Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1061

Pages:91

Published On:October 2025

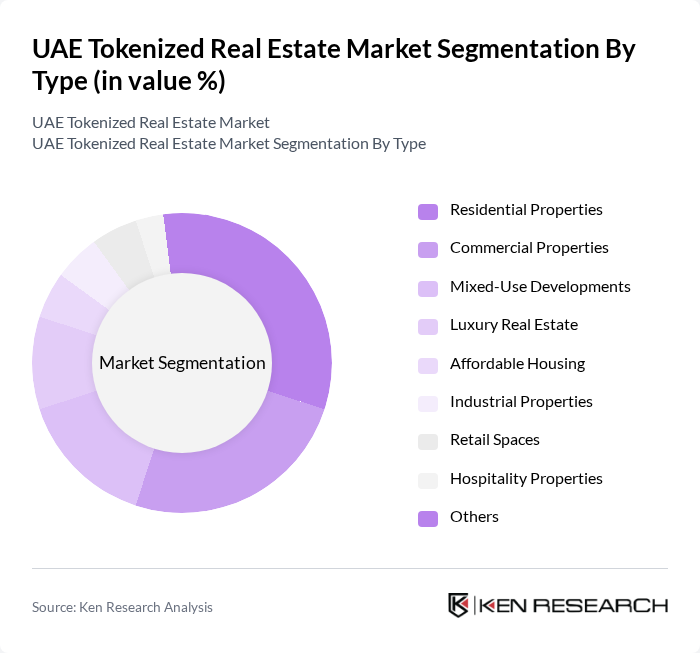

By Type:The market is segmented into various property types, including residential properties, commercial properties, mixed-use developments, luxury real estate, affordable housing, industrial properties, retail spaces, hospitality properties, and others. Each sub-segment caters to different investor needs and preferences, reflecting the diverse landscape of the tokenized real estate market. Residential and commercial properties remain the most actively tokenized segments, driven by investor demand for fractional ownership and liquidity .

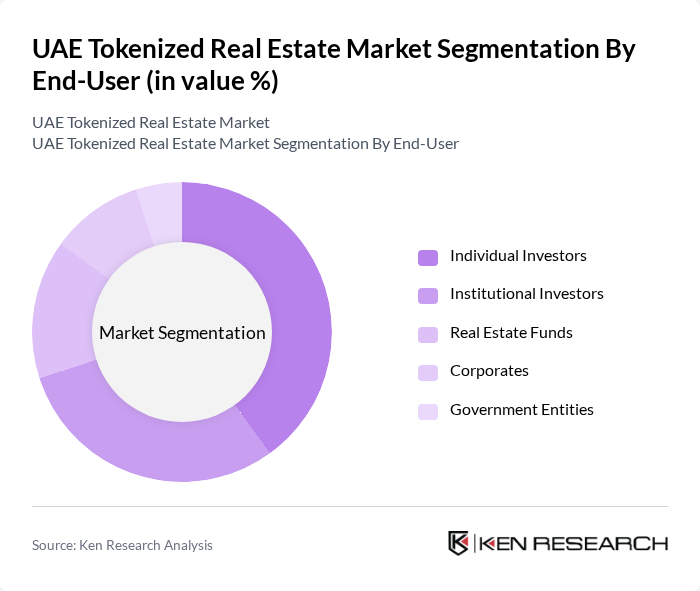

By End-User:The end-user segmentation includes individual investors, institutional investors, real estate funds, corporates, and government entities. Each group has distinct investment strategies and objectives, influencing their participation in the tokenized real estate market. Individual and institutional investors are the primary drivers of market activity, with increasing participation from real estate funds and corporates seeking digital asset exposure .

The UAE Tokenized Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mavryk Network, Prypco, SmartCrowd, RealT, Blocksquare, SolidBlock, Harbor Platform, TokenEstate, RealtyBits, RedSwan CRE, Myco, Brickblock, Blockimmo, Tokeny Solutions, and Fractional contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE tokenized real estate market appears promising, driven by increasing technological integration and a growing acceptance of digital assets. As blockchain technology matures, it is expected to enhance transaction efficiency and security, attracting more investors. Additionally, the UAE government is likely to establish clearer regulations, fostering a more conducive environment for tokenization. This evolving landscape will likely lead to greater participation from both local and international investors, further solidifying the UAE's position as a leader in innovative real estate solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Mixed-Use Developments Luxury Real Estate Affordable Housing Industrial Properties Retail Spaces Hospitality Properties Others |

| By End-User | Individual Investors Institutional Investors Real Estate Funds Corporates Government Entities |

| By Investment Size | Micro Investments (Under AED 100,000) Small Investments (AED 100,000 - AED 1 Million) Medium Investments (AED 1 Million - AED 5 Million) Large Investments (Over AED 5 Million) |

| By Property Location | Prime Urban Areas (e.g., Downtown Dubai, Dubai Marina) Secondary Urban Areas Suburban Areas Rural Areas |

| By Tokenization Model | Equity Tokenization Debt Tokenization Revenue Sharing Models Hybrid Models |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Market Maturity | Emerging Market Growth Market Established Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Developers | 60 | CEOs, Project Managers, Blockchain Specialists |

| Investors in Tokenized Assets | 50 | Institutional Investors, High Net-Worth Individuals |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Blockchain Technology Providers | 45 | CTOs, Product Managers, Business Development Leads |

| Real Estate Analysts | 40 | Market Researchers, Financial Analysts |

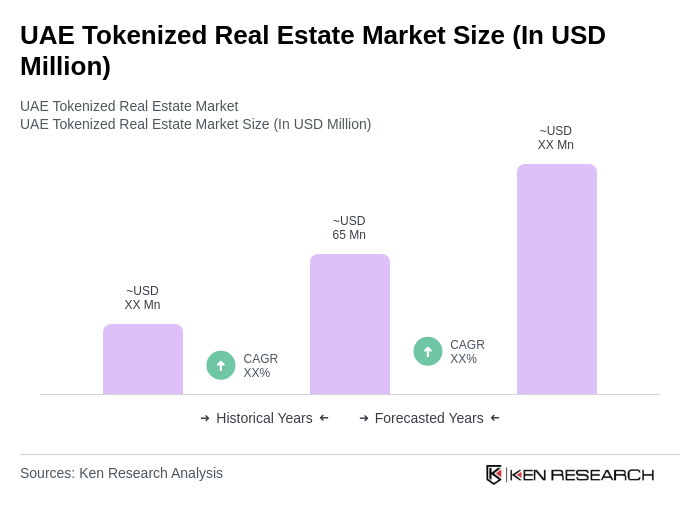

The UAE Tokenized Real Estate Market is valued at approximately USD 65 million, reflecting significant growth driven by blockchain technology adoption, demand for fractional ownership, and cross-border investment opportunities.