Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0986

Pages:94

Published On:October 2025

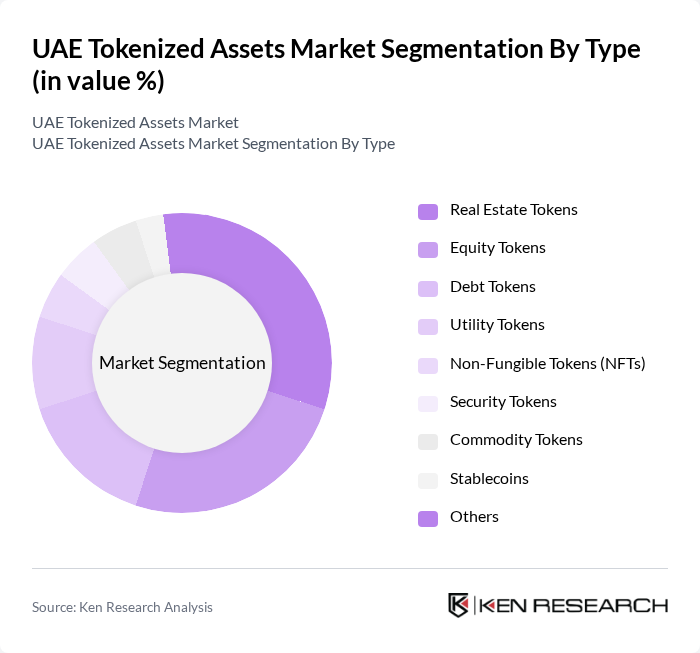

By Type:The tokenized assets market can be segmented into various types, including Real Estate Tokens, Equity Tokens, Debt Tokens, Utility Tokens, Non-Fungible Tokens (NFTs), Security Tokens, Commodity Tokens, Stablecoins, and Others. Among these, Real Estate Tokens are gaining significant traction due to the growing trend of fractional ownership, allowing investors to participate in high-value properties with lower capital requirements. Equity Tokens are also prominent, driven by the increasing interest in tokenized equity offerings as a means of raising capital. The market is witnessing rapid institutional adoption of tokenized treasury products and private credit, with tokenized U.S. Treasury products alone surpassing USD 7.4 billion globally by mid-2025, reflecting demand from funds, corporates, and crypto-native treasuries seeking on-chain yield and instant settlement collateral.

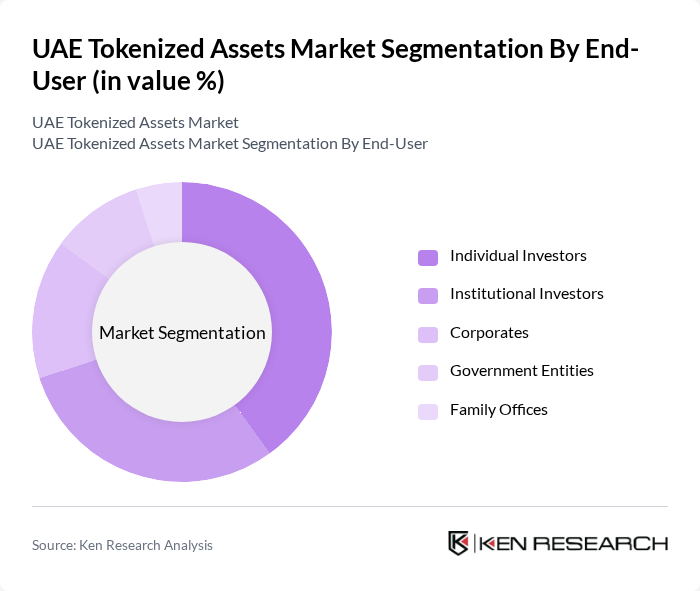

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, Government Entities, and Family Offices. Individual Investors are increasingly participating in the tokenized assets market, driven by the accessibility and lower investment thresholds offered by tokenization. Institutional Investors are also becoming significant players, as they seek innovative investment opportunities and diversification through tokenized assets. The involvement of local banks, asset managers, and sovereign wealth funds is deepening, with wealth managers packaging tokenized assets into investment products and government entities exploring tokenization for infrastructure and development projects.

The UAE Tokenized Assets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, BitOasis, FTX Trading Ltd., eToro, Crypto.com, Dubaicoin, RAK Digital Assets Oasis, Abu Dhabi Global Market (ADGM), Dubai Multi Commodities Centre (DMCC), Sygnum Bank, Tokeny Solutions, Nexo, KuCoin, Kraken, Chainalysis, DAMAC Group, MANTRA, Ctrl Alt, Prypco Mint, Cobo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE tokenized assets market appears promising, driven by increasing institutional investment and the integration of advanced technologies. As more financial institutions recognize the potential of tokenization, the market is likely to see a rise in innovative financial products. Additionally, the emergence of new use cases for tokenized assets, particularly in sectors like real estate and art, will further enhance market dynamics, creating a robust ecosystem for digital asset transactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Tokens Equity Tokens Debt Tokens Utility Tokens Non-Fungible Tokens (NFTs) Security Tokens Commodity Tokens Stablecoins Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities Family Offices |

| By Application | Investment and Trading Asset Management Fundraising and Crowdfunding Supply Chain Management Real Estate Fractionalization Private Credit and Lending |

| By Distribution Channel | Direct Sales Online Platforms Brokerages Licensed Exchanges |

| By Regulatory Compliance | Fully Compliant Tokens Semi-Compliant Tokens Non-Compliant Tokens |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Market Maturity | Emerging Market Growth Market Established Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Institutions Engaged in Tokenization | 100 | Investment Managers, Compliance Officers |

| Blockchain Technology Providers | 80 | Chief Technology Officers, Product Development Leads |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Regulatory Analysts |

| Investors in Tokenized Assets | 100 | Private Investors, Institutional Investors |

| End-users of Tokenized Platforms | 70 | Retail Investors, Tech-savvy Consumers |

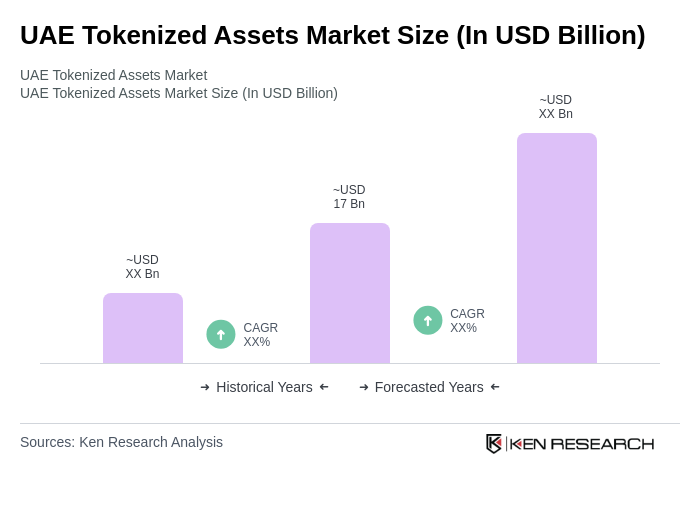

The UAE Tokenized Assets Market is valued at approximately USD 17 billion as of early 2025. This valuation reflects the on-chain value of various tokenized real-world assets associated with the UAE, driven by blockchain adoption and regulatory advancements.