Region:Middle East

Author(s):Shubham

Product Code:KRAC4228

Pages:85

Published On:October 2025

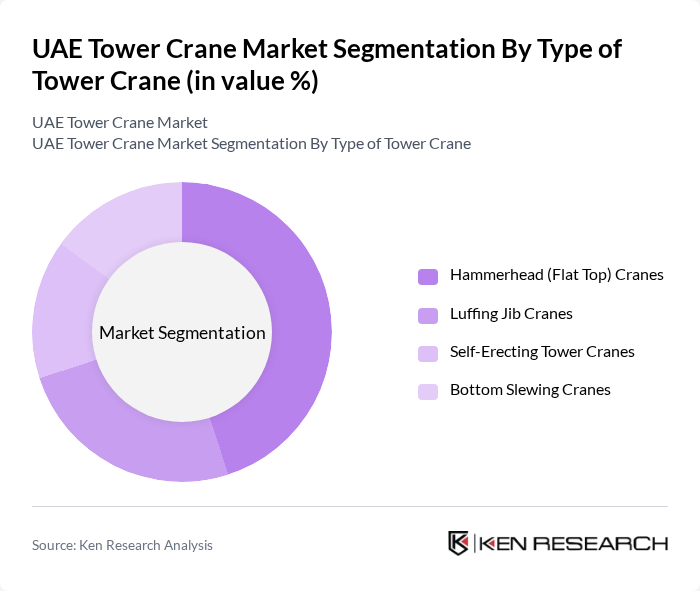

By Type of Tower Crane:The market is segmented into Hammerhead (Flat Top) Cranes, Luffing Jib Cranes, Self-Erecting Tower Cranes, and Bottom Slewing Cranes. Hammerhead cranes hold the largest share due to their versatility and efficiency in handling heavy loads, making them ideal for high-rise construction. Luffing jib cranes are increasingly favored in dense urban environments for their ability to operate in confined spaces and avoid over-swinging adjacent properties. Self-erecting cranes are preferred for smaller, short-duration projects due to rapid setup and ease of operation. Demand is also rising for technologically advanced models with digital telematics and remote monitoring .

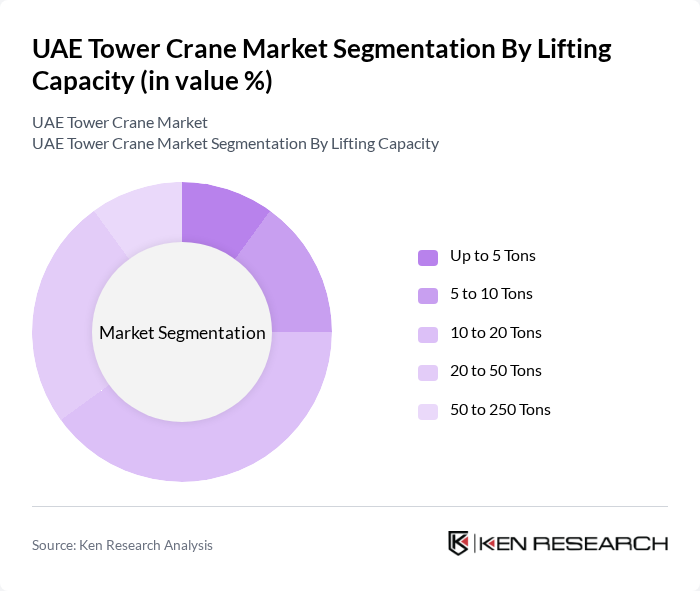

By Lifting Capacity:The lifting capacity segmentation includes Up to 5 Tons, 5 to 10 Tons, 10 to 20 Tons, 20 to 50 Tons, and 50 to 250 Tons. The 10 to 20 Tons segment leads the market, serving a broad spectrum of construction projects from residential to commercial. This range is preferred for its optimal balance of lifting power and operational efficiency. The 20 to 50 Tons segment is also significant, especially for infrastructure and industrial projects that require higher capacity cranes. The market is witnessing increased demand for medium and high-capacity cranes as project complexity and scale grow .

The UAE Tower Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Liebherr Group, SANY Group, XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., Manitowoc Company, Inc., Terex Corporation, Potain (Manitowoc Brand), Comansa, WOLFFKRAN International AG, JASO Tower Cranes, Konecranes, TADANO Ltd., Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Alimak Group, and local UAE-based crane rental and services providers contribute to innovation, geographic expansion, and service delivery in this space.

The UAE tower crane market is poised for significant transformation, driven by technological advancements and a focus on sustainability. The integration of automation and IoT in crane operations is expected to enhance efficiency and safety, while the shift towards electric and hybrid cranes aligns with global sustainability trends. Additionally, the government's commitment to smart city initiatives will further stimulate demand for innovative construction solutions, ensuring a robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type of Tower Crane | Hammerhead (Flat Top) Cranes Luffing Jib Cranes Self-Erecting Tower Cranes Bottom Slewing Cranes |

| By Lifting Capacity | Up to 5 Tons to 10 Tons to 20 Tons to 50 Tons to 250 Tons |

| By End-Use Industry | Building & Construction (Residential & Commercial) Civic Infrastructure & Urban Development Energy & Utilities Projects Tourism & Hospitality Development Logistics & Port Development |

| By Rental Type & Duration | Short-Term Rental (Daily/Weekly) Medium-Term Rental (Monthly) Long-Term Rental (Annual/Multi-Year) Lease-to-Own Models |

| By Sales Channel | Direct Sales Rental Services Authorized Distributors Equipment Leasing Companies |

| By Technology Integration | Conventional Cranes Telematics-Enabled Cranes IoT & AI-Assisted Cranes Digital Twin & Predictive Maintenance Systems |

| By Environmental Specifications | Heat-Reflective Coated Cranes Anti-Corrosion Component Cranes Electric & Hybrid-Powered Cranes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Construction Managers, Procurement Officers |

| Infrastructure Projects (Bridges, Roads) | 70 | Site Supervisors, Operations Managers |

| Crane Rental Services | 50 | Business Development Managers, Fleet Managers |

| Construction Equipment Suppliers | 60 | Sales Managers, Product Specialists |

The UAE Tower Crane Market is valued at approximately USD 330 million, driven by significant investments in infrastructure, real estate, and mega-projects, particularly in cities like Dubai and Abu Dhabi.