Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3825

Pages:97

Published On:September 2025

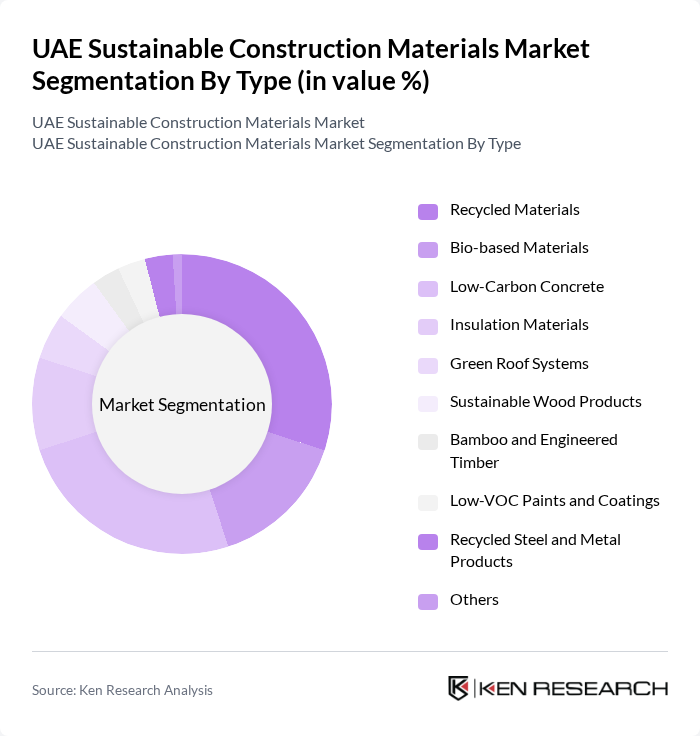

By Type:The market is segmented into various types of sustainable construction materials, including recycled materials, bio-based materials, low-carbon concrete, insulation materials, green roof systems, sustainable wood products, bamboo and engineered timber, low-VOC paints and coatings, recycled steel and metal products, and others. Among these, recycled materials and low-carbon concrete are gaining significant traction due to their environmental benefits, cost-effectiveness, and alignment with UAE’s green building codes. The adoption of advanced insulation and modular prefabrication is also accelerating, driven by energy efficiency targets and regulatory compliance .

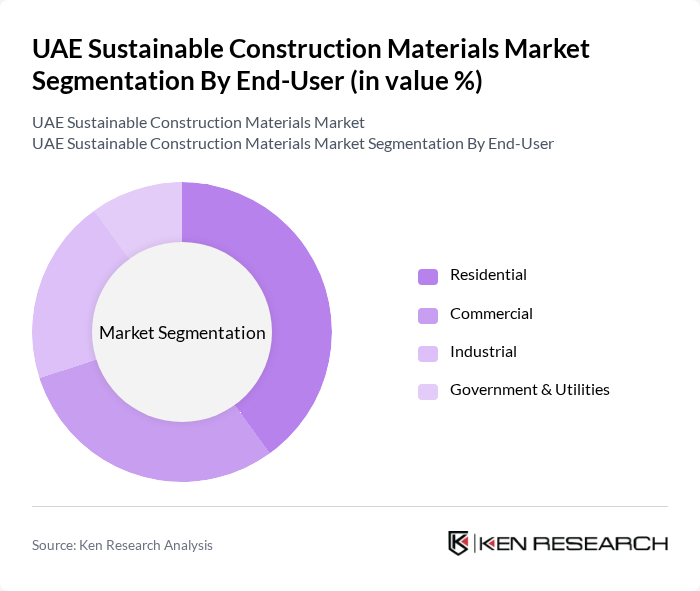

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential sector is the largest consumer of sustainable construction materials, driven by increasing consumer awareness, demand for eco-friendly homes, and regulatory incentives for green housing. The commercial sector follows closely, as businesses seek to enhance their sustainability profiles and reduce operational costs through energy-efficient buildings. Industrial and government sectors are also expanding adoption, particularly for infrastructure and public facility upgrades aligned with national sustainability goals .

The UAE Sustainable Construction Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Green Building Council, Dubai Investments, Abu Dhabi Commercial Bank, Gulf Cement Company, RAK Ceramics, Al Ain Cement Factory, National Cement Company, Lafarge Emirates Cement, Holcim UAE, Saint-Gobain, CEMEX UAE, Sika UAE, Knauf Insulation, BASF UAE, Kingspan Insulation LLC, Emaar Properties, Siemens Smart Infrastructure, Schneider Electric UAE, Johnson Controls UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE sustainable construction materials market appears promising, driven by increasing government support and a growing emphasis on environmental sustainability. As the nation aims to diversify its economy, investments in green technologies and sustainable practices are expected to rise. Additionally, the integration of smart technologies in construction will enhance efficiency and reduce waste, further propelling the adoption of sustainable materials. The market is poised for significant transformation as stakeholders prioritize eco-friendly solutions in their projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Recycled Materials Bio-based Materials Low-Carbon Concrete Insulation Materials Green Roof Systems Sustainable Wood Products Bamboo and Engineered Timber Low-VOC Paints and Coatings Recycled Steel and Metal Products Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Infrastructure Development Landscaping Roofing Framing Interior Finishing Exterior Siding |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Material Source | Local Suppliers International Suppliers |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Firms Utilizing Sustainable Materials | 100 | Project Managers, Sustainability Managers |

| Architectural Firms Focused on Green Design | 60 | Lead Architects, Design Engineers |

| Suppliers of Eco-friendly Construction Materials | 40 | Sales Managers, Product Development Specialists |

| Government Regulatory Bodies on Construction Standards | 40 | Policy Makers, Compliance Officers |

| Industry Experts and Consultants in Sustainable Construction | 50 | Consultants, Industry Analysts |

The UAE Sustainable Construction Materials Market is valued at approximately USD 1.2 billion, reflecting its leadership in the GCC region's green building materials market, which totals around USD 10.6 billion.