Region:Middle East

Author(s):Rebecca

Product Code:KRAC3961

Pages:87

Published On:October 2025

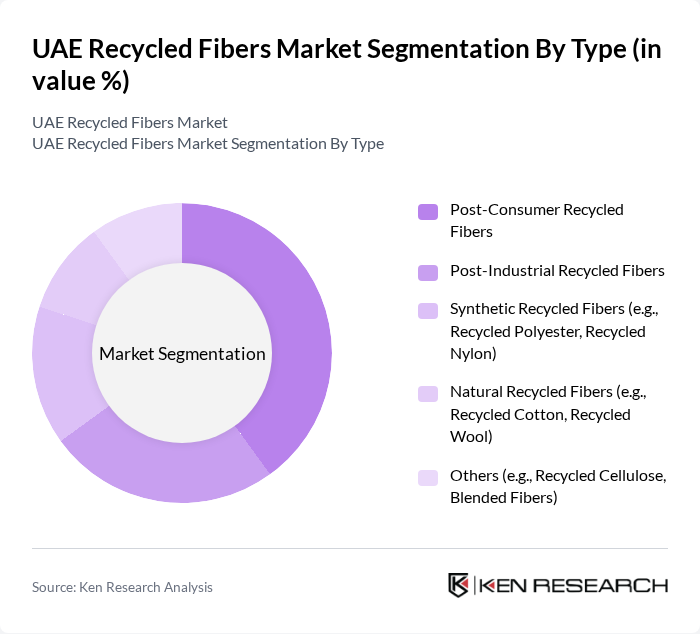

By Type:The market is segmented into various types of recycled fibers, including Post-Consumer Recycled Fibers, Post-Industrial Recycled Fibers, Synthetic Recycled Fibers (e.g., Recycled Polyester, Recycled Nylon), Natural Recycled Fibers (e.g., Recycled Cotton, Recycled Wool), and Others (e.g., Recycled Cellulose, Blended Fibers). Among these,Post-Consumer Recycled Fibersare leading the market, driven by growing consumer awareness of sustainability and the increasing trend of recycling used textiles. The demand for these fibers is propelled by their application in the textile and apparel industry, where brands are focusing on sustainable sourcing and production practices .

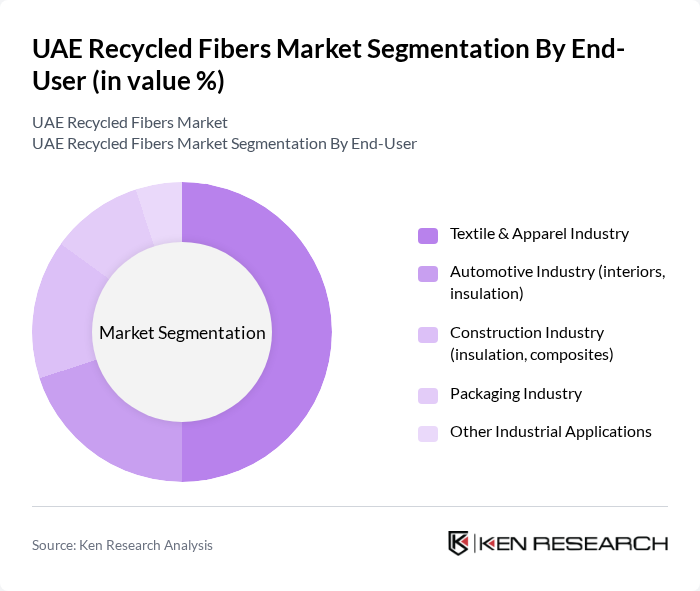

By End-User:The end-user segmentation includes the Textile & Apparel Industry, Automotive Industry (interiors, insulation), Construction Industry (insulation, composites), Packaging Industry, and Other Industrial Applications. TheTextile & Apparel Industryis the dominant segment, driven by increasing consumer demand for sustainable fashion and the adoption of eco-friendly materials by major brands. Regulatory frameworks, such as the UAE Circular Economy Policy, are encouraging the use of recycled materials, making this a key driver for the growth of recycled fibers in the UAE .

The UAE Recycled Fibers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Worn Again Technologies, Lenzing AG, Birla Cellulose, The Woolmark Company, EcoTex Group, Boer Group, Unifi, Inc., Textile Recycling International Limited, Hyosung Corporation, Martex Fiber, re:newcell AB, BLS Ecotech, Indorama Ventures Public Company Limited, Reliance Industries Limited, Recover Textile Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE recycled fibers market appears promising, driven by increasing government support and technological innovations. As the nation strives to meet its sustainability goals, the integration of advanced recycling technologies will likely enhance efficiency and product quality. Furthermore, consumer preferences are shifting towards sustainable products, creating a favorable environment for recycled fibers. The collaboration between businesses and government entities will be crucial in overcoming challenges and capitalizing on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-Consumer Recycled Fibers Post-Industrial Recycled Fibers Synthetic Recycled Fibers (e.g., Recycled Polyester, Recycled Nylon) Natural Recycled Fibers (e.g., Recycled Cotton, Recycled Wool) Others (e.g., Recycled Cellulose, Blended Fibers) |

| By End-User | Textile & Apparel Industry Automotive Industry (interiors, insulation) Construction Industry (insulation, composites) Packaging Industry Other Industrial Applications |

| By Application | Apparel Manufacturing Home Furnishings (carpets, upholstery) Industrial Products (filters, geotextiles) Non-Woven Fabrics |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distributors Others |

| By Material Source | Municipal Solid Waste Industrial Waste Agricultural Residues Textile Waste (pre- and post-consumer) Others |

| By Quality Grade | High-Quality Recycled Fibers Medium-Quality Recycled Fibers Low-Quality Recycled Fibers |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturers | 100 | Production Managers, Sustainability Officers |

| Recycling Facilities | 60 | Operations Managers, Facility Supervisors |

| Retail Sector Stakeholders | 50 | Supply Chain Managers, Procurement Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Consumer Insights | 70 | End-users, Sustainability Advocates |

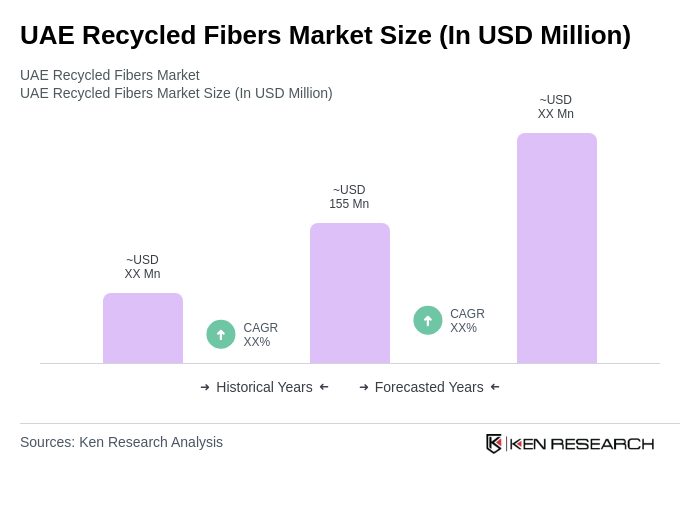

The UAE Recycled Fibers Market is valued at approximately USD 155 million, reflecting a growing trend towards sustainability and recycling in various industries, including textiles, packaging, and construction.