Region:Middle East

Author(s):Rebecca

Product Code:KRAC1088

Pages:95

Published On:October 2025

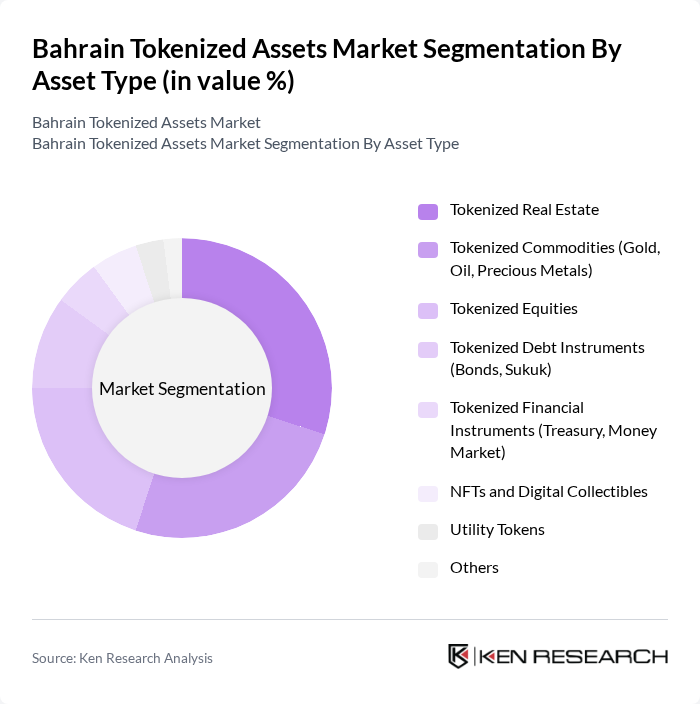

By Asset Type:The tokenized assets market can be segmented into various asset types, including tokenized real estate, commodities, equities, debt instruments, financial instruments, NFTs, utility tokens, and others. Tokenized real estate has gained significant traction due to its ability to provide fractional ownership opportunities and increased liquidity, making property investment accessible to both institutional and retail investors who previously faced high entry barriers. Tokenized commodities, particularly gold-backed tokens, have emerged as a major segment, with the global tokenized gold market valued at approximately USD 1.2 billion. Gold and other precious metals are popular as they offer portfolio diversification, hedge against inflation, and combine the stability of physical commodities with blockchain-enabled tradability. Tokenized financial instruments, including treasury and money-market assets, have also witnessed substantial growth, with global tokenized U.S. Treasury and money-market assets reaching USD 7.4 billion.

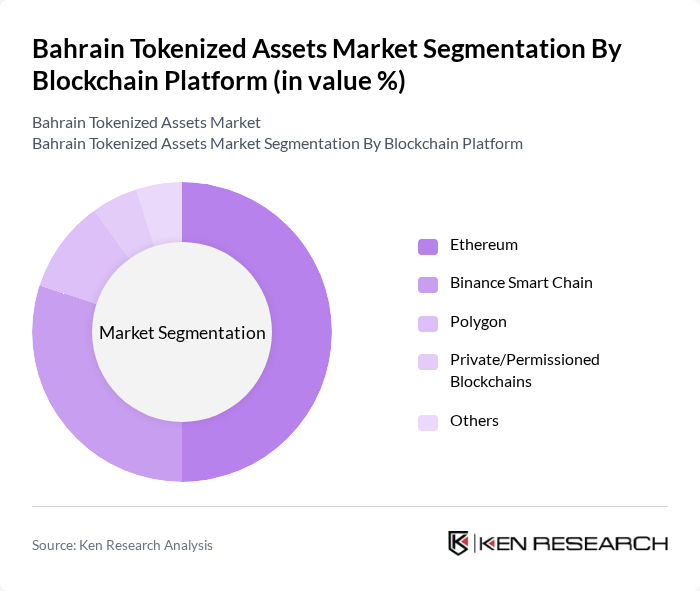

By Blockchain Platform:The market can also be segmented based on the blockchain platforms used for tokenization, including Ethereum, Binance Smart Chain, Polygon, private/permissioned blockchains, and others. Ethereum remains the dominant platform due to its robust smart contract capabilities, extensive developer ecosystem, and widespread institutional adoption for asset tokenization. The platform's established infrastructure and compatibility with various tokenization standards have made it the preferred choice for issuing security tokens and real-world asset tokens. Binance Smart Chain has gained market share due to its lower transaction fees and faster processing times compared to Ethereum, attracting projects seeking cost-efficient tokenization solutions. Private and permissioned blockchains are increasingly adopted by financial institutions and enterprises that require enhanced privacy controls, regulatory compliance features, and permission-based access for tokenized assets, particularly for institutional-grade securities and compliance-heavy asset classes.

The Bahrain Tokenized Assets Market is characterized by a dynamic mix of regional and international players. Leading participants such as ATME (Arab Token Market Exchange), Rain Financial, CoinMENA, Bahrain FinTech Bay, Gulf International Bank (GIB), Al Baraka Banking Group, Bahrain Islamic Bank, BitOasis, Fasset, Eazy Financial Services, Takaful International, Securitize, BFC Group Holdings, Aion Digital, Arcana (Bahrain Blockchain Initiative Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tokenized assets market in Bahrain appears promising, driven by increasing regulatory clarity and technological advancements. As more financial institutions adopt blockchain technology, the efficiency and security of tokenized transactions are expected to improve significantly. Additionally, the growing interest in sustainable investments and decentralized finance (DeFi) will likely create new avenues for growth, attracting a broader range of investors and enhancing market liquidity in the future.

| Segment | Sub-Segments |

|---|---|

| By Asset Type | Tokenized Real Estate Tokenized Commodities (Gold, Oil, Precious Metals) Tokenized Equities Tokenized Debt Instruments (Bonds, Sukuk) Tokenized Financial Instruments (Treasury, Money Market) NFTs and Digital Collectibles Utility Tokens Others |

| By Blockchain Platform | Ethereum Binance Smart Chain Polygon Private/Permissioned Blockchains Others |

| By End-User | Institutional Investors Accredited Retail Investors Corporate Entities Government and Sovereign Wealth Funds High-Net-Worth Individuals (HNWIs) |

| By Token Standard | ERC-20 ERC-721 (NFT) ERC-1400 (Security Token) BEP-20 Others |

| By Regulatory Compliance | Central Bank of Bahrain (CBB) Licensed AML/KYC Compliant Shariah-Compliant Tokens Unregulated/Offshore |

| By Liquidity Mechanism | Exchange-Traded (Secondary Market) Over-the-Counter (OTC) Peer-to-Peer (P2P) Redeemable for Physical Assets |

| By Investment Horizon | Short-Term (< 1 Year) Medium-Term (1-5 Years) Long-Term (> 5 Years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Institutions' Adoption of Tokenization | 45 | Banking Executives, Compliance Officers |

| Technology Providers in Blockchain | 40 | CTOs, Product Managers |

| Investors in Tokenized Assets | 50 | Wealth Managers, Individual Investors |

| Regulatory Perspectives on Tokenization | 30 | Regulatory Officials, Legal Advisors |

| Market Trends and Consumer Sentiment | 45 | Market Analysts, Financial Advisors |

The Bahrain Tokenized Assets Market is valued at approximately USD 1.3 billion, driven by the adoption of blockchain technology, regulatory support from the Central Bank of Bahrain, and increasing interest in digital assets among investors.