Region:Middle East

Author(s):Shubham

Product Code:KRAD3505

Pages:95

Published On:November 2025

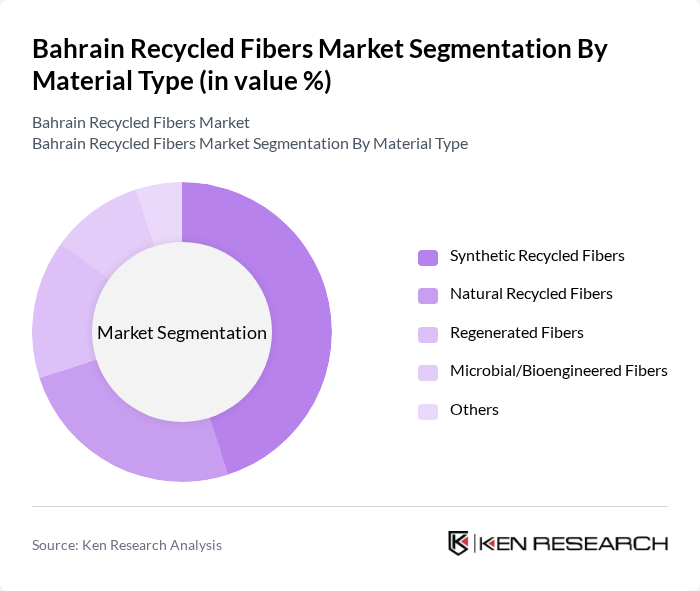

By Material Type:The market is segmented into Synthetic Recycled Fibers, Natural Recycled Fibers, Regenerated Fibers, Microbial/Bioengineered Fibers, and Others. Synthetic Recycled Fibers hold the largest share, driven by their extensive use in textiles, apparel, and automotive applications. Consumer demand for durable, sustainable products and the push to reduce plastic waste have accelerated the adoption of recycled synthetic fibers, particularly polyester, across the region .

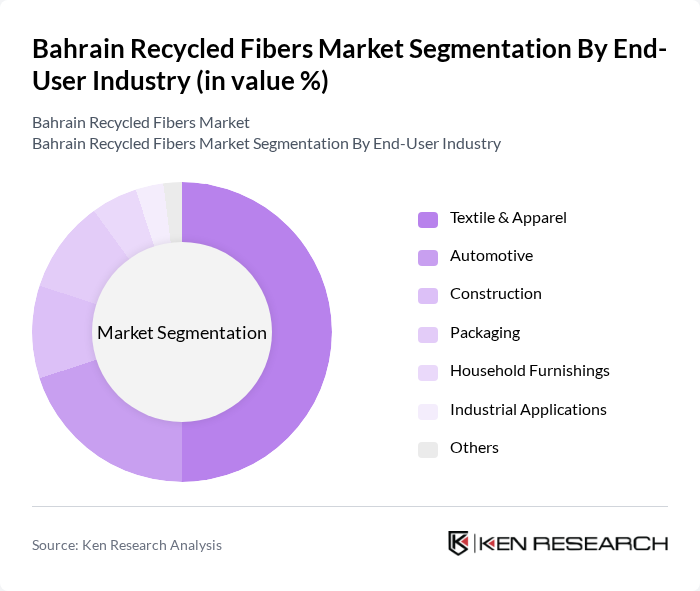

By End-User Industry:The end-user industries for recycled fibers include Textile & Apparel, Automotive, Construction, Packaging, Household Furnishings, Industrial Applications, and Others. The Textile & Apparel sector is the leading segment, reflecting the global trend toward sustainable fashion and the increased use of recycled materials in clothing and accessories. This is further supported by consumer preferences for environmentally responsible products and the fashion industry's adoption of circular economy principles .

The Bahrain Recycled Fibers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Recycled Fibers Company (BRFC), Gulf Sustainable Materials LLC, Al-Hilal Environmental Solutions, Bahrain Waste & Recycling Industries, EcoFiber Middle East, Arabian Green Fibers, Bahrain Industrial Recycling Corporation, Gulf Fiber Technologies, Al-Mohannadi Recycling & Trading, Sustainable Fiber Solutions Bahrain, Bahrain Textile Waste Management, Arabian Recycled Materials Co., Green Fiber Innovations Bahrain, Gulf Environmental Fiber Recycling, Bahrain Circular Economy Fibers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain recycled fibers market appears promising, driven by increasing environmental awareness and supportive government policies. As the nation moves towards a circular economy, investments in recycling technologies and infrastructure are expected to rise. By 2025, the recycling rate is projected to reach 30%, fostering a more sustainable market. Additionally, consumer preferences for eco-friendly products will likely continue to shape industry dynamics, encouraging innovation and collaboration among stakeholders in the recycling ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Synthetic Recycled Fibers Natural Recycled Fibers Regenerated Fibers Microbial/Bioengineered Fibers Others |

| By End-User Industry | Textile & Apparel Automotive Construction Packaging Household Furnishings Industrial Applications Others |

| By Application | Non-Woven Fabrics Composite Materials Insulation Materials Fillers and Additives Others |

| By Source | Post-Consumer Waste Post-Industrial Waste Pre-Consumer Waste Others |

| By Processing Method | Mechanical Recycling Chemical Recycling Thermal Recycling Others |

| By Distribution Channel | Direct Sales to Manufacturers Distributors and Wholesalers Online Platforms Retail Sales Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Recycling Operations | 100 | Operations Managers, Sustainability Coordinators |

| Waste Management Companies | 60 | Business Development Managers, Environmental Compliance Officers |

| Manufacturers of Recycled Fibers | 70 | Production Managers, Quality Assurance Specialists |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Textile Industry Associations | 50 | Association Leaders, Research Analysts |

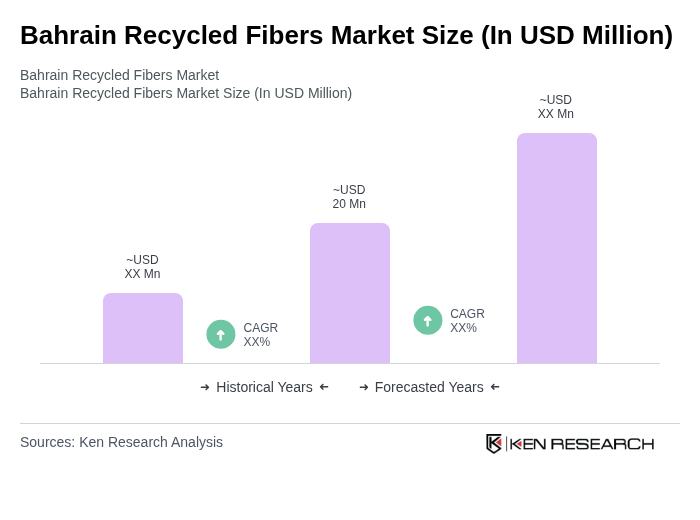

The Bahrain Recycled Fibers Market is valued at approximately USD 20 million, reflecting a growing trend driven by environmental awareness and government sustainability initiatives across various industries, including textiles and automotive.