Region:Middle East

Author(s):Dev

Product Code:KRAD3432

Pages:92

Published On:November 2025

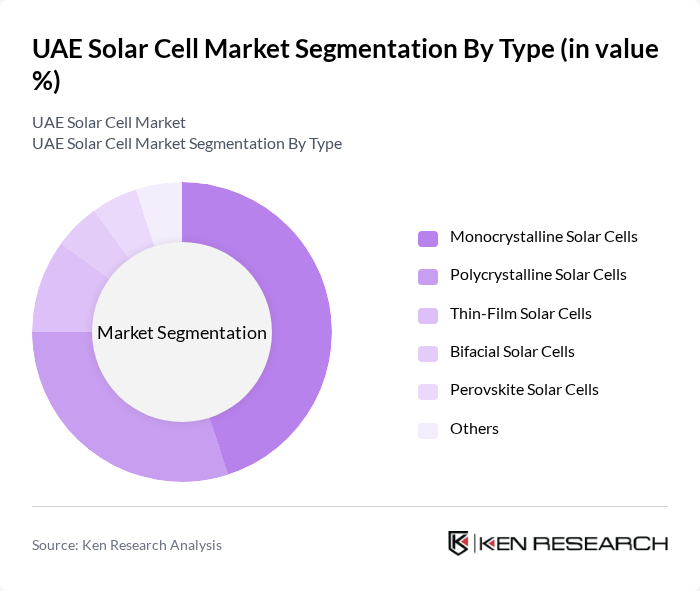

By Type:The market is segmented into various types of solar cells, including Monocrystalline Solar Cells, Polycrystalline Solar Cells, Thin-Film Solar Cells, Bifacial Solar Cells, Perovskite Solar Cells, and Others. Among these, Monocrystalline Solar Cells dominate the market due to their high efficiency and space-saving characteristics, making them a preferred choice for residential and commercial applications. Polycrystalline Solar Cells follow closely, offering a cost-effective alternative with slightly lower efficiency. The demand for Thin-Film Solar Cells is growing, particularly in large-scale installations where space is less of a constraint.

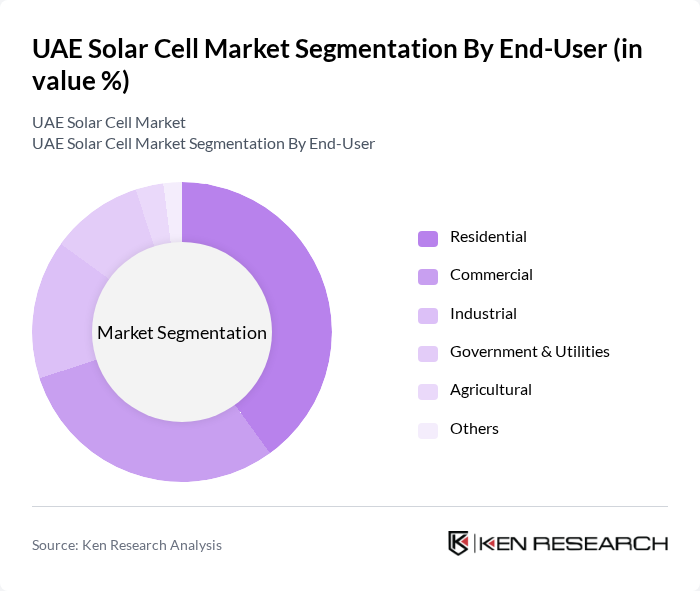

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, Agricultural, and Others. The Residential segment is the largest, driven by increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The Commercial sector is also significant, as businesses seek to reduce energy costs and enhance sustainability. The Industrial segment is growing, particularly in energy-intensive industries, while Government & Utilities are investing heavily in large-scale solar projects to meet national energy goals.

The UAE Solar Cell Market is characterized by a dynamic mix of regional and international players. Leading participants such as Masdar (Abu Dhabi Future Energy Company), Dubai Electricity and Water Authority (DEWA), Abu Dhabi National Energy Company (TAQA), First Solar, JinkoSolar, Trina Solar, LONGi Green Energy Technology Co., Ltd., Canadian Solar, Hanwha Q CELLS, JA Solar Technology Co., Ltd., Yingli Green Energy Holding Company Limited, GCL-Poly Energy Holdings Limited, SunPower Corporation, Enviromena Power Systems, Yellow Door Energy contribute to innovation, geographic expansion, and service delivery in this space.

The UAE solar cell market is poised for significant growth, driven by increasing government support and technological advancements. As the nation strives to meet its renewable energy targets, investments in solar infrastructure and innovative technologies are expected to rise. Additionally, the integration of smart technologies and decentralized energy systems will enhance efficiency and accessibility. The focus on sustainability will further encourage corporate responsibility, positioning the UAE as a leader in solar energy adoption and innovation in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Monocrystalline Solar Cells Polycrystalline Solar Cells Thin-Film Solar Cells Bifacial Solar Cells Perovskite Solar Cells Others |

| By End-User | Residential Commercial Industrial Government & Utilities Agricultural Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Technology | Photovoltaic (PV) Concentrated Solar Power (CSP) Solar Thermal Hybrid Systems Others |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Floating Solar Others |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Multilateral Funding Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Net Metering Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 120 | Homeowners, Solar Installation Managers |

| Commercial Solar Projects | 85 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 65 | Project Developers, Energy Analysts |

| Government Policy Impact | 50 | Regulatory Officials, Energy Policy Advisors |

| Solar Technology Innovations | 55 | R&D Managers, Technology Experts |

The UAE Solar Cell Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by government initiatives, investments in solar technology, and the country's abundant sunlight, making it a key player in the global solar market.