Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRAD5040

Pages:89

Published On:December 2025

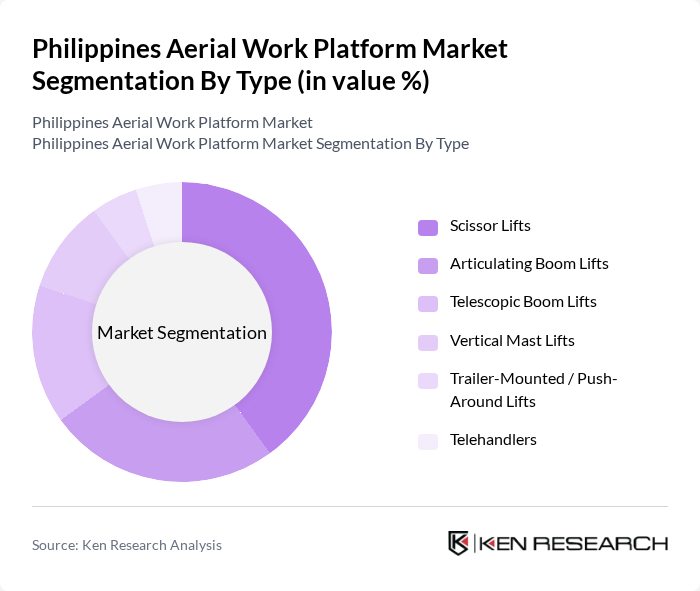

By Type:The market is segmented into various types of aerial work platforms, including Scissor Lifts, Articulating Boom Lifts, Telescopic Boom Lifts, Vertical Mast Lifts, Trailer-Mounted / Push-Around Lifts, and Telehandlers. This typology aligns with global product segmentation used in major aerial work platform industry studies, where boom lifts, scissor lifts, vertical mast lifts, and telehandlers are treated as the primary categories. Among these, Scissor Lifts are currently widely adopted in the Philippines due to their compact design, load capacity, and suitability for slab-on-grade applications such as indoor fit?outs, warehousing, and general construction. Articulating Boom Lifts are also gaining traction for their ability to reach difficult and obstructed areas around building envelopes, in industrial plants, and in utilities and telecom maintenance, reflecting the broader Asia Pacific trend where boom lifts command a significant share of aerial work platform revenues.

By End-User:The end-user segmentation includes Residential and Commercial Construction, Industrial and Manufacturing, Warehousing, Logistics and E-commerce Fulfilment, Power, Utilities and Telecom, Facility Management and Airports, Events, Media and Entertainment, and Others. This structure is consistent with global market analyses, which identify construction, industrial, warehousing and logistics, and facility management as the dominant application clusters for aerial work platforms. The Residential and Commercial Construction sector is the leading end-user, driven by ongoing transport, housing, commercial, and mixed?use infrastructure projects in major Philippine cities, as well as stronger enforcement of safe work practices at height on construction sites.

The Philippines Aerial Work Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLG Industries, Inc., Genie (Terex Corporation), Haulotte Group, Skyjack Inc. (Linamar Corporation), Manitou Group, Dingli Machinery Co., Ltd., Sinoboom Intelligent Equipment Group Co., Ltd., XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., SANY Group, LiuGong Machinery Co., Ltd., Shandong LGMG Co., Ltd., Toyota Material Handling Philippines, Inc., Maclin Electronics & Industrial Corporation (Maclin Aerial Platforms), Civic Merchandising, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aerial work platform market in the Philippines appears promising, driven by ongoing urbanization and infrastructure development. As the government continues to invest in large-scale projects, the demand for advanced aerial work platforms is expected to rise in future. Additionally, the integration of smart technologies and a focus on sustainability will likely shape the market landscape, encouraging manufacturers to innovate and adapt to changing consumer preferences while enhancing operational efficiency and safety standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Scissor Lifts Articulating Boom Lifts Telescopic Boom Lifts Vertical Mast Lifts Trailer-Mounted / Push-Around Lifts Telehandlers |

| By End-User | Residential and Commercial Construction Industrial and Manufacturing Warehousing, Logistics and E?commerce Fulfilment Power, Utilities and Telecom Facility Management and Airports Events, Media and Entertainment Others |

| By Region | Mega Manila (NCR and surrounding growth corridors) North and Central Luzon South Luzon and Bicol Visayas Mindanao |

| By Application | Building Construction and Renovation Industrial Maintenance and Repair Infrastructure and Utility Line Work Warehouse Racking and Material Handling Installation and Commissioning Services Others |

| By Rental vs. Purchase | Organized Rental Fleets Small / Independent Rental Fleets Direct Purchase by End Users |

| By Payload Capacity | Up to 230 kg –450 kg Above 450 kg |

| By Power Source | Electric / Battery-Powered Diesel / Engine-Powered Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Usage | 120 | Project Managers, Site Supervisors |

| Maintenance and Repair Services | 90 | Facility Managers, Maintenance Supervisors |

| Event Management Applications | 60 | Event Coordinators, Logistics Managers |

| Rental Companies Insights | 100 | Rental Fleet Managers, Business Development Heads |

| Safety and Compliance Perspectives | 70 | Safety Officers, Compliance Managers |

The Philippines Aerial Work Platform market is valued at approximately USD 40 million, reflecting a significant growth trajectory driven by the expansion of construction and infrastructure sectors, as well as stringent safety regulations requiring aerial work platforms for various applications.