Region:Middle East

Author(s):Dev

Product Code:KRAB7559

Pages:84

Published On:October 2025

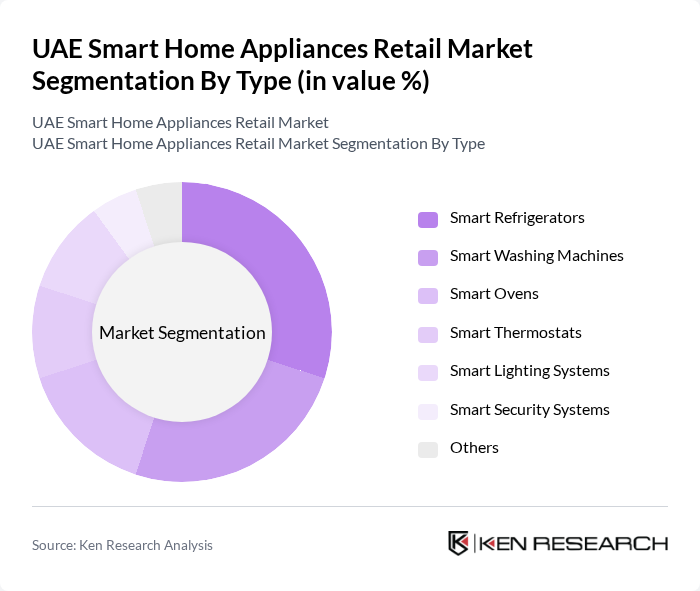

By Type:The market is segmented into various types of smart home appliances, including smart refrigerators, smart washing machines, smart ovens, smart thermostats, smart lighting systems, smart security systems, and others. Among these, smart refrigerators and smart washing machines are leading the market due to their advanced features and energy efficiency, which appeal to environmentally conscious consumers. The trend towards automation and convenience in daily chores is driving the demand for these appliances.

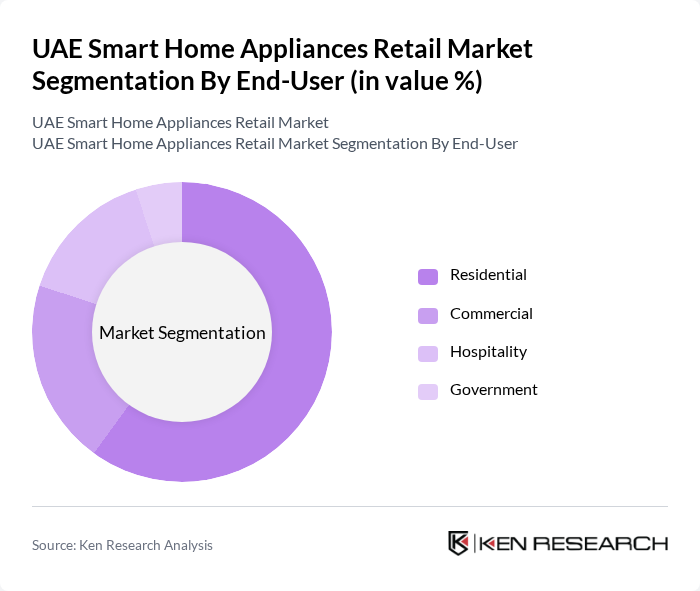

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by increasing consumer interest in home automation and energy efficiency. The growing trend of smart homes and the desire for enhanced convenience and security are key factors contributing to the rise in demand for smart home appliances among homeowners.

The UAE Smart Home Appliances Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics, Samsung Electronics, Philips Electronics, Bosch Home Appliances, Whirlpool Corporation, Panasonic Corporation, Haier Group, Electrolux AB, Miele & Cie. KG, Siemens AG, TCL Technology, Hisense Group, Sharp Corporation, GE Appliances, Arcelik A.S. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart home appliances market appears promising, driven by technological advancements and increasing consumer interest in home automation. As the government continues to promote energy efficiency and sustainability, more households are likely to invest in smart technologies. Additionally, the integration of AI and IoT will enhance user experiences, making smart appliances more accessible and appealing. The market is expected to evolve with innovative solutions that cater to the growing demand for convenience and energy savings in everyday life.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Refrigerators Smart Washing Machines Smart Ovens Smart Thermostats Smart Lighting Systems Smart Security Systems Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Functionality | Basic Functionality Advanced Functionality Multi-Functional Appliances |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Home Appliance Retailers | 150 | Store Managers, Sales Executives |

| Consumer Electronics Buyers | 200 | Homeowners, Tech Enthusiasts |

| Smart Home Technology Installers | 100 | Installation Technicians, Service Providers |

| Market Analysts and Consultants | 50 | Industry Analysts, Market Researchers |

| Smart Home Product Developers | 75 | Product Managers, R&D Engineers |

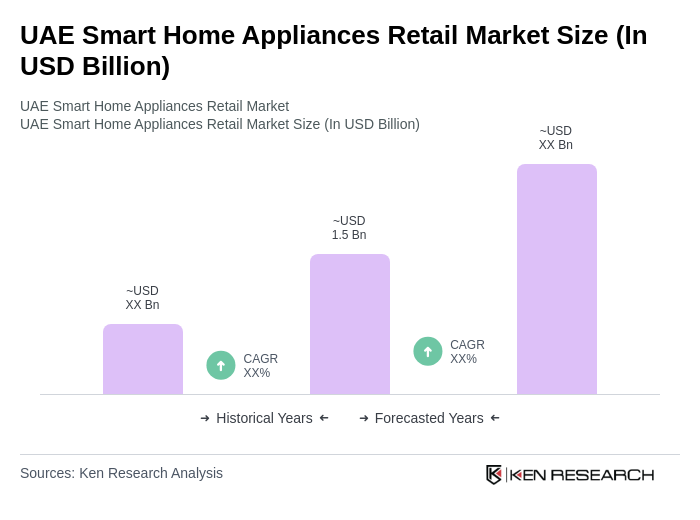

The UAE Smart Home Appliances Retail Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and technologically advanced home solutions.