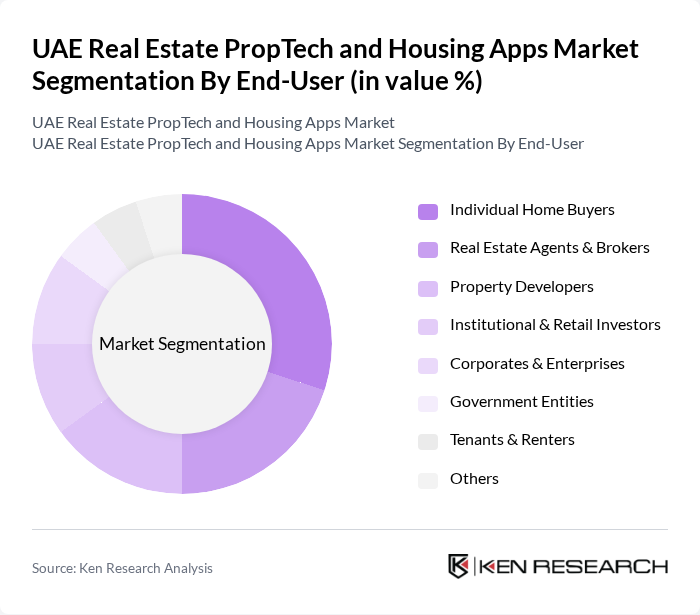

By End-User:This segmentation includes Individual Home Buyers, Real Estate Agents & Brokers, Property Developers, Institutional & Retail Investors, Corporates & Enterprises, Government Entities, Tenants & Renters, and Others. The Individual Home Buyers segment is leading the market, driven by the increasing number of first-time buyers seeking digital solutions for property purchases. The convenience of accessing property listings, virtual tours, and online transaction capabilities has made this segment particularly attractive, resulting in a surge in user engagement and market growth. Expatriates and tech-savvy residents are significant contributors to this segment, reflecting Dubai and Abu Dhabi’s diverse, digitally oriented population.

The UAE Real Estate PropTech and Housing Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, Dubizzle, JustProperty, SmartCrowd, Houza, YallaCompare, Aqarat.com, Property Monitor, Emaar Properties, Aldar Properties, DAMAC Properties, RAK Properties, Asteco, Betterhomes contribute to innovation, geographic expansion, and service delivery in this space.

The UAE real estate PropTech and housing apps market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. As urbanization continues to rise, the demand for smart, efficient housing solutions will increase. Additionally, the integration of AI and big data analytics will enhance property management and customer engagement. The focus on sustainability and eco-friendly practices will also shape the market, encouraging innovation and investment in green technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Apps Real Estate Listing Platforms Virtual Reality & Augmented Reality Solutions Investment & Crowdfunding Platforms Smart Home Integration Apps Rental Management Solutions Blockchain-based Transaction Platforms Others |

| By End-User | Individual Home Buyers Real Estate Agents & Brokers Property Developers Institutional & Retail Investors Corporates & Enterprises Government Entities Tenants & Renters Others |

| By Application | Residential Real Estate Commercial Real Estate Industrial Real Estate Mixed-Use Developments Land Development Others |

| By Sales Channel | Direct Sales Online Platforms & Marketplaces Real Estate Agencies Mobile Applications Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options Others |

| By Customer Segment | First-Time Buyers Luxury Buyers Institutional & Retail Investors Renters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Housing Apps | 120 | Home Buyers, Renters, Real Estate Agents |

| Commercial Real Estate Platforms | 90 | Commercial Property Managers, Investors |

| PropTech Startups | 60 | Founders, Product Managers, Technology Specialists |

| Real Estate Investment Trusts (REITs) | 50 | Investment Analysts, Portfolio Managers |

| Urban Development Authorities | 40 | Urban Planners, Policy Makers, Government Officials |

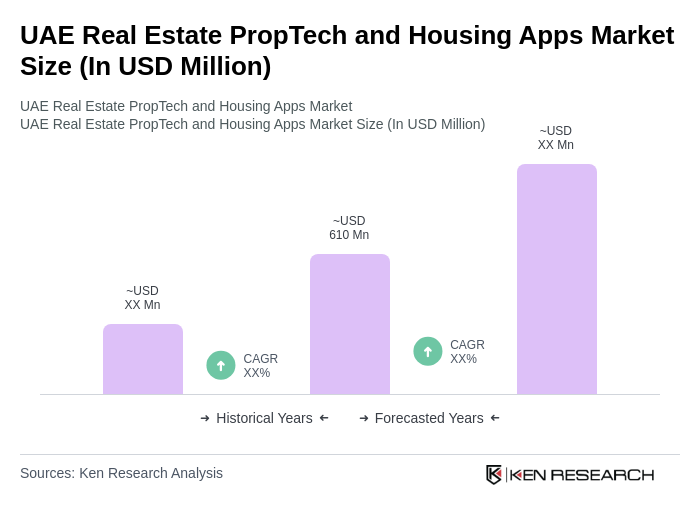

The UAE Real Estate PropTech and Housing Apps Market is valued at approximately USD 610 million, reflecting significant growth driven by technological adoption and consumer demand for digital solutions in real estate transactions.